DXY is holding up as EUR falls.

But AUD is squeezing higher anyway on metals mania.

It can still close some gap with lead boots.

That said, metals mania printed massive shooting stars across the complex. Warning to bulls.

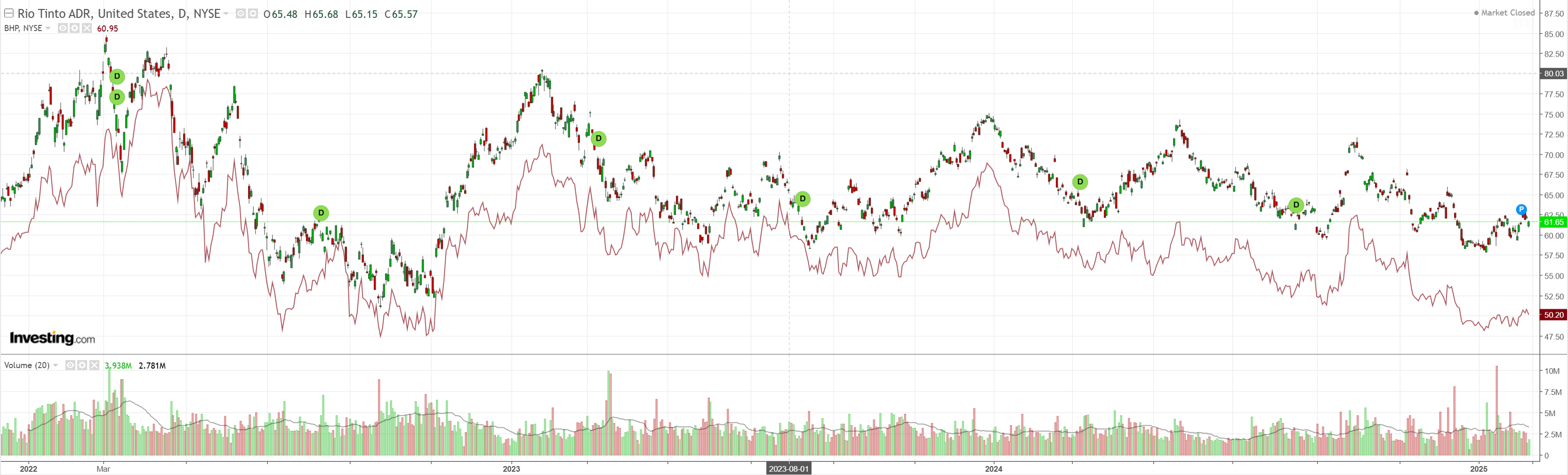

Miners are zombie stocks.

EM meh.

Junk is a real problem for the broader rally.

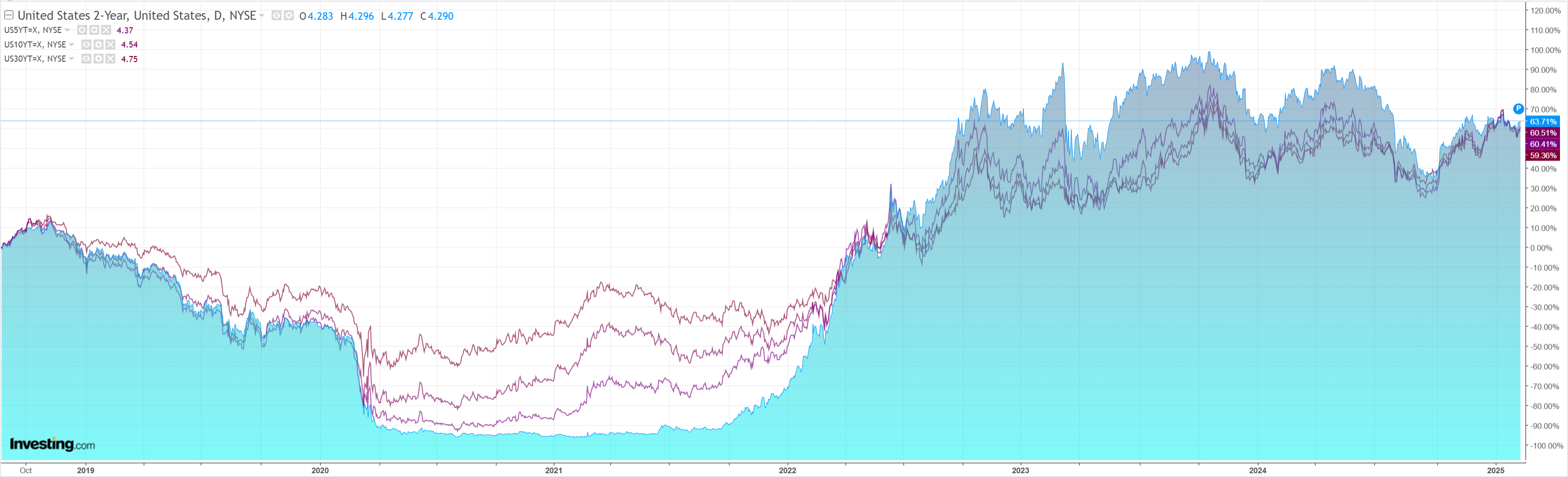

Yields firmed.

Stocks meh.

Jay Powell was hawkish in Congress.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance.”

“We know that reducing policy restraint too fast or too much could hinder progress on inflation”.

“At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment.”

And tomorrow’s CPI is not shaping well. Goldman has more.

We expect a 0.34% increase in January core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.19% (vs. 3.1% consensus).

We expect a 0.36% increase in January headline CPI (vs. 0.3% consensus), reflecting 0.4% higher food prices and 0.6% higher energy prices.

Our forecast is consistent with a 0.40% increase in CPI core services excluding rent and owners’ equivalent rent and with a 0.32% increase in core PCE in December.

That would not help an AUD rally that has survived tariffs so far.

That said, so long as the market remains so short, it’s going to keep bobbing back up like a cork.