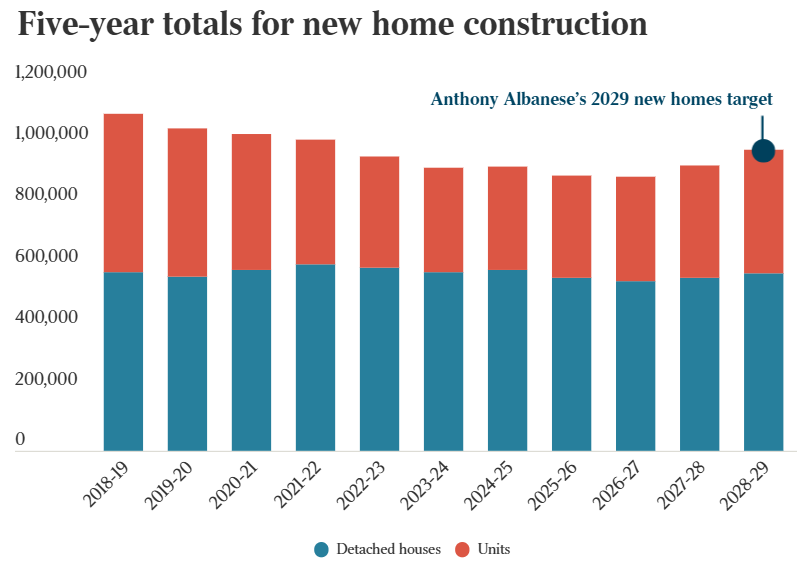

The Albanese government’s target of building 1.2 million homes over five years remains hopelessly out of reach.

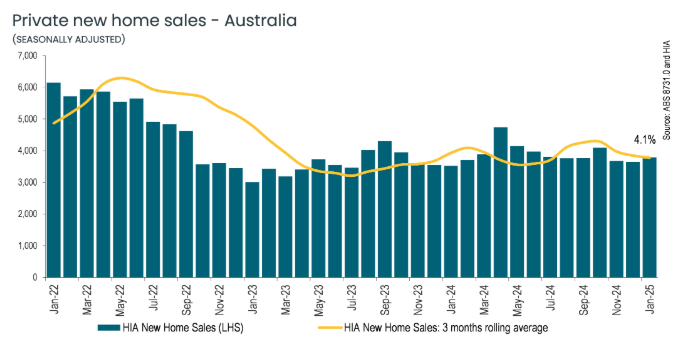

On Tuesday, the Housing Industry Association (HIA) reported that new home sales increased by 4.1% in the month of January 2025, offsetting weaker sales in November and December 2024.

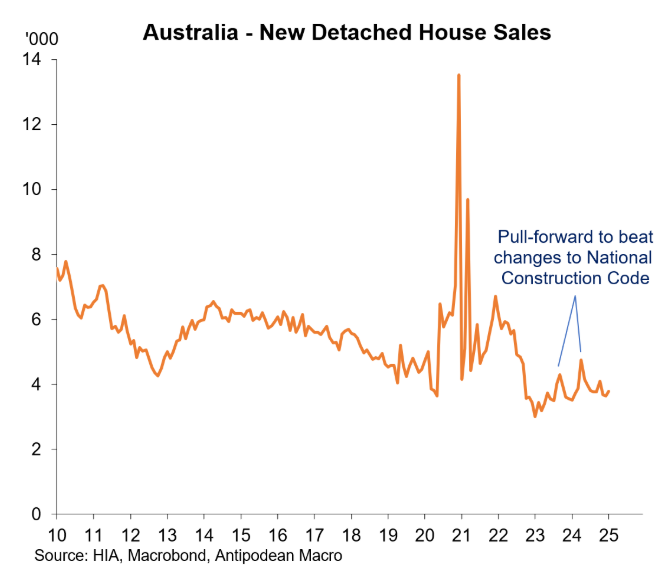

While sales rebounded in January, the following chart from Justin Fabo from Antipodean Macro shows that home sales have retraced following the pull-forward to beat amendments to the National Construction Code.

While new home sales also increased by 4.1% in the year to January 2025, they remained historically low overall.

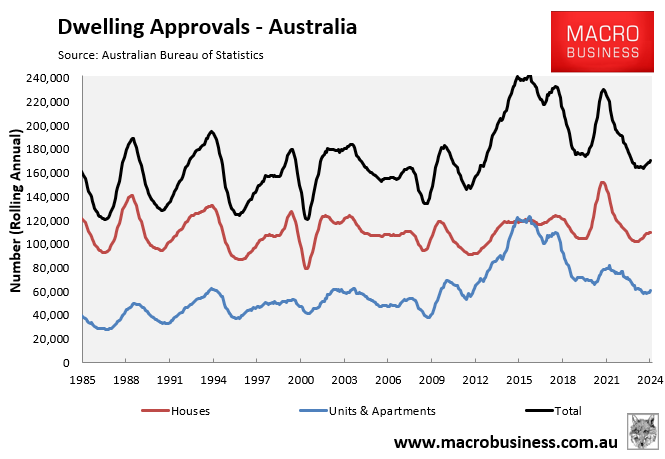

The same can be said for Australian dwelling approvals, which improved moderately to 170,700 for the year ending December 2024. However, they were still 69,300 (29%) short of the Albanese government’s annual target of 240,000 dwellings.

The homebuilding industry remains severely supply-restricted.

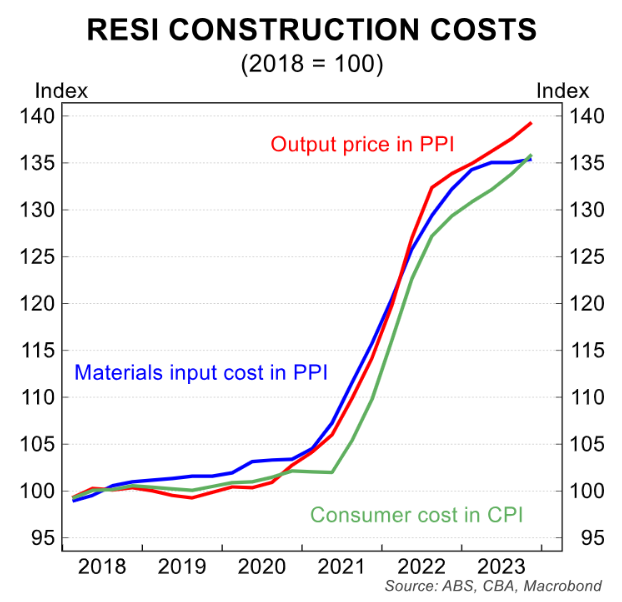

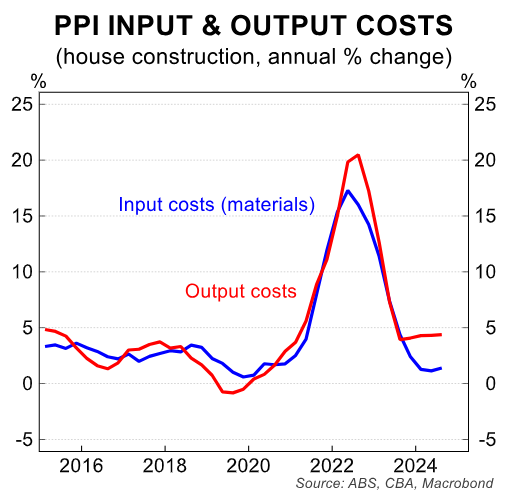

Residential construction costs have risen by around 40% since the pandemic began.

While cost inflation has slowed dramatically, actual build costs remain structurally higher than pre-pandemic levels.

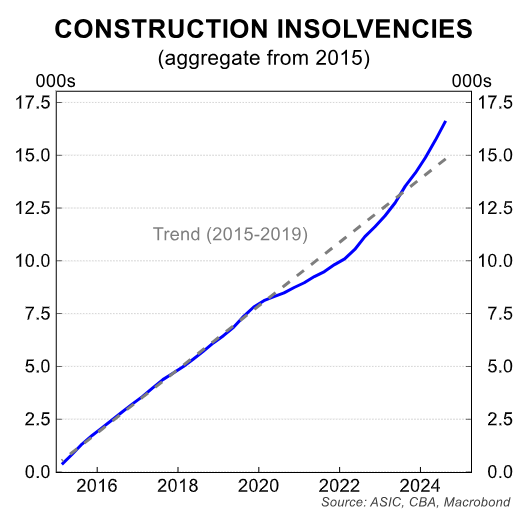

The high number of insolvencies in the sector has further reduced supply capacity.

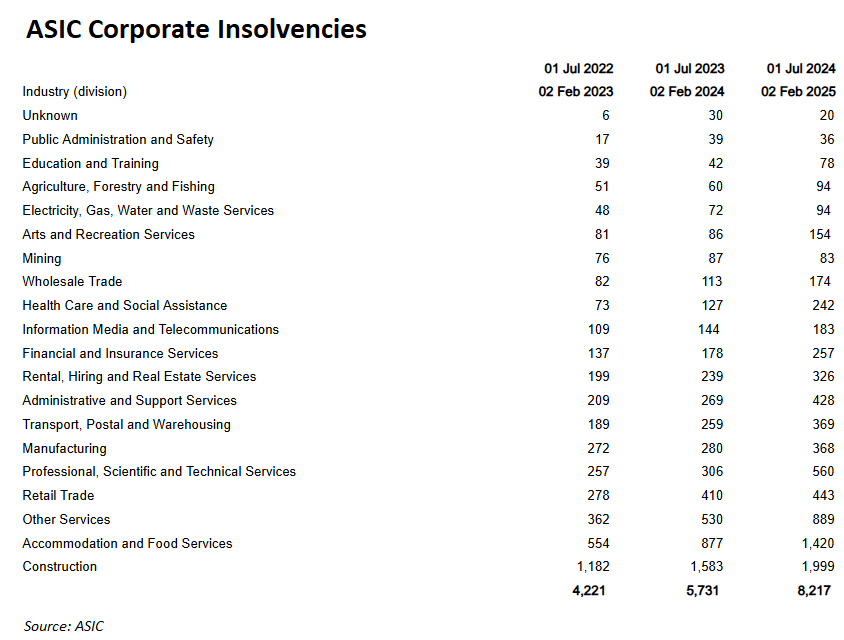

The latest insolvency data from ASIC shows that 1,999 construction firms were declared bankrupt in the first seven months of this financial year.

This was 26% higher than the same period in 2023-24 (1,583) and 69% higher than 2022-23 (1,182).

“High interest rates, inflation, and labour shortages continue to impact businesses in our sector”, Master Builders Australia CEO Denita Wawn told The Australian Financial Review recently.

“Even if some of the issues related to building materials inflation are beginning to subside, the pandemic’s impact is still being felt. Unfortunately, the ripple effect continues to spread throughout the business”.

Separately, Warn told Radio 4BC that Australia would fall short of its 1.2 million housing objective by almost 400,000 dwellings.

For its part, the HIA projects that 983,500 homes will commence construction over five years to mid-2029, 216,500 short of the government’s 1.2 million target.

HIA housing construction projection

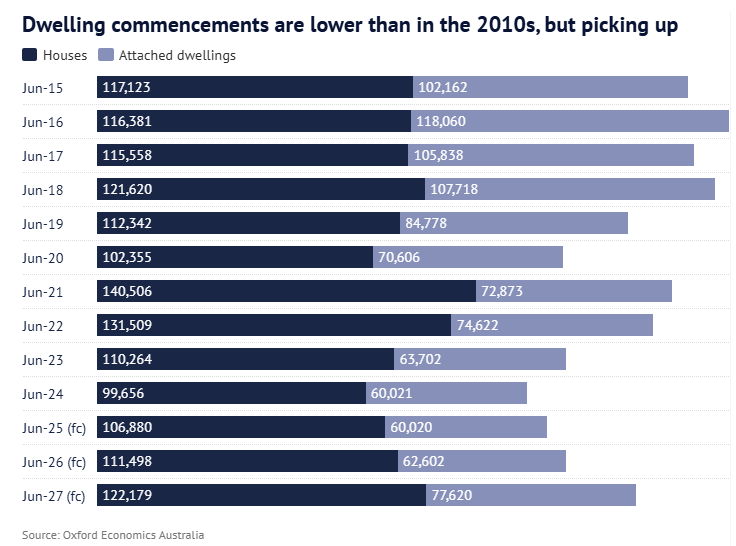

Oxford Economics Australia forecasts that only 874,442 homes would commence construction in the five years to Q2 2027—a level well below the prior five-year period.

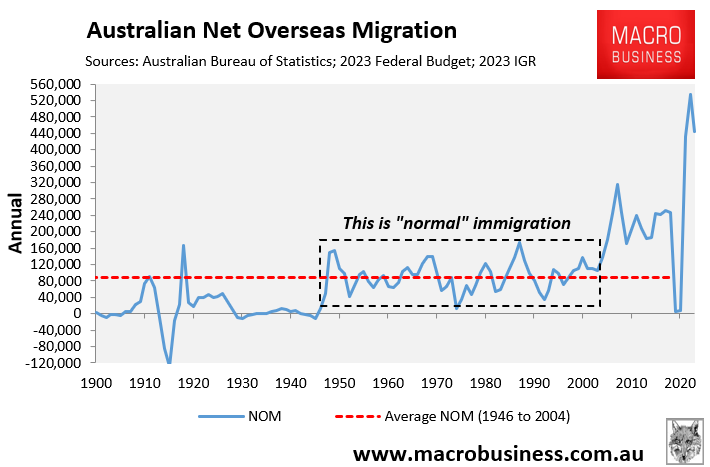

Although net overseas migration has moderated from last year’s record levels, it remains historically high.

The federal government continues to import new housing demand faster than housing and infrastructure can be created.

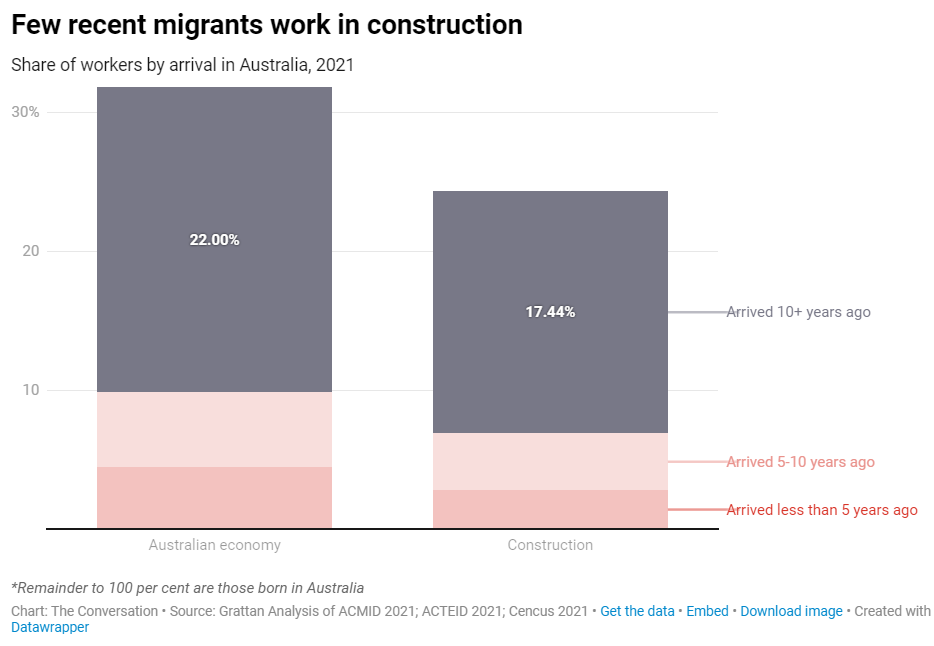

The situation is aggravated by the fact that so few of these migrants work in construction.

The solution to Australia’s housing shortage must include reducing the number of migrants entering the country to reduce housing demand and allow the building and construction sectors to catch up on existing projects.