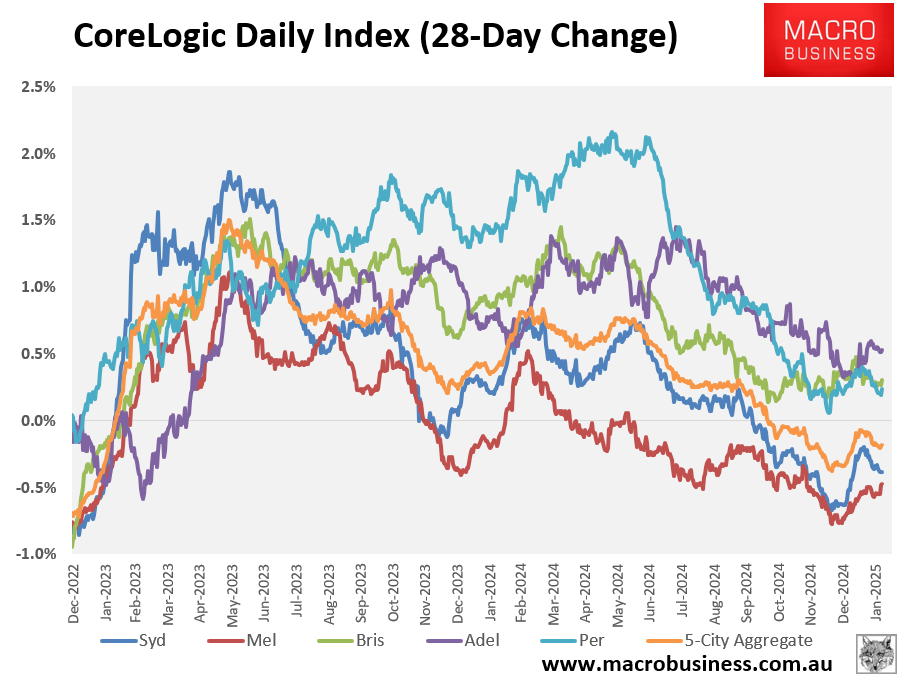

CoreLogic’s daily dwelling values index continues to fall, dragged lower by Sydney and Melbourne.

Values at the 5-city aggregate level fell by 0.2% over the past 28 days and have been underwater since October 2024, declining by 0.8% over that period.

Melbourne continues to lead the decline, with values down 0.5% over the past 28 days. Melbourne home values have fallen since late 2023, down 4.0%.

Sydney dwelling values declined by 0.4% over the past 28 days and have fallen since September 2024, down 1.8%.

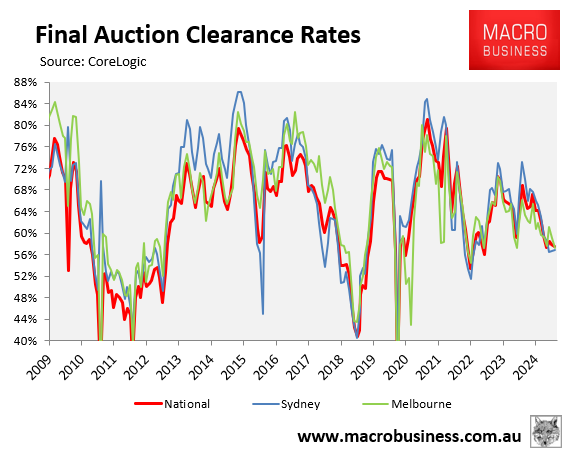

The decline in dwelling values matches the slump in auction clearance rates.

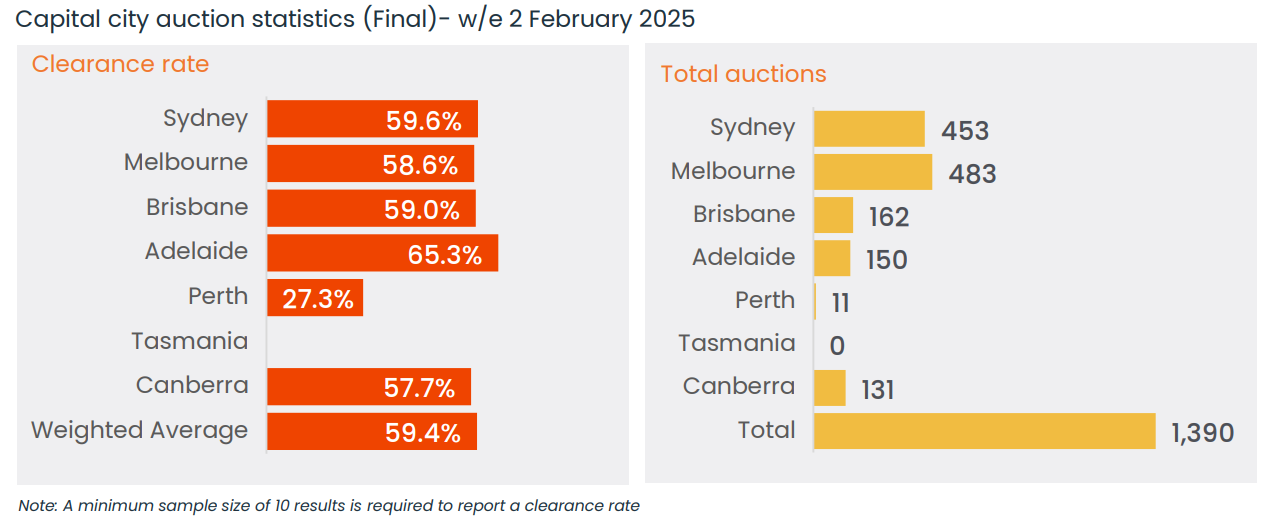

Last week’s final auction clearance rates were below 60% across Sydney, Melbourne, and nationally.

At the weighted national level, the final auction clearance rate has remained below 60% since mid-October 2024.

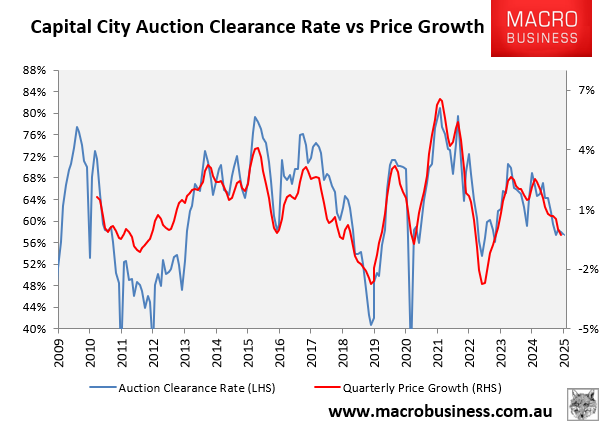

As illustrated in the following chart, there is a very strong correlation between auction clearance rates and price growth.

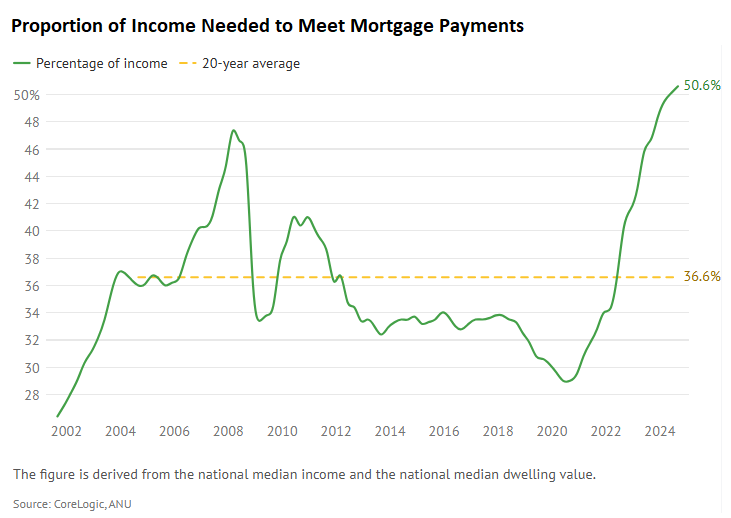

With mortgage affordability at a record low, interest rate cuts are required to stem the bleeding.

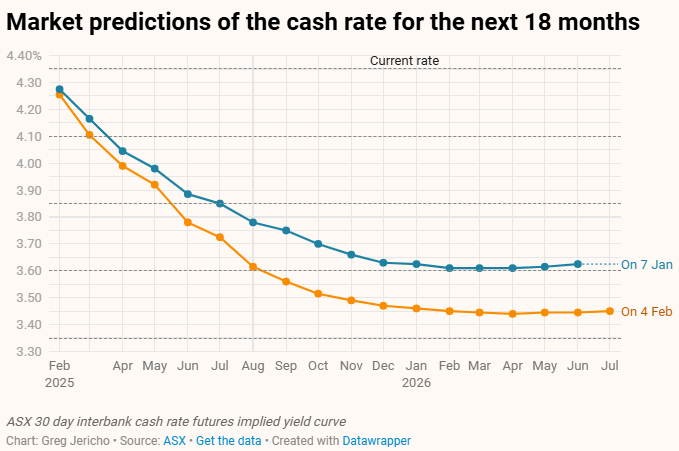

Financial markets are forecasting rate cuts throughout 2025, with the official cash rate expected to settle around 0.85% lower by the end of the year.

Such rate cuts could usher in a mini upcycle in home prices.