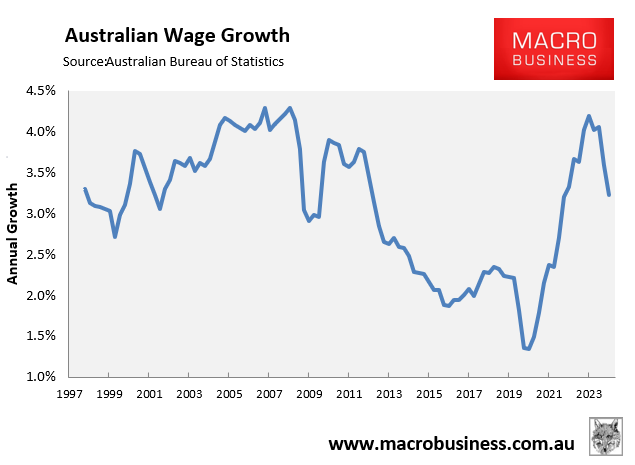

The Reserve Bank of Australia’s (RBA) February Statement of Monetary Policy (SoMP) forecast that the wage price index would record 3.2% growth for the year ended Q4 2024.

On Wednesday, the Australian Bureau of Statistics (ABS) released the Q4 2024 wage price index, which met the RBA’s expectations, coming in at 0.7% for the quarter and 3.2% year-on-year.

Commenting on the result, ABS head of prices statistics, Michelle Marquardt, noted: “The 0.7% rise this quarter was the equal lowest growth since March quarter 2022. At 3.2%, the annual increase in wages was down from 4.2% in December quarter 2023 and is the equal lowest since September quarter 2022”.

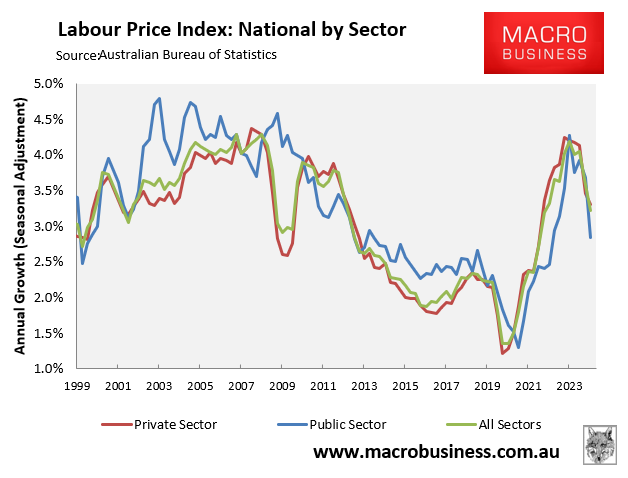

The decline in wage growth was led by the public sector.

Annual private sector growth (3.3%) was the lowest since June 2022, whereas annual wage growth for the public sector (2.8%) fell below 3% for the first time since Q2 2023.

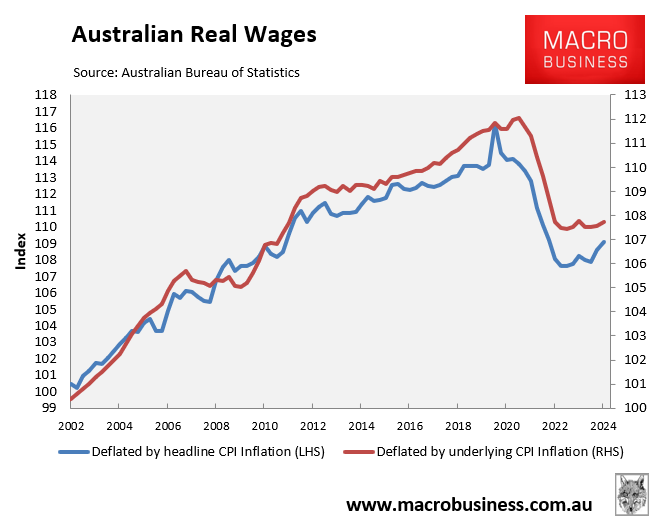

The following chart plots real wage growth, deflated by headline CPI and underlying (trimmed mean) inflation.

Real wages deflated by headline CPI remained 6.2% below the Q2 2020 peak but have recovered slightly following the subsidy-induced decline in headline inflation.

Real wages deflated by underlying inflation remained 3.8% below the Q2 2021 peak and have flatlined for eight consecutive quarters.

No doubt Treasurer Jim Chalmers will champion this result as a win for workers, noting that Labor is getting “real wages moving again”.

The reality is that Australian workers have suffered the largest decline in real wages in modern recorded history.

On a positive note, the RBA will take confidence that inflation is under control, paving the way for additional rate cuts.