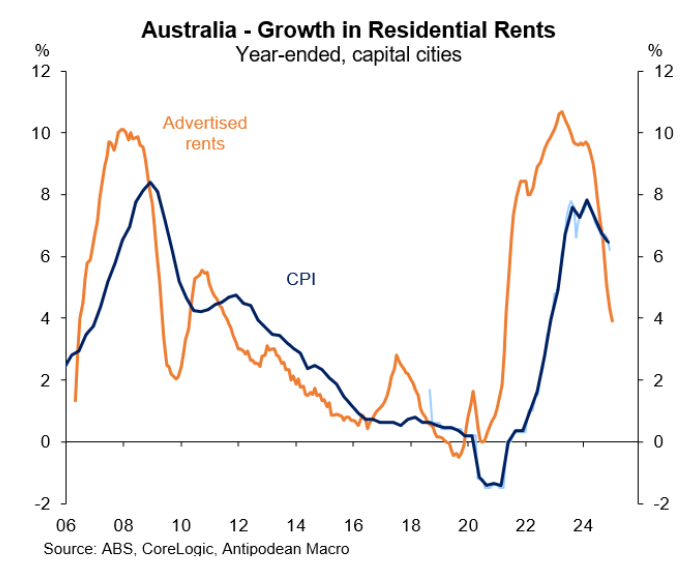

Australia’s rental crisis appeared to be easing after CoreLogic and the Australian Bureau of Statistics (ABS) reported a marked easing in rental growth.

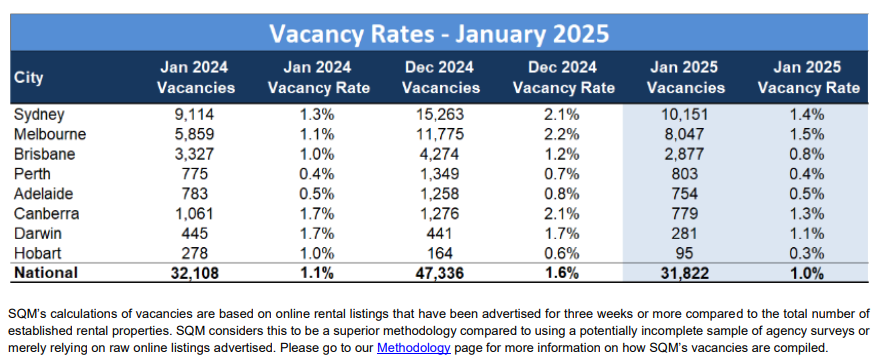

However, the latest rental vacancy data from SQM Research suggests that the rental crisis has resumed. Following a period of rental easing during the second half of 2024, the national vacancy rate fell to just 1.0% in January 2025, to be 0.1% lower year-on-year.

“The sharp decrease in rental vacancies strongly indicates Australia’s rental market crisis is not over and has potentially deteriorated at the start of 2025”, SQM Research noted.

Rental prices also recorded a sharp rise in January following a period of moderation in 2024. Capital city advertised rents rose by 1.6% over the month.

SQM Research managing director Louis Christopher suggested the tightening may not be an anomaly.

“From a tenant’s perspective, the sharp drop in rental vacancies at the start of 2025 is highly disappointing, especially since there were some glimpses of a moderating rental market in the latter half of 2024″, Christopher wrote.

“Is this a one-off abnormality? Unfortunately, I don’t think it is, as our records of February listings to date are lower than what was recorded in January”.

“As a research house, we are aware of the ongoing under building that has been occurring. Over and above this, our concern is what is not known. And that is the real-time, present level of overseas arrivals”.

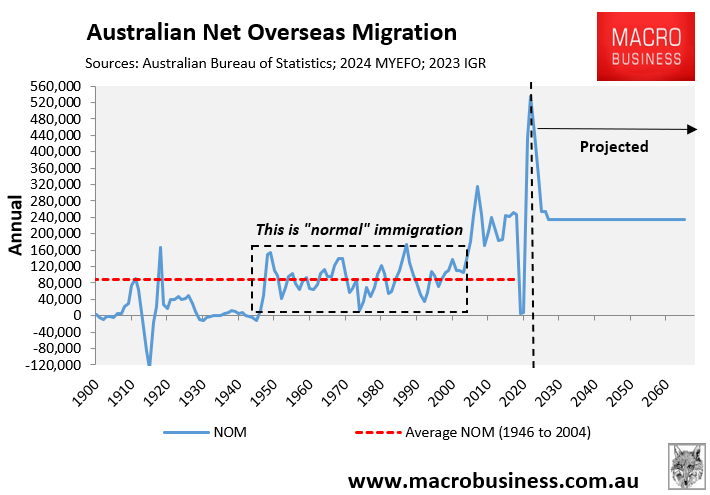

“Could there have been another surge in migration levels in recent weeks? We don’t know for sure but clearly something has driven this retreat in rental vacancies”, Christopher said.

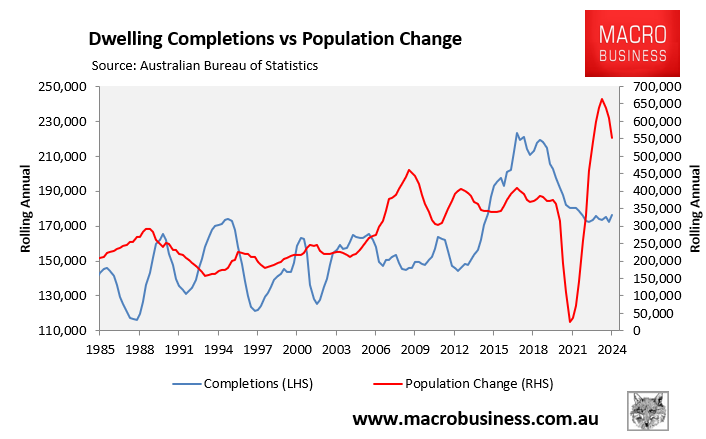

The fundamentals have not changed significantly. Australia’s population continues to grow much faster than dwelling supply.

The longer-term outlook is also poor. The supply side of the housing market is likely to remain constrained due to:

- Structurally higher interest rates;

- Structurally higher building costs;

- Labour shortages; and

- High builder insolvencies.

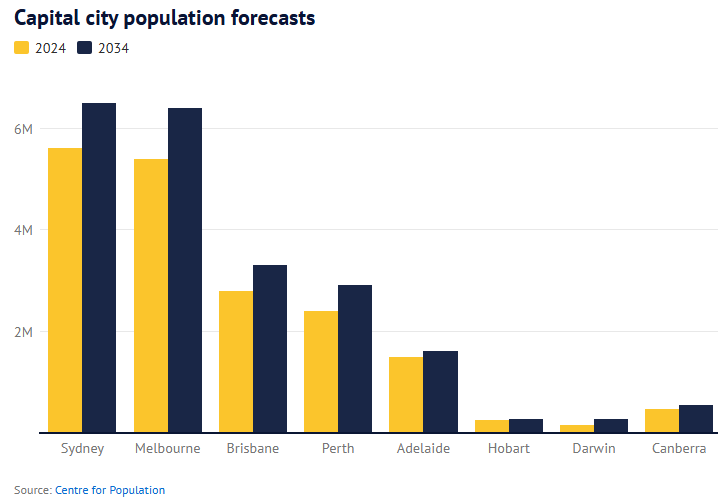

Meanwhile, the Australian Treasury’s Centre for Population projected that the nation’s population will balloon by 4.1 million people over the coming decade, with most new residents landing in the major capital cities.

If the federal government continues growing the population faster than new homes can be built, the rental market will remain tight.

The number one solution to Australia’s rental crisis is to significantly lower net overseas migration to a level compatible with the nation’s ability to build housing and infrastructure.

Otherwise, the rental crisis will continue and Australian tenants will suffer.