A year ago, former Treasury Secretary Dr Ken Henry, who produced a 1,000-page review of Australia’s tax system in 2010, advocated for fundamental tax reform, claiming that the existing system is an “intergenerational tragedy”.

Henry asserted that Australia’s tax structure has deteriorated compared to 15 years ago, with young people bearing the brunt of higher tax burdens, reduced disposable income, and restricted access to necessities like housing.

He also claimed that intergenerational imbalances would worsen as the population ages and reliance on income taxation increases.

Henry warned that workers today bear a considerably higher share of the tax burden than they did 15 years ago because other taxes have generated less income over time as the economy has changed and governments have failed to reform the system.

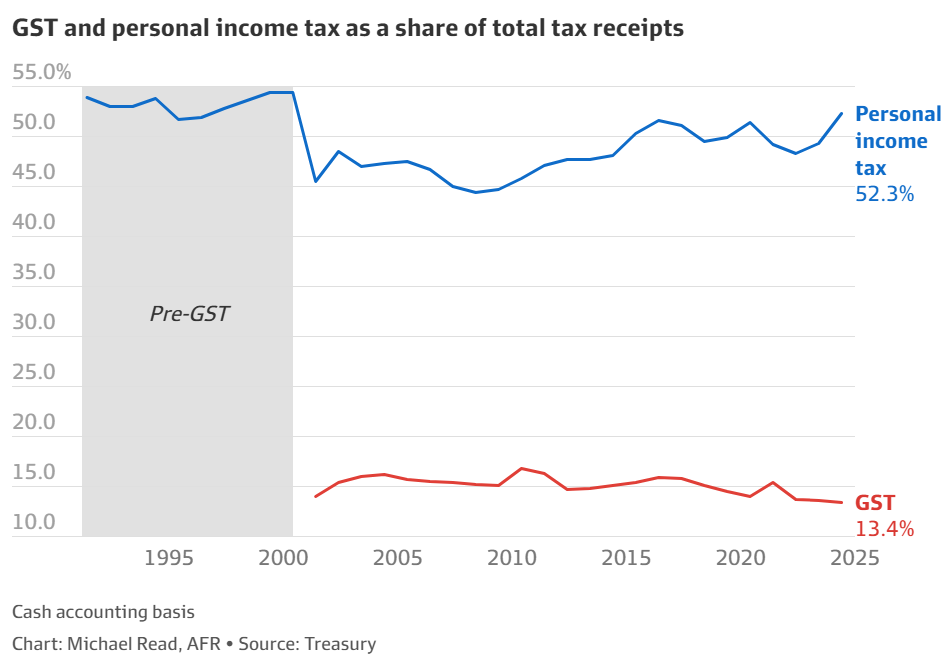

He claimed that the late 1990s attempt to shift the “tax mix” away from a heavy reliance on personal income tax and towards more broad-based indirect taxes had been “completely undone”.

Last week, Henry used an address to the Per Capita think tank tax summit in Melbourne to accuse recent federal treasurers of breaching the Charter of Budget Honesty rules.

Legislated by former Liberal treasurer Peter Costello in 1998, they contain five principles, including integrity of the tax system and considering financial effects on future generations.

Henry said that every government since the rules were adopted has broken all five principles, including the current government. He said the tax system is “eroding” and is one that punishes young people.

He also said government policy seemed aimed at hurting young people and future generations.

“You simply can’t achieve something like that by accident. Reckless indifference, perhaps. Wilful acts of bastardry, more likely. Accident, no”, Henry said.

“Young workers are also being denied a reasonable prospect of homeownership”.

“They are burdened by the punishing costs of securing a tertiary education”.

“There is no plan to control spending, nor to balance the budget. The budget places a heavy reliance upon fiscal drag that punishes innovation, enterprise and effort; distorts the pattern of saving; and rewards tax avoidance and evasion”.

“Attending to the interests of future generations is a big program of work. The alternative is an intergenerational tragedy”, he said.

Ken Henry is right.

Personal income taxes comprise the highest share of tax revenue since before the GST was introduced in 2000:

The Treasury’s Intergenerational Report projected that personal income tax revenue would rise to 58.4% of total taxes in 2062-63 unless tax reform replaced dropping fuel and tobacco levies.

Even worse, as the population ages, a smaller workforce will be liable for paying the higher personal income tax.

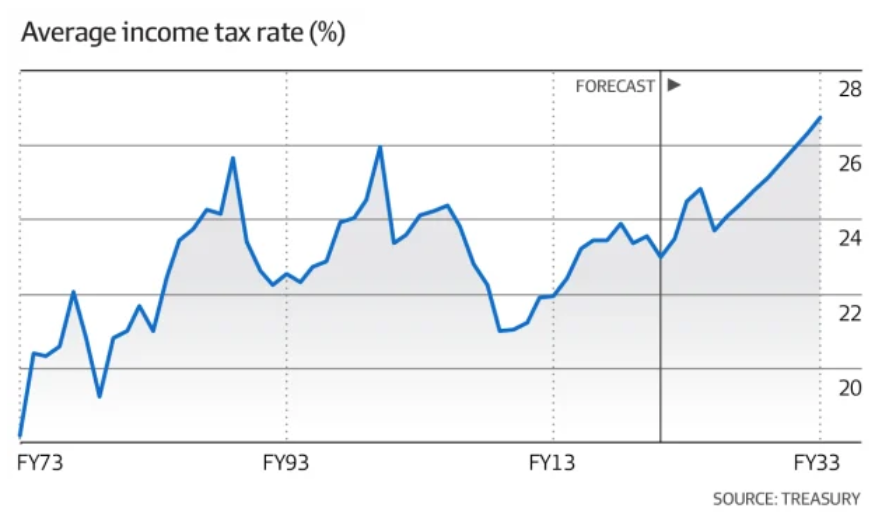

The Treasury also projects that inflation-driven bracket creep will cause average tax rates to rise further.

The Australian tax system’s reliance on fewer people paying income tax is clearly unsustainable, wasteful, and unfair.

This is especially true given that the elderly population is growing and paying lower taxes than ever before, despite controlling the majority of the country’s wealth.

Australia needs comprehensive tax reform that shifts the tax base away from productive activities (taxing individuals) and towards more efficient sources such as resources, land, and consumption.

Moving the tax base away from personal income taxes would also diminish the need for large-scale immigration to raise federal income tax revenue.

The 2010 Henry Tax Review already has a reform roadmap, which only needs to be updated.

Australia cannot afford to put off tax reform for another decade. This would jeopardise workers, intergenerational equity, and the nation’s productivity.