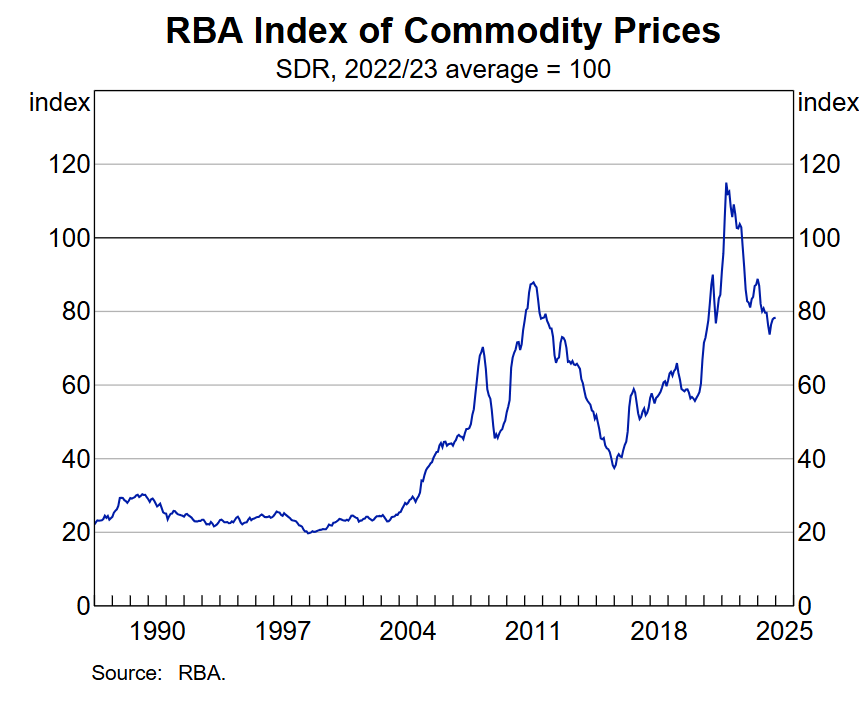

The Aussie terms of trade shellacking is taking a breather, but the trend is intact and will get much worse.

The last Commodity Price Index from the RBA was enjoying a dead cat bounce.

But the two coals have continued their collapse. Metallic coal is grinding lower. My target price in 25/26 is $100. It is 14.2% of the index.

The thermal coal crash has arguably been overshot. My target is $80 over 25/26. It is 12.3% of the index.

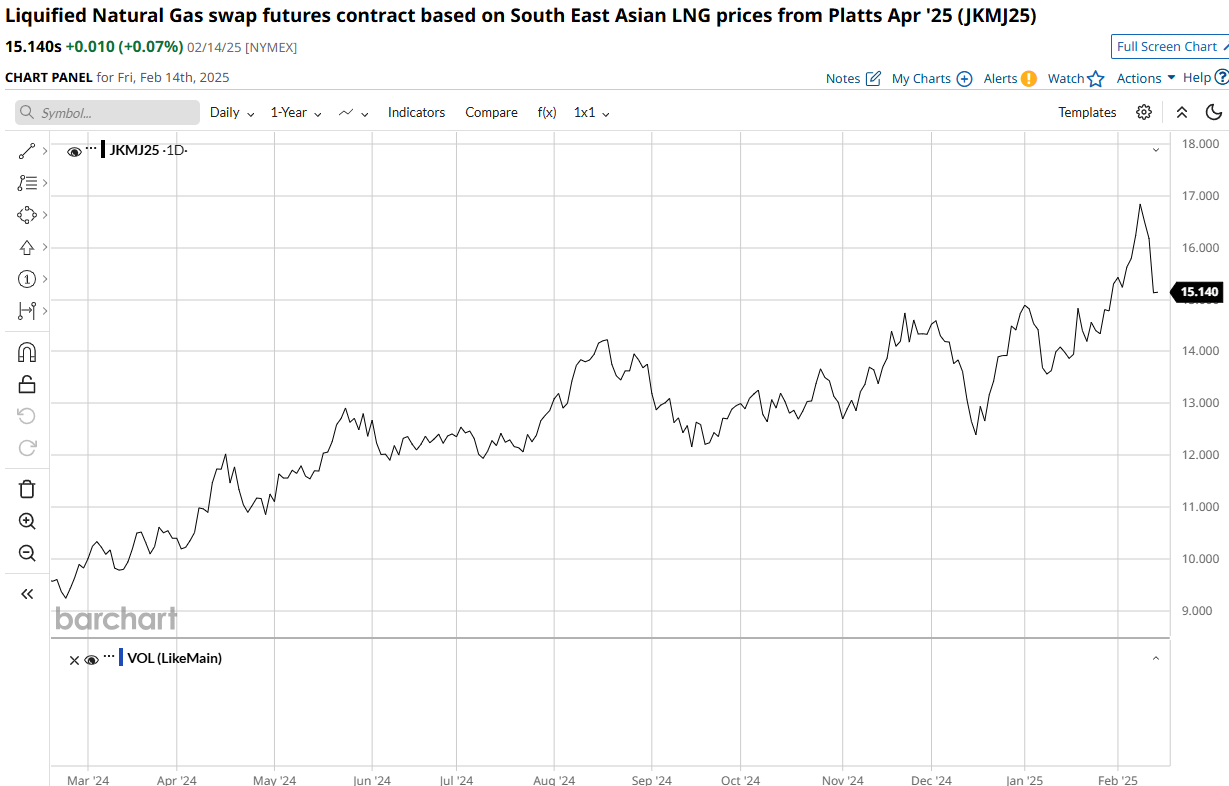

One of the reasons that thermal coal is oversold is the LNG price, which has been powering. The two compete directly to fuel power. My target price for LNG is in flux. If we get peace in Ukraine, then it is going to crash. If not, then current pricing will prevail over 25/26. It is 17.9% of the index, but the QLD gas rort works in the opposite way that it should because higher prices equal lower national income and vice versa. Rather complicating things. Anyways, Ukraine peace means $6Gj JKM.

The big one is iron ore. I expect it will halve over 25/26 and it is 28.1% of the index.

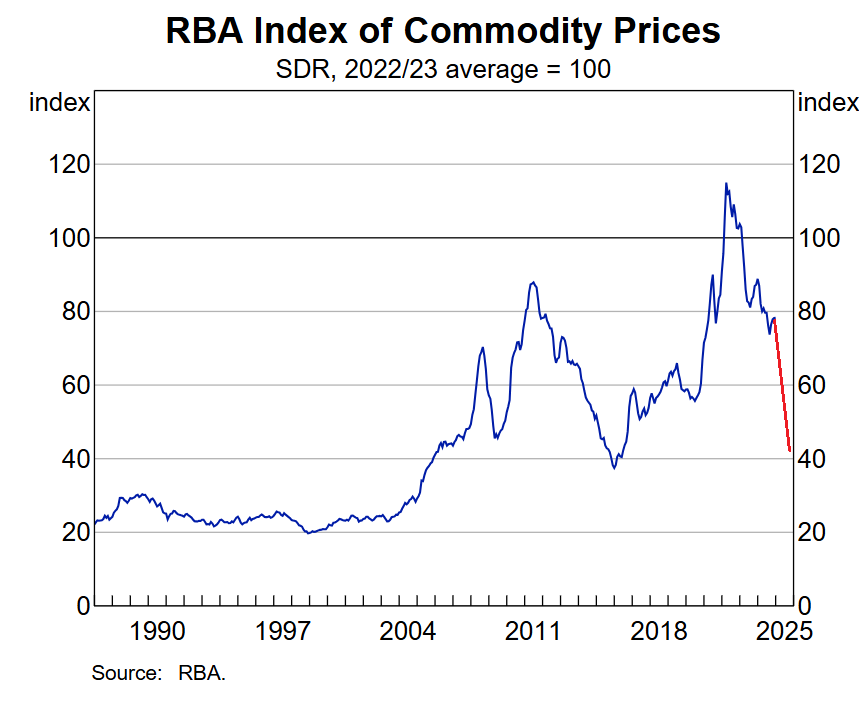

In sum, if we reach my forecasts and there is peace in Ukraine, the terms of trade will look like this over the next two years.

This will monster national income, wipe out nominal growth, crush wage growth and inflation, and send interest rates plus the AUD much lower than anybody expects.

Canberra will respond with ever higher immigration, exacerbating all of it.

Conversely, if there is no Ukraine peace deal, then Aussie LNG imports will begin at 300% higher prices, and crushed national income will meet smashed nominal growth with fiscal and monetary both constrained by a huge energy inflation shock reminiscent of Argentina.

And the Aussie economy will be scythed off at the knees.