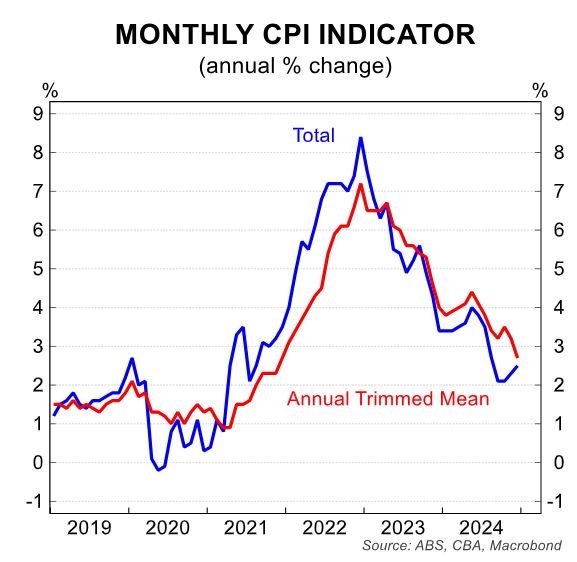

Australia’s inflation is falling. CBA forecasts that trimmed mean inflation will fall to 2.8% in January, within the Reserve Bank of Australia’s (RBA) 2% to 3% inflation target.

However, this does not mean that the cost-of-living crisis is over.

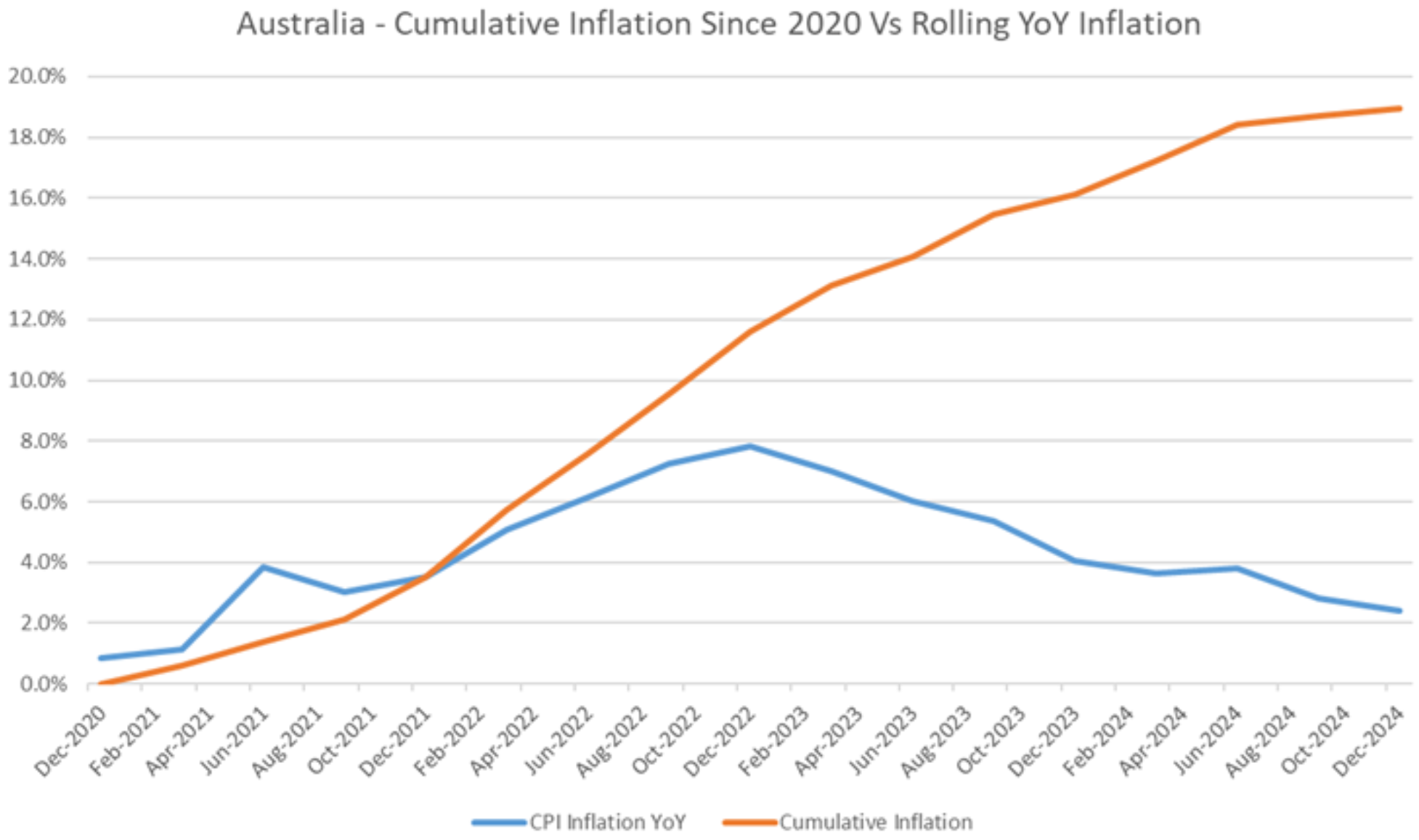

As independent economist Tarric Brooker illustrated, since Q42020, cumulative Australian inflation has increased by 19%.

That cost is now embedded and will not decline. The lower inflation merely means that costs will rise at a slower rate in the future.

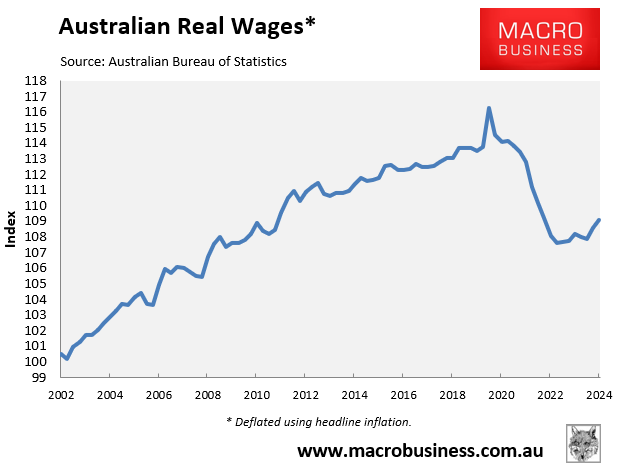

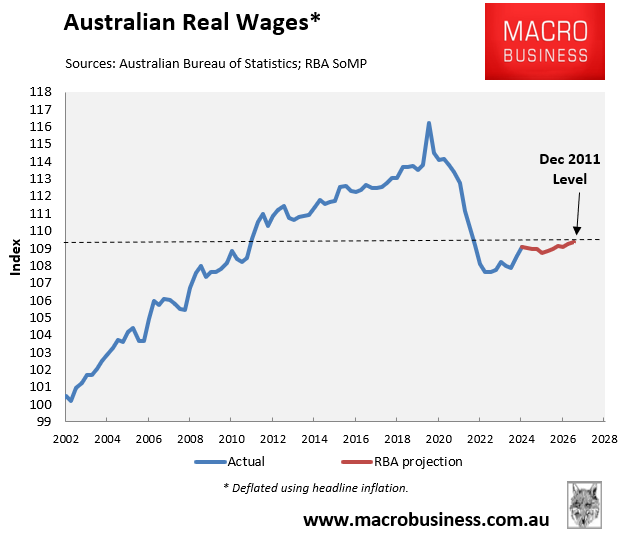

The cost of living crisis is reflected in the record collapse in Australian real wages, illustrated below.

As of Q4 2024, Australian real wages were tracking 6.2% below their peak at Q4 2010 levels.

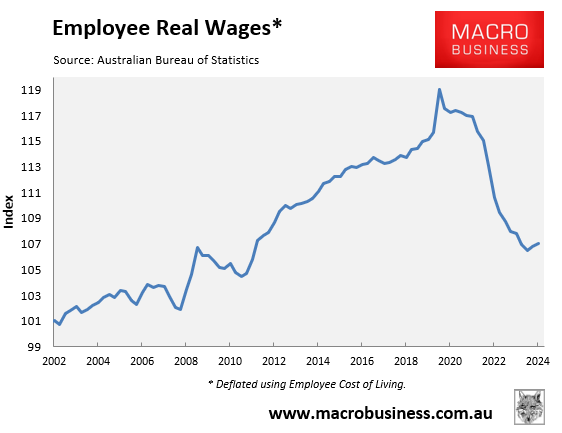

The situation worsens when the wage price index is deflated against the ABS’s employee cost of living index.

Using this measure, real wages in Q4 2024 were tracking 10.1% below the peak at around Q1 2012 levels.

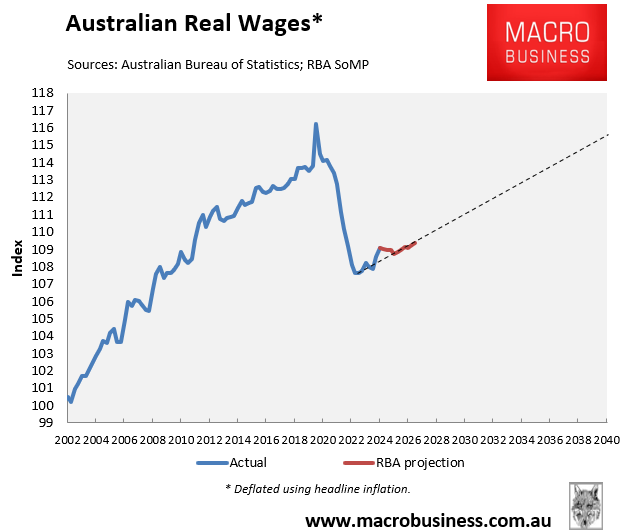

The RBA’s latest Statement of Monetary Policy projects a slow rebound in real wages.

By Q2 2027, real wages will still be tracking 5.9% below the peak at Q4 2011 levels.

Worse, extrapolating the RBA’s forecast suggests that real wages may not recover to their former peak until around 2040.

Australians will feel the impacts of the post-pandemic cost of living crisis for many years.

The battle against inflation may finally be over. But that doesn’t mean that financial conditions will become much easier for Australian families.

The recovery from the recession will be a long, slow, and painful process.