The rotting fishhead AFR launched a stingingly politicised campaign to prevent monetary easing, and its journos and hangers-on were all wrong.

Unsurprisingly.

If all you can see is politics, then you’re so busy gaslighting everybody that you have no idea what is going on fundamentally.

Enter Michael Stutchbury, the Rotten Fishhead himself, where the stench is greatest.

Michele Bullock and the Reserve Bank board have put their inflation-fighting credibility on the line by delivering a politically convenient interest rate cut without providing a compelling economic case to do so.

But, after roughing up the central bank, Anthony Albanese and Jim Chalmers should take whatever sliver of bacon the RBA will give financially squeezed voters in mortgage belt seats.

They can’t rely on getting any more mortgage relief from the central bank in the next few months. It’s taken a twist of reasoning from Governor Bullock to deliver even a “small” 25 basis point cut to the RBA’s 4.35 per cent cash rate

Despite financial markets punting on a sure-thing 90 per cent February rate cut, Bullock called it a “difficult decision” with arguments to both cut and to hold.

Markets should stop pricing in a repeat any time soon, she said, because of the risk that “disinflation could stall”. That leaves a possible one-and-done, at least for the election timetable, after a hawkish February cut.

Blah, blah, blah, stink, pong, reek. What the Rotten Fishhead meant to say was “I was wrong on the RBA”.

And he is going to be wrong again, for an easing cycle has begun. The rotten fishhead’s badgery of the RBA, which is far worse than anything Albo and Chalmers did, is the real politicised commentary here.

Most of it barely refers to data. It has very few charts. It privileges hawks and suppresses doves and has no framework of substance to make its judgments beyond cheerleading the LNP.

This is hardly surprising given the Rotten Fidshhead learned his trade at Murdoch and corrupted the AFR with the same when he took over as editor.

These days, the AFR is little more than a businessomics stinkbomb that betrays truth, journalistic integrity, intellect, and nation.

Turning to what is actually going on in, you know, the economy and inflation, we can rely on the outstanding Andrew Boak at Goldman who has pwned this cycle.

In her post-meeting press conference RBA Governor Bullock noted that today’s 25bp rate cut was a consensus decision of the Board, would “reduce a little bit of policy restrictiveness”, and that future decisions would “depend on the data”.

That said, the Governor struck a relatively hawkish tone during parts of the press conference, including noting the market is “too confident” in pricing additional policy easing over 2025 and highlighted that the labour market remained “tight”.

From our perspective, we caution against putting too much weight on the RBA’s forward guidance and concerns on the strength of the labour market.

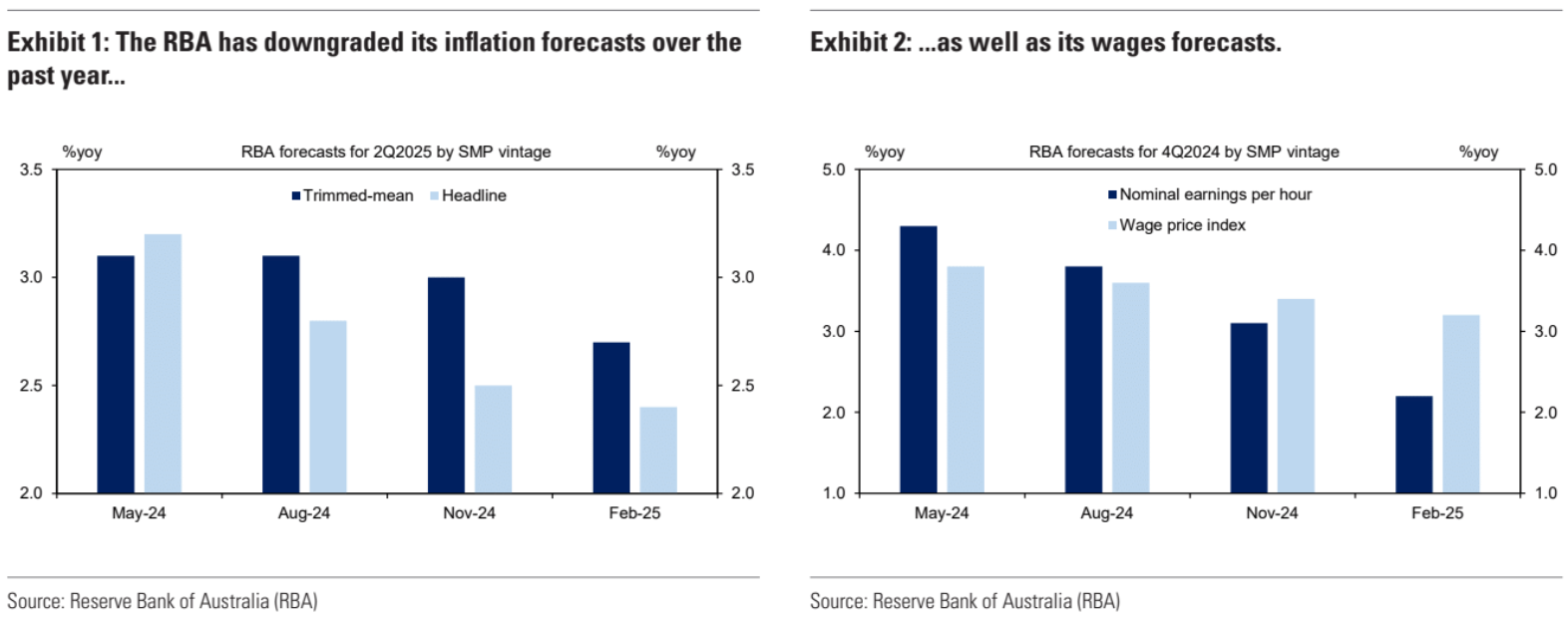

The latter has not stopped the Bank from pivoting dovish over the past few months and ultimately cutting rates today, consistent with large downward revisions to the staff forecasts for wages growth and inflation (Exhibit 1)

Our recent research highlighted some reasons why the labour market is not proving to be inflationary, and we expect continued sanguine reads on labour costs and inflation will draw the RBA into further rate cuts over the coming months.

Our base case is that the RBA cuts the policy rate again in April, May and November to a 3.25% terminal rate, although we acknowledge the balance of risks is skewed to a more elongated easing cycle.

Err, so Bullock criticised the market for being too dovish while she downgraded her own stupidly hawkish forecasts. Lol.

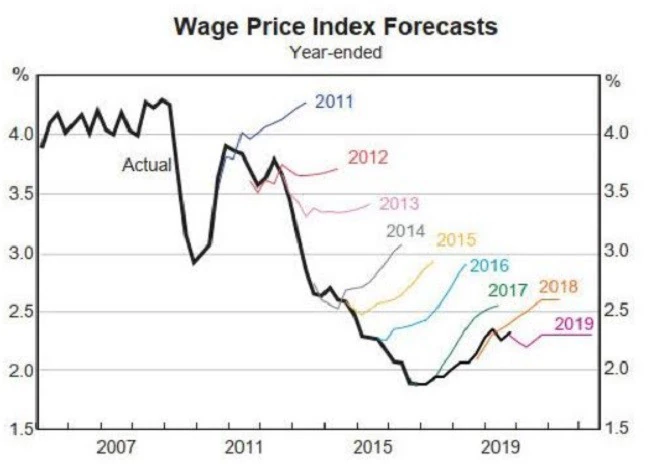

The RBA remains the single worst forecaster in the world, adding another chapter to the last cycle’s debacle.

Why is the Australian central bank so useless? Because it is paid to be.

The Australian economy is not a typical developed market in which business investment leads economic growth.

Rather, Australia’s economy is an immigration-led, labour market expansion growth model.

It is disproductive but never produces wage inflation because it grows exclusively through a permanent cheap foreign worker supply shock.

This cycle, that supply shock has shifted from wealthy Chinese to impoverished Indians, which will make it even more deflationary.

The RBA’s economic idiocy is the lynchpin in this system. If it told the truth, that it is operating a full-blown wage suppression system to support house prices and select ASX100 profits, the government of the day would be forced to slash immigration. So the central bank lies, and others, like the Rotten Fishead, lie about it lying.

Failing RBA credibility and the million-dollar plus salary of the governor/liar is just another exhibit of Australia’s inexorable collapse of living standards.

Many more cuts to come this cycle as the RBA is gleefully wrong all over again!