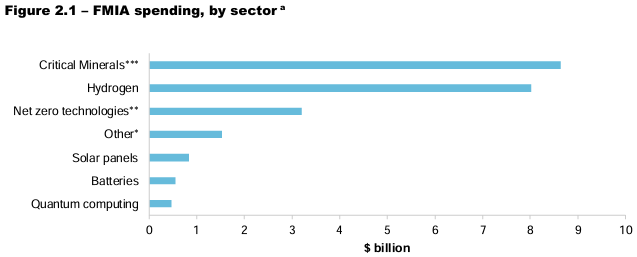

The Australian’s Judith Sloan argues that Labor’s $22.7 billion Future Made in Australia (FMIA) policy is badly planned and badly executed.

Labor has promoted FMIA as a plan to create new jobs and opportunities by maximising the economic and industrial benefits of moving towards net zero emissions.

Sloan argues that it is, in fact, a repackaging of several existing off-budget schemes that have been grouped together around a questionable theme.

The irony is that at the same time as the government is promoting its FMIA plan, several large manufacturers are either exiting Australia or have flagged their intention to do so.

“Let’s be clear here: it’s about government picking winners according to the government’s interpretation of the changing investment environment and the presumed unstoppable decarbonisation transition”, Judith Sloan writes.

“Bear in mind that countries responsible for over half of global greenhouse emissions have not committed to net zero 2050″…

“The German economy is now into its second year of recession and the output of its most energy-intensive factories fell by nearly 25 per cent last year. The country is rapidly deindustrialising, with some large operations relocating to other countries, including China”…

“The UK economy is also floundering as its equally committed Energy Secretary, Ed Miliband, continues to try to place round pegs in square holes”, Sloan wrote.

Last year’s Trade & Assistance Review from the Productivity Commission (PC) warned that FMIA subsidies for low-emissions manufacturing are a new form of protectionism that risks degrading Australia’s future productivity growth and living standards.

“It is important that industry policy is well-articulated and subject to rigorous and public cost benefit analysis. Policy discipline will ensure industry assistance is focused on achieving clear goals at least cost to the Australian community, without inadvertently becoming a new form of trade protectionism”, PC deputy chairman Alex Robson said.

“Governments should be cautious in pursuing industry policy on this basis and build in off-ramps to allow a timely exit if these policies fail to achieve their stated aims”.

“While the current suite of industry policies has been aimed at a range of policy goals … if poorly designed, they could act as a form of trade protectionism”.

“After all, a $100 subsidy for domestic producers can have the same protectionist effect as a $100 tariff imposed on their foreign competitors”, he said.

PC chairwomen Danielle Wood also warned that FMIA risked “creating a host of inefficient and uncompetitive firms forever reliant on subsidies”.

The reality is that Australia can never have a sustainable manufacturing sector so lond as it has expensive energy.

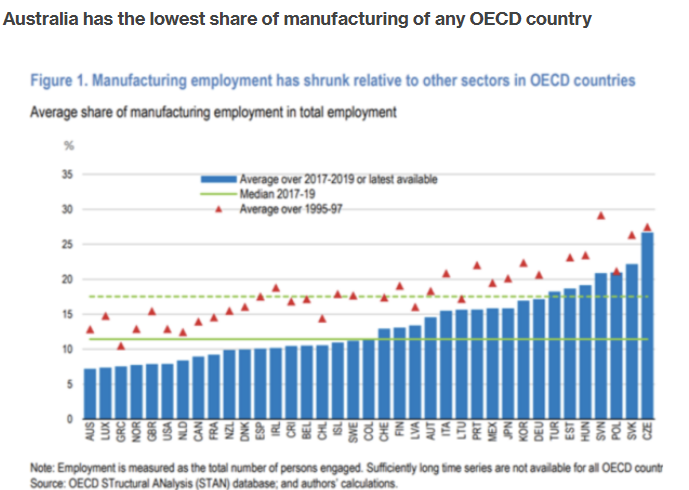

Australia’s manufacturing sector is already the smallest in the OECD as a share of the economy.

Australian manufacturing is also in terminal decline.

Incitec Pivot, a major fertiliser company, closed its Australian operations in 2022 due to high energy costs.

Qenos, Australia’s last major plastics producer, closed in 2024 due to high energy prices, leaving the country completely reliant on imported polymers from China.

Last month, Orica, the world’s largest manufacturer of mining explosives, chemicals, and agricultural fertilisers, threatened to close its Australian facilities and invest in the United States instead.

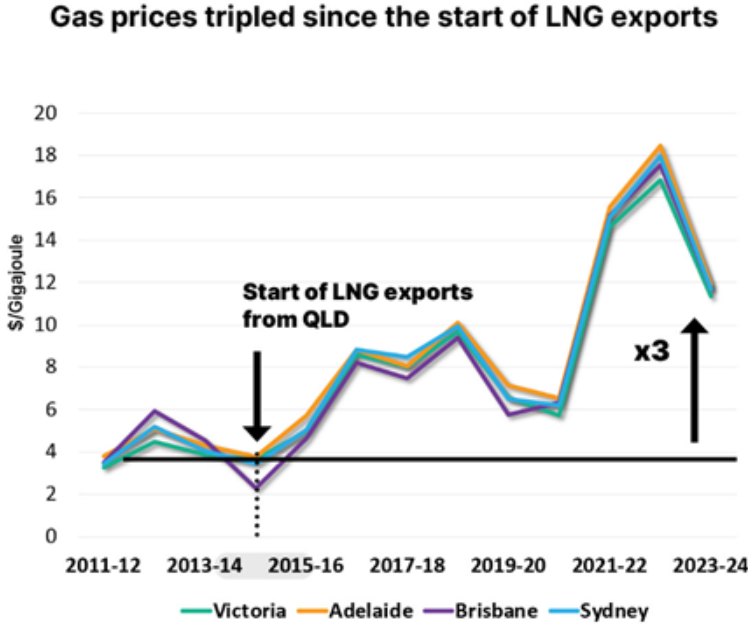

Sanjeev Gandhi, Orica’s managing director, claimed that electricity rates in Australia have tripled in the last decade, gas prices have quadrupled, and renewable energy is expensive.

“The US is pro-manufacturing, they’ve got cheap energy, they’ve got good gas supply and reserves”, Gandhi said.

Oceania Glass, Australia’s only architectural glass manufacturer, closed this month after 169 years in business, citing excessive energy prices and Chinese dumping.

Bluescope Steel has threatened to close its Australian operations and shift to the US due to expensive energy costs.

The latest insolvency data from ASIC shows that almost 1390 manufacturers nationwide have become insolvent since 2022-23.

Moody’s this month warned that Australia’s green energy transition could increase real wholesale power prices (excluding transmission costs) by 5%-15% by 2035 and retail energy bills by 20%-35%.

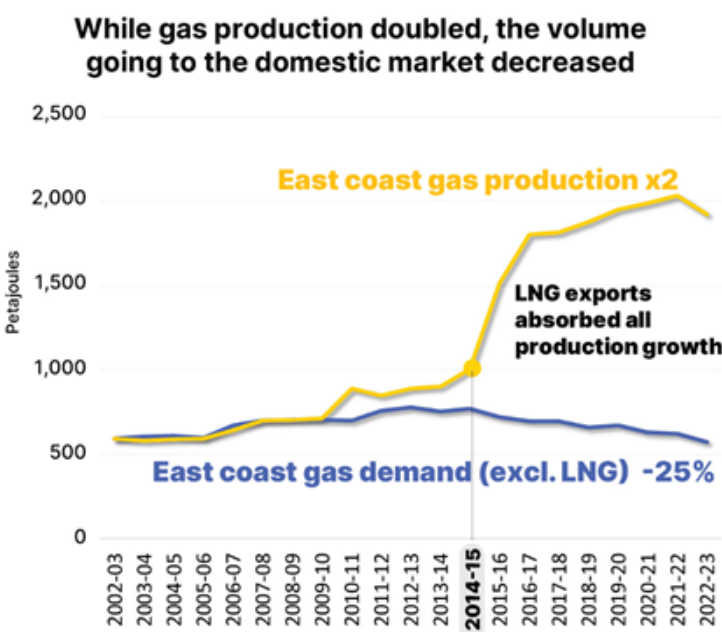

In reality, energy costs are likely to rise significantly more than Moody’s forecast since East Coast gas prices will continue to rise, making firming power more expensive.

Due to no local reservation policy on the East Coast, nearly three-quarters of gas is exported, primarily to China, resulting in shortages and rising costs at home.

If the Albanese government genuinely wanted to stimulate manufacturing in Australia, it would reform the East Coast gas market and make gas cheap for Australian businesses and individuals. Doing so would also lower electricity prices.

Then, Australian manufacturing would become more internationally competitive and would flourish independently, obviating the necessity for government subsidies.

Australia has plenty of energy, so its power costs should be among the lowest in the world.

Do we want an economy where the only viable manufacturing in Australia depends on government subsidies and poorer Australians cannot afford to heat or cool their homes?

There is no manufacturing future in Australia without reliable and affordable energy.