The most significant information in Wednesday’s monthly inflation indicator from the Australian Bureau of Statistics (ABS) was the sharp decline in housing inflation.

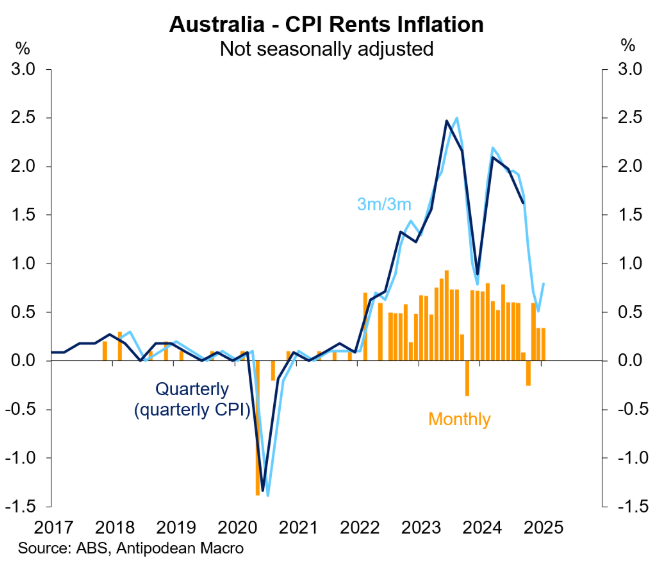

As illustrated below by Justin Fabo from Antipodean Macro, the easing in CPI rent inflation continued in January, with rents rising by only 0.3% over the month to be 5.8% higher year-on-year.

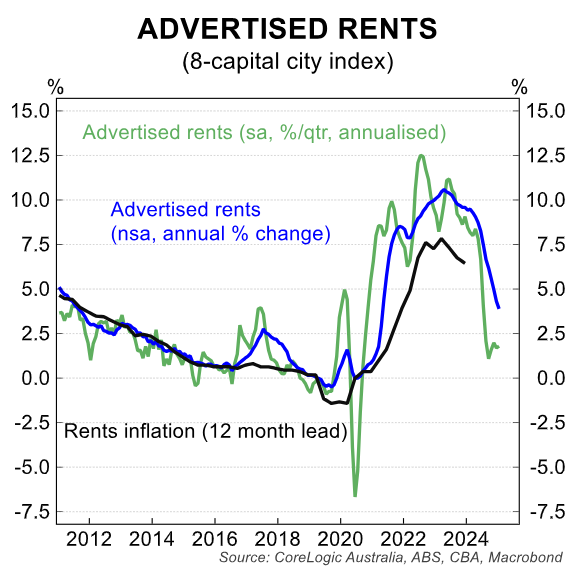

The following chart from CBA plots CoreLogic’s asking rents series against the ABS’ CPI rents. As you can see, advertised rents are pointing to further disinflation in the period ahead.

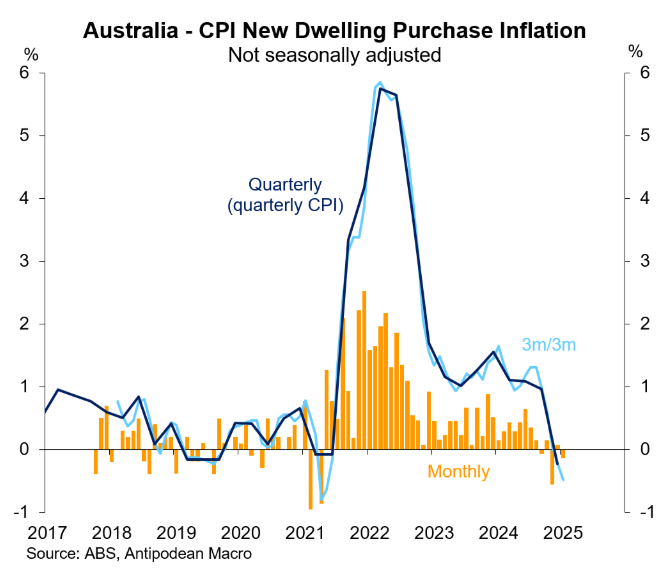

New dwelling purchase prices also fell by 0.1% in January, continuing the recent run of soft prints. The ABS attributed the decline in prices to “project home builders offering incentives and promotional offers to entice business”.

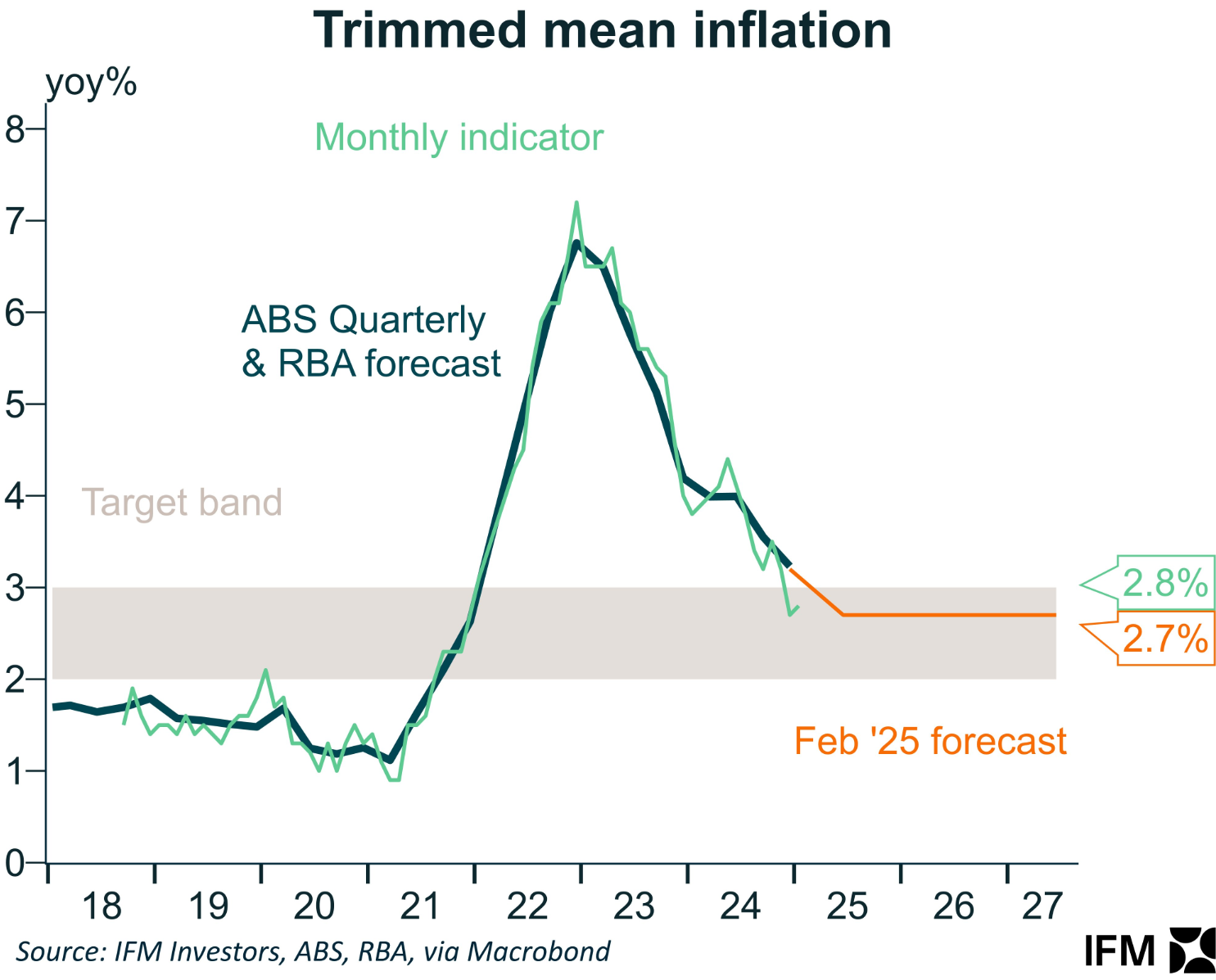

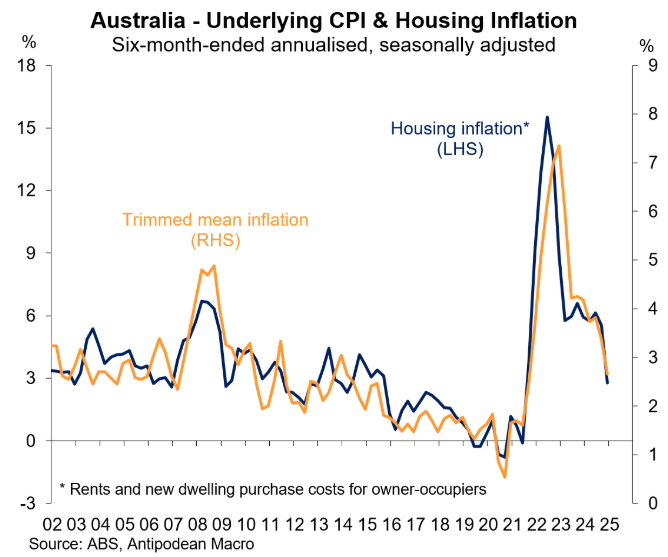

Below is the ‘money’ chart from Fabo. It illustrates the strong correlation between housing and trimmed mean inflation.

“The weak outcomes for rents and new dwelling purchase inflation will be very welcome news for the RBA (and rate doves)”, Fabo said.

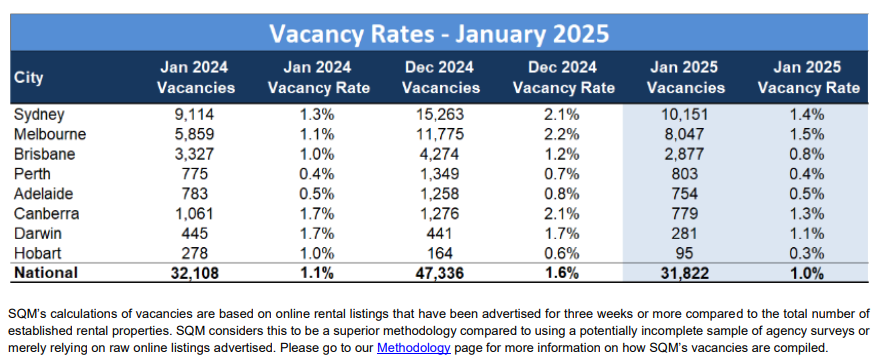

It is worth reminding readers that the latest rental vacancy data from SQM Research showed that the nation’s vacancy rate fell to 1.0% in January 2025, down 0.1% from a year earlier.

“The sharp decrease in rental vacancies strongly indicates Australia’s rental market crisis is not over and has potentially deteriorated at the start of 2025”, SQM Research noted.

SQM Research also recorded a sharp rise in rental prices in January following a period of moderation in 2024. Capital city advertised rents rose by 1.6% over the month.

Whether SQM Research’s data is an outlier remains to be seen.

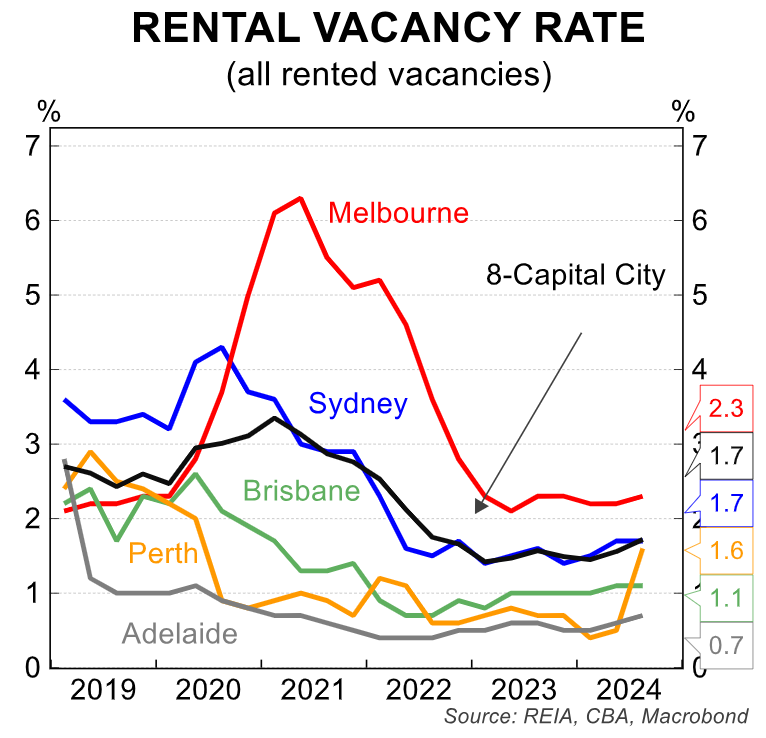

Separate rental vacancy data from the REIA suggests the vacancy rate has eased a little but remains tight.

CoreLogic’s latest Cordell Construction Cost Index (CCCI) also showed that residential construction costs grew 3.4% over the 12 months to December 2024, the largest annual increase in construction costs since the year to September 2023 (4.0%).

“While deflation in new dwelling purchases seems contrary to increasing construction costs, the ABS noted this decline was primarily driven by builders offering discounts and promotional offers to entice business, putting further pressure on margins”, CoreLogic Economist Kaytlin Ezzy said.

Thus, the deceleration of housing inflation signals lower underlying inflation and more rate cuts. But risks remain.