Local gas prices are still outrageous, above $13Gj.

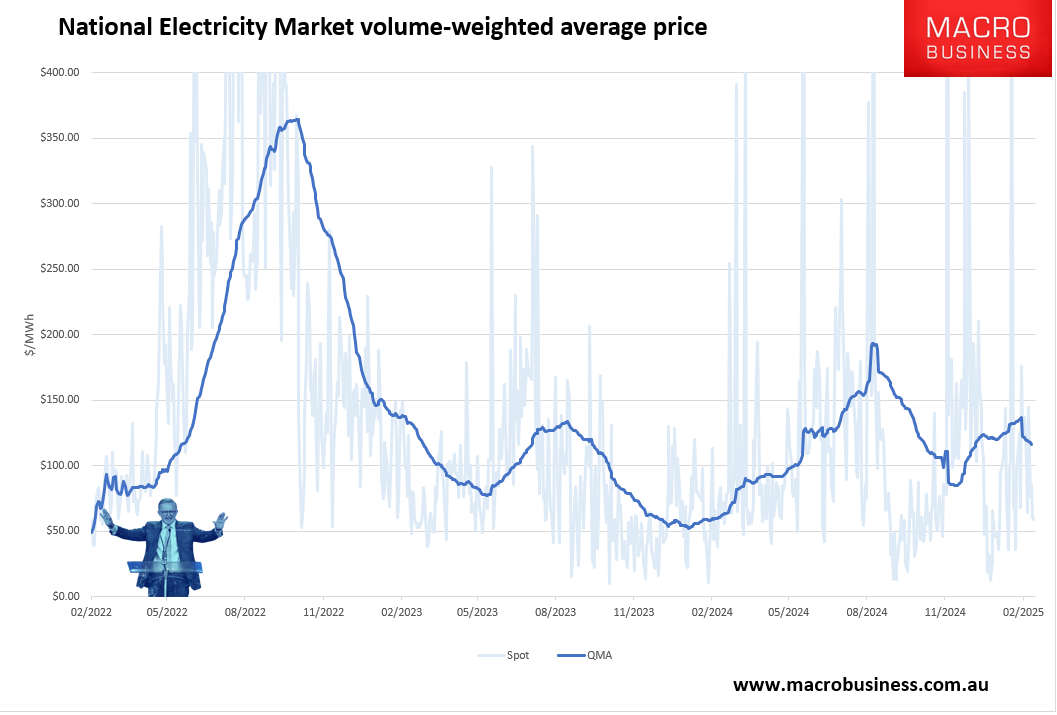

Electricity prices have come down with gas but also still nosebleed.

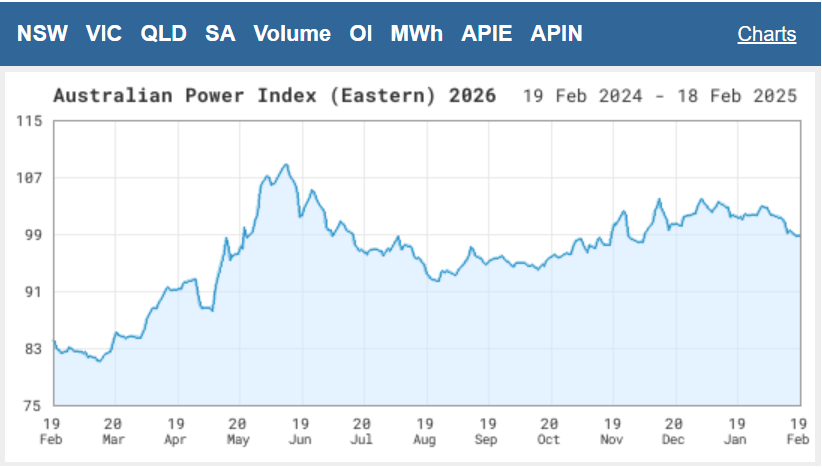

With futures showing the coming price retail hikes.

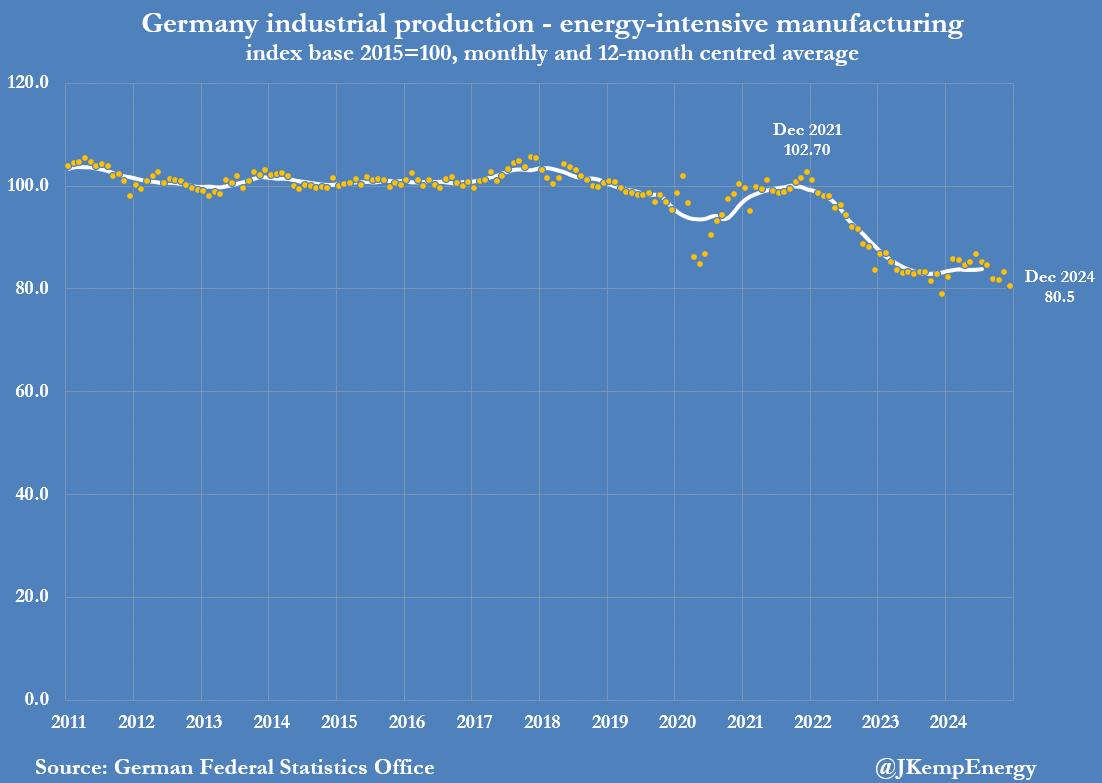

Finally, today, a kick-arse chart by John Kemp showing what expensive gas does to an advanced manufacturing base. Example Germany.

GERMANY’s energy-intensive manufacturing output was down by 22% in December 2024 compared with the same month three years earlier. Businesses in iron and steel, smelting, chemicals, fertilisers, glass, ceramics and papermaking have struggled to adjust to the massive escalation of gas and electricity prices since Russia’s full-scale invasion of Ukraine in 2022. Energy-intensive output showed no sign of recovering even before the most recent escalation of gas futures prices:

Smashed.

This is the plan for Australia when LNG imports arrive later this year for Australia as well.

The only difference?

We have cheap local gas to reserve if we want to. Germany has none.

Australia does not so much have a gas export industry as it does a gas scarcity import industry.