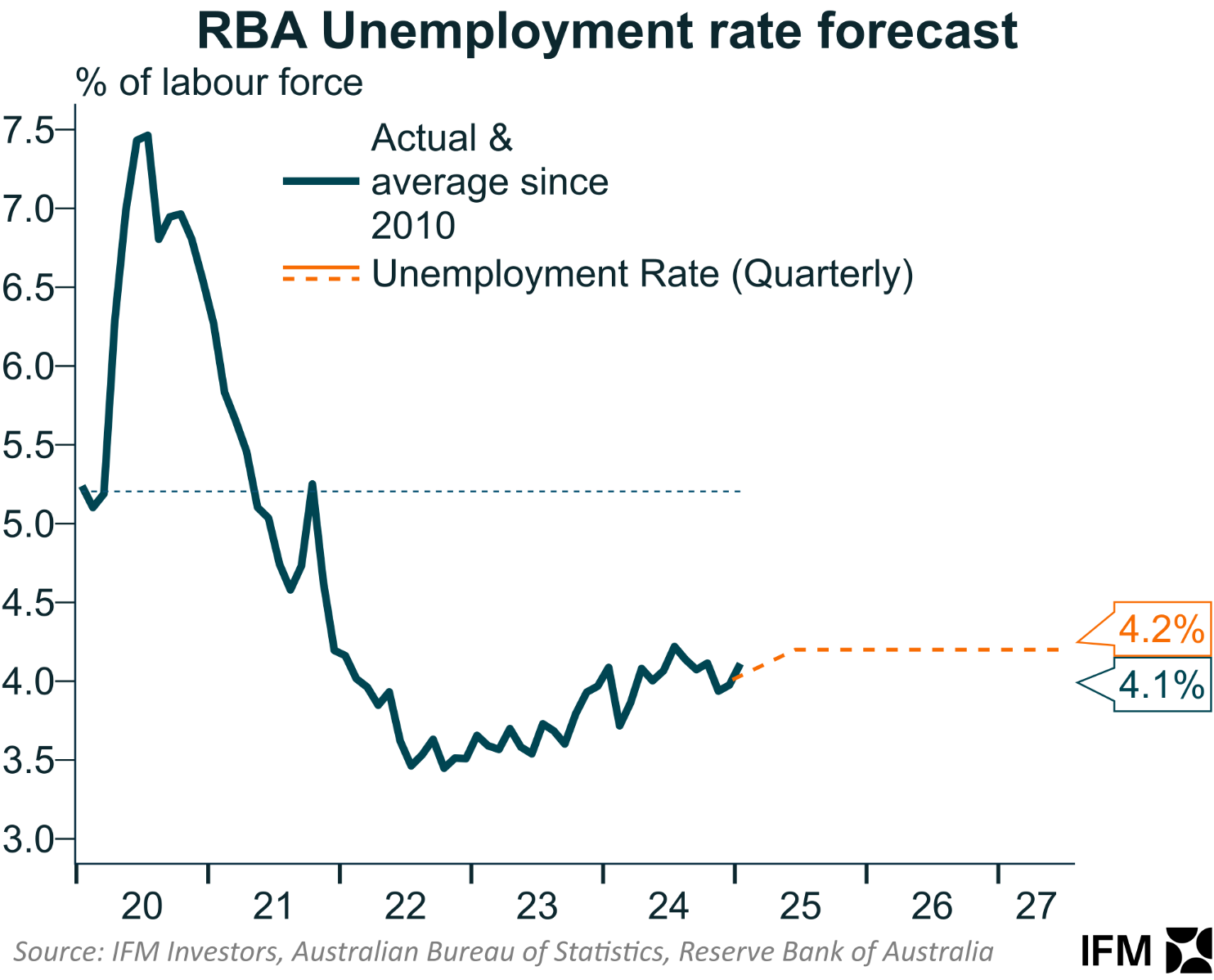

The strength of Australia’s labour market was the biggest factor working against an interest rate cut at Tuesday’s Reserve Bank of Australia (RBA) monetary policy meeting.

It was also the biggest upside risk highlighted in the RBA’s statement on the decision.

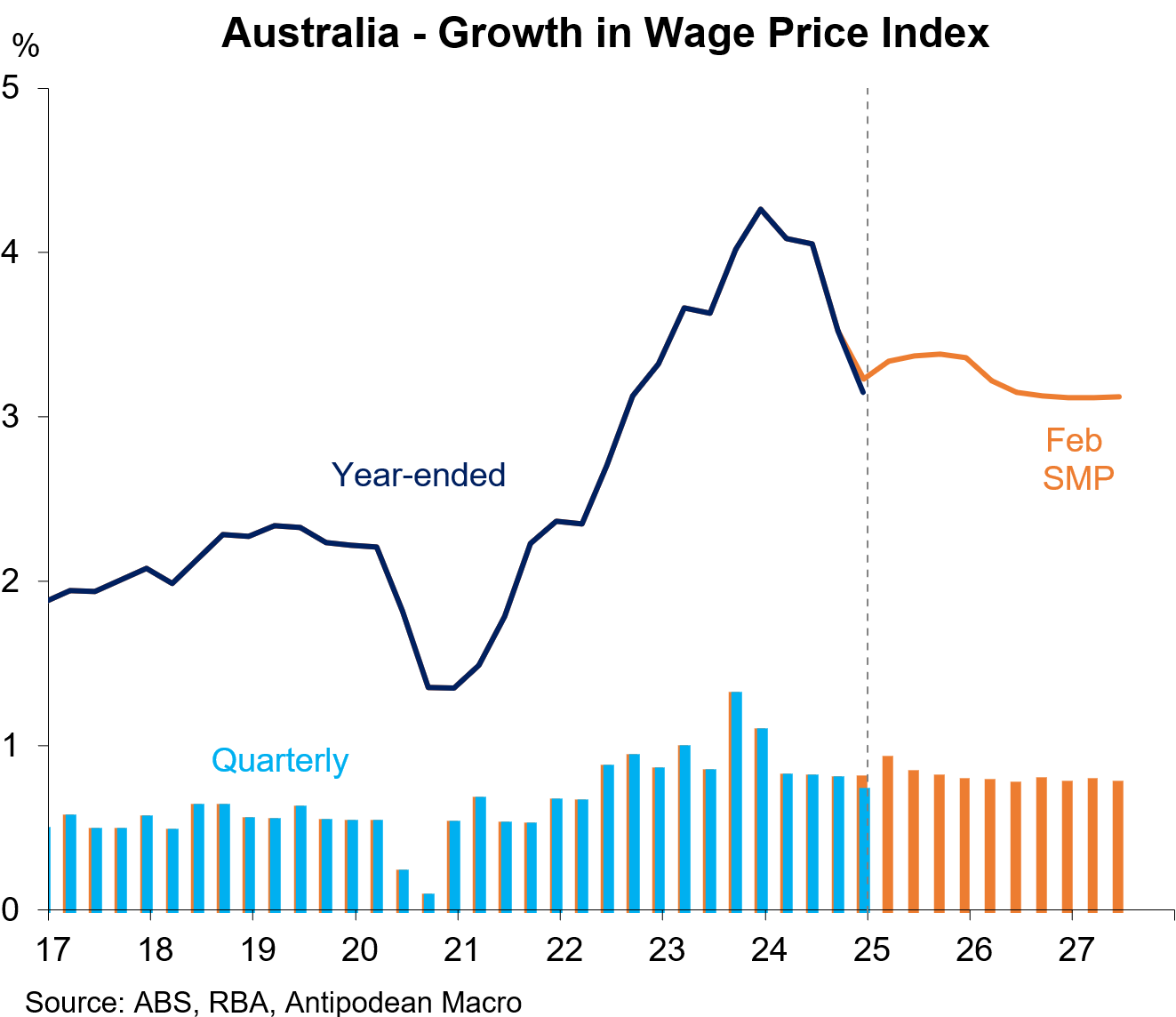

On Wednesday, the Australian Bureau of Statistics (ABS) released the Q4 2024 wage price index, which showed that wage inflation is falling fast and tracking below the RBA’s latest forecasts.

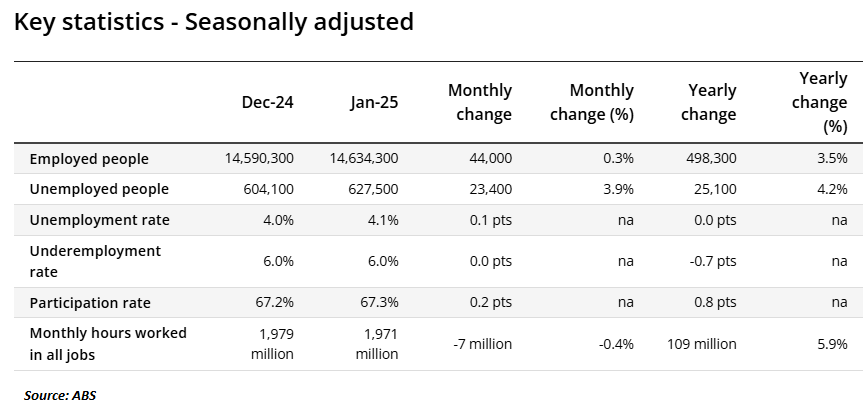

On Thursday, the ABS released the January labour force report, which recorded a 0.1% increase in Australia’s unemployment rate (to 4.1%) and a 0.4% decline in monthly hours worked.

While the result was far from weak—given the solid rise in employment and participation—the RBA should take comfort that the labour market didn’t tighten further.

Indeed, it would have been embarrassing for the RBA if they had cut rates only to then see the unemployment rate decline.

Still, Alex Joiner from IFM Investors cautioned on Twitter (X) that the labour market remains strong and is likely adding to demand.

“The tick higher in the unemployment rate is not the main game in these strong labour market data for the RBA”.

“Strong employment growth, record employment level, record proportion of population employed and record participation all means there’s more people with a wage (a very positive thing) that are adding to demand”.

If there is a strong result in next month’s ABS labour force release that sees the unemployment rate drop below 4%, it could prevent the RBA from cutting again at its next meeting in April.