Australians are continually told that the nation’s housing crisis is a supply issue.

We are told that the crisis would be resolved if planning was eased and the nation built more homes.

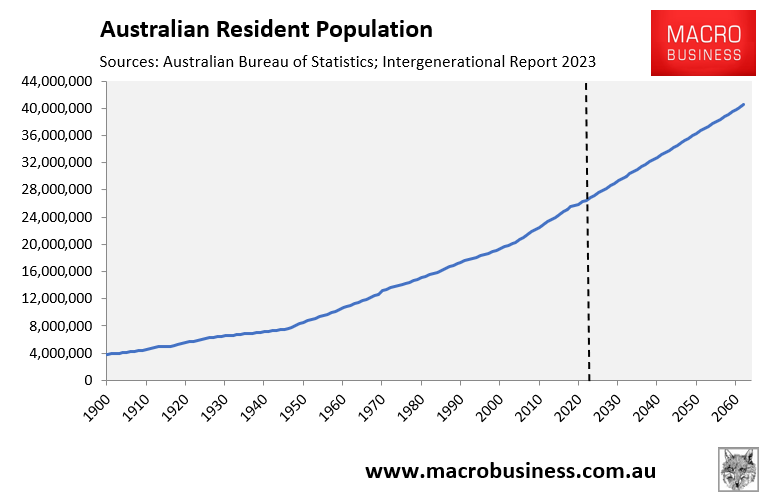

As a result, we are being conditioned for a future of high-rise apartment living to accommodate the projected 13 million extra residents expected to arrive in Australia over the coming 38 years.

However, the federal government’s actual housing affordability policies always revolve around pumping demand.

This week, Treasurer Jim Chalmers directed Australia’s financial regulators to ease home-lending restrictions for millions of Australians with education loans.

A borrower’s student debt will be excluded from mortgage serviceability tests where a bank anticipates the borrower to pay off the amount in “the near term”.

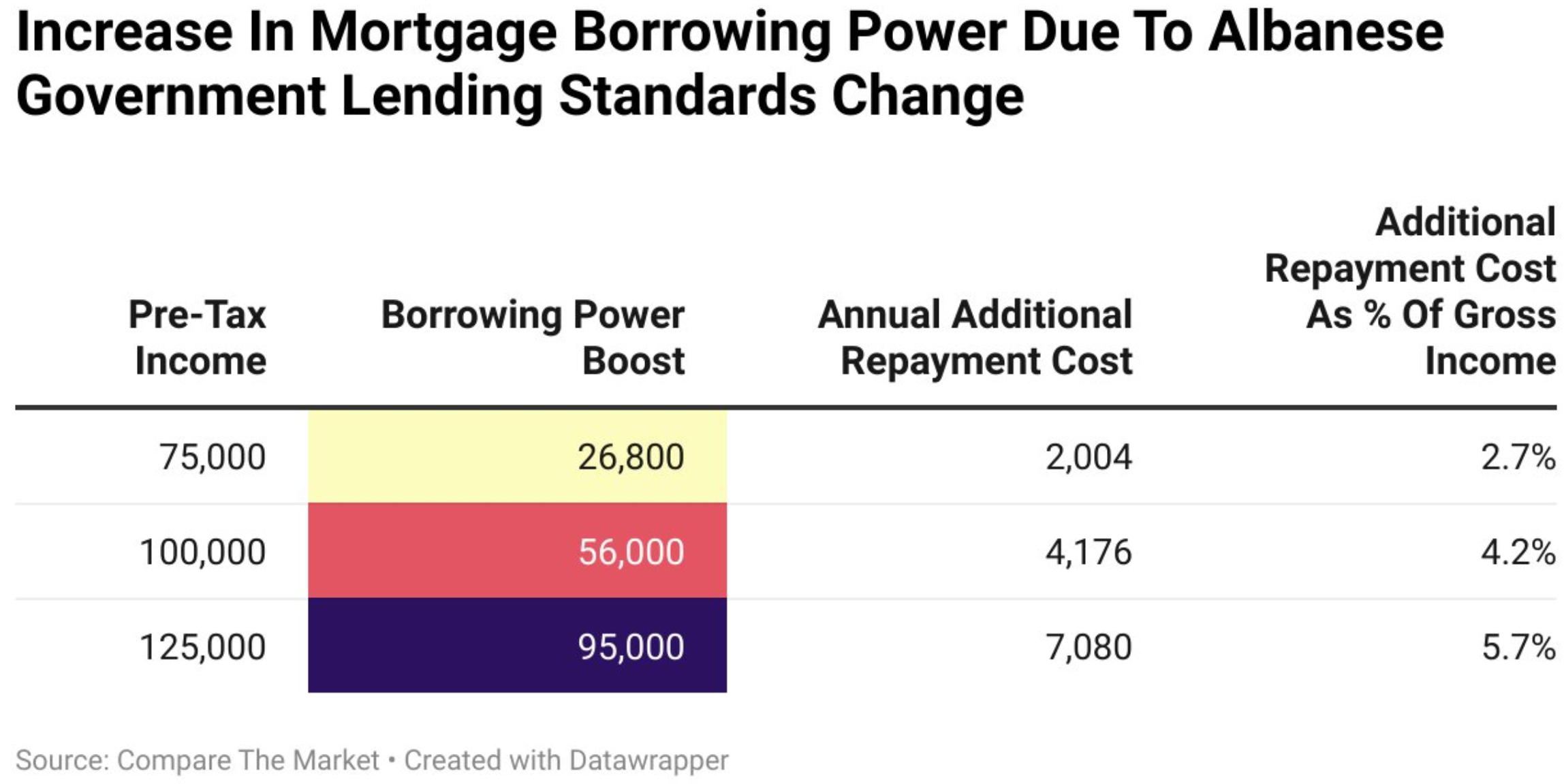

According to Compare the Market, a tertiary-educated single professional earning $125,000 would be able to borrow an additional $95,900 under the announced policy.

Someone earning $100,000 would have an extra borrowing capacity of $56,000, whereas someone earning $75,000 would be able to borrow an additional $26,800.

Late last year, housing minister Clare O’Neil explicitly stated that government policy would not lower house prices and that Labor wants to see prices rise “sustainably”.

“We want to bring house price growth into something sustainable. So we are not trying to bring down house prices”, O’Neil said.

“Our government’s policies are not going to reduce house prices and we want house prices to grow sustainably”.

This week, O’Neil spruiked the latest lending changes, which are “focused on getting young Australians into a home of your own”.

The reality is that the changes will intensify Australia’s housing crisis by increasing demand and inflating home values.

We shouldn’t be surprised by this policy. It was explicitly flagged by O’Neil last year. The government’s official policy is to increase home prices while they pretend to tackle “affordability” via demand-side stimulus.

The Coalition is no different.