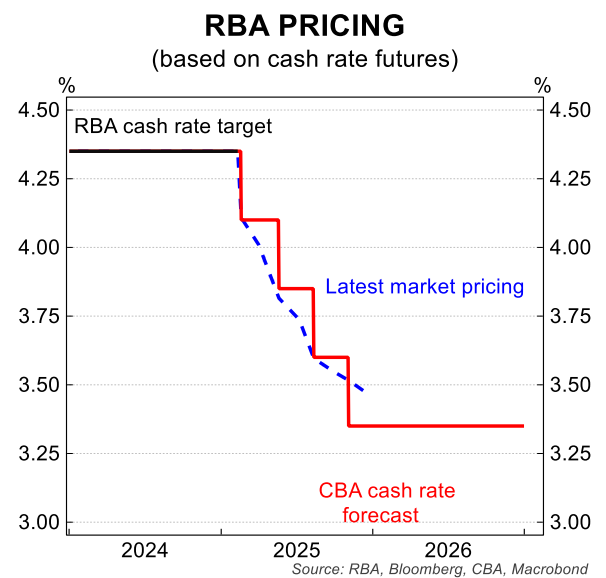

Current market pricing has ascribed a 93% probability that the Reserve Bank of Australia (RBA) will cut the official cash rate at next week’s monetary policy meeting.

CBA’s head of Australian economics, Gareth Aird, ascribes an 80% probability of a 0.25% rate cut next week.

Aird noted that the Q4 24 trimmed mean CPI came in materially below the RBA’s forecast and wage growth has also moderated more quickly than the RBA anticipated.

On the other hand, the unemployment rate over Q4 24 was lower than the RBA forecast, but Aird believes this shouldn’t stand in the way of commencing an easing cycle in February given policy is at a restrictive setting.

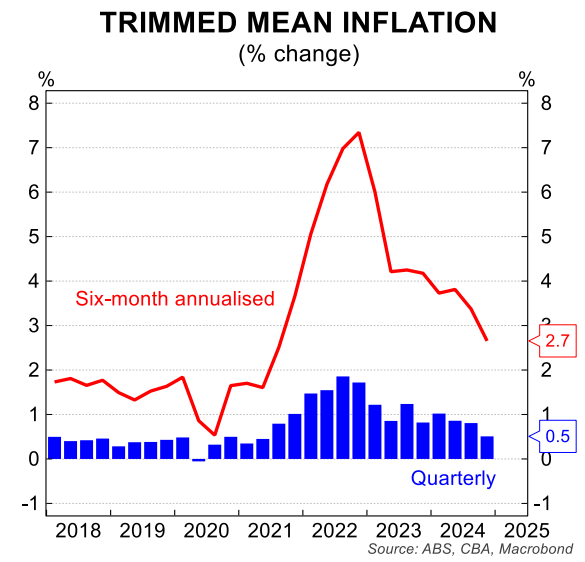

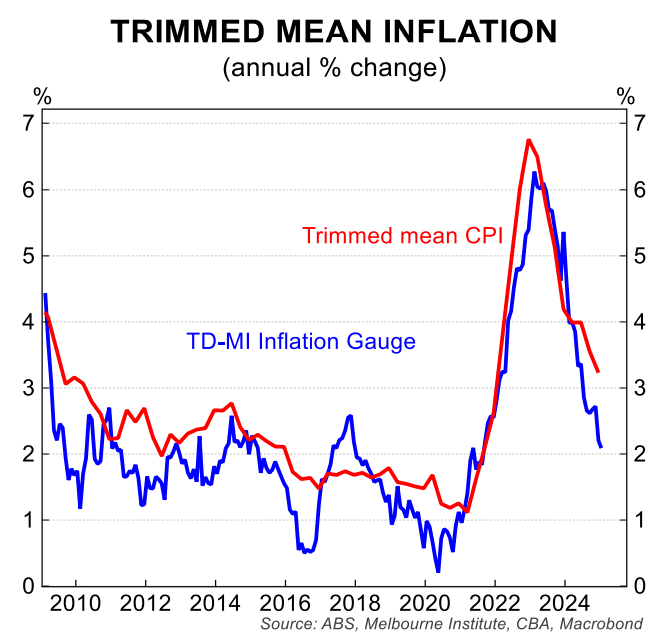

Aird published a series of charts illustrating the decline in Australia’s inflation.

Trimmed mean inflation has fallen within the RBA’s 2% to 3% target band when measured on both a quarterly (0.5%) and a six-month average basis (2.7%).

The Melbourne Institute inflation gauge has also fallen sharply.

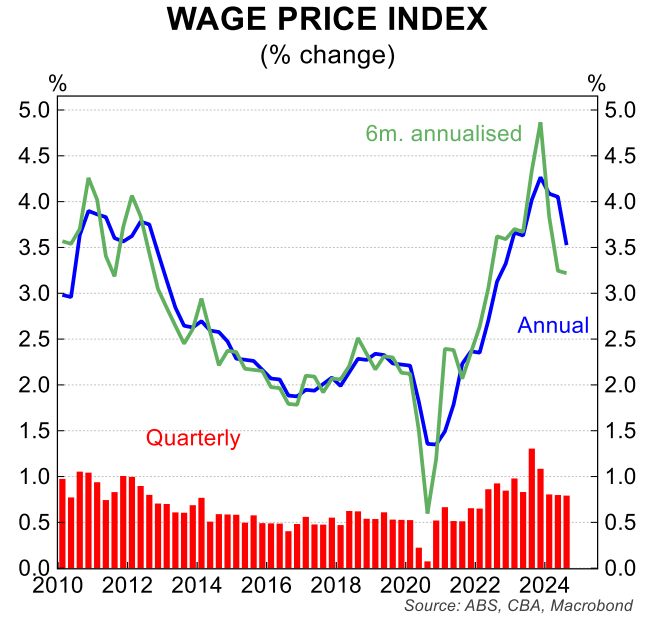

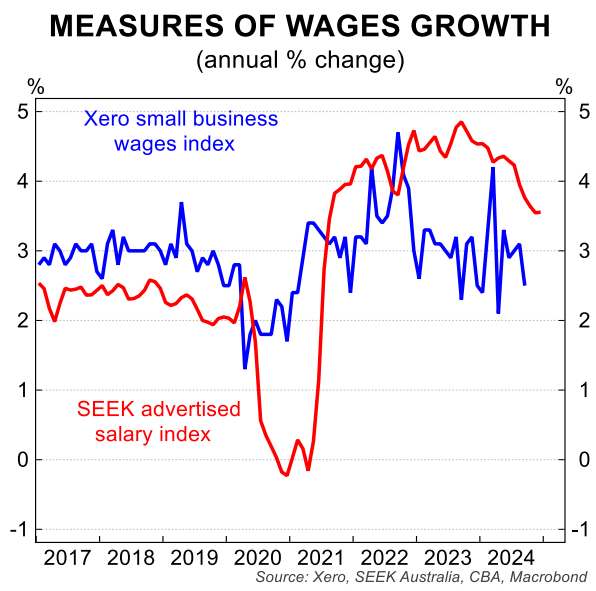

Various measures of wage growth have moderated significantly.

This includes the official wage price index.

The SEEK advertised salary and XERO small wage index have likewise stepped down.

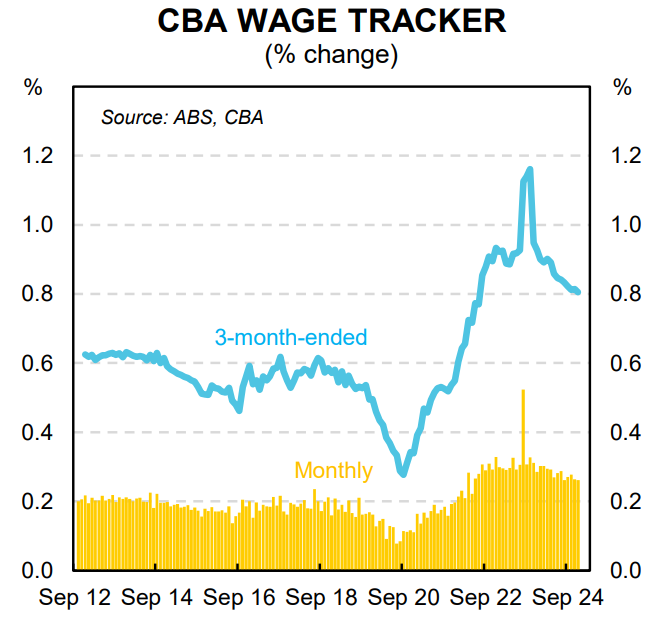

CBA’s wage tracker is also trending lower.

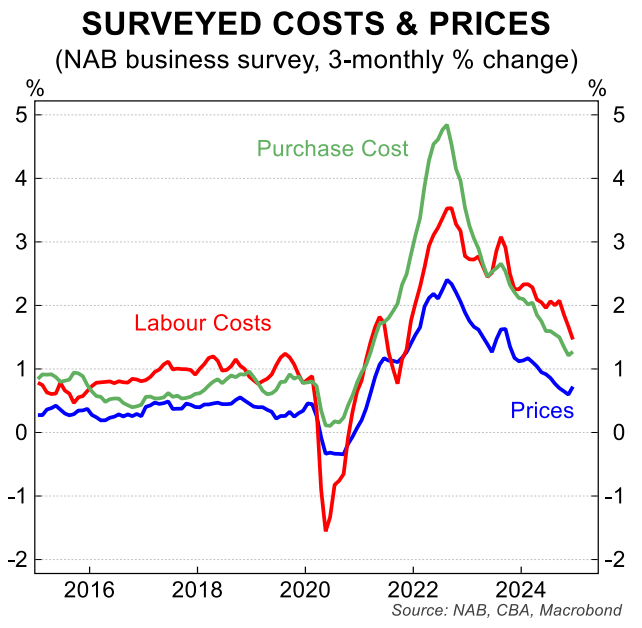

The various inflation measures of the NAB Business Survey—purchase costs, labour costs, and prices—have moderated as well.

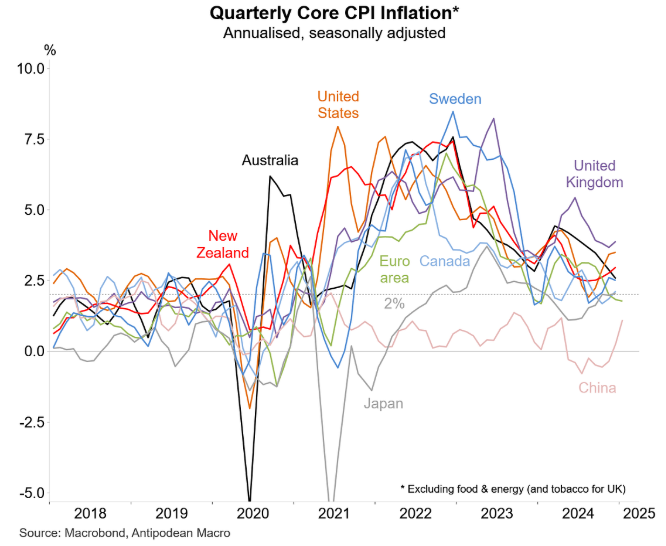

The upshot is that Australia’s core inflation is now tracking below the United States, New Zealand, and the United Kingdom, which have each already commenced easing cycles.

While the inflation dragon appears to have been slain, their are risks brewing on the horizon.

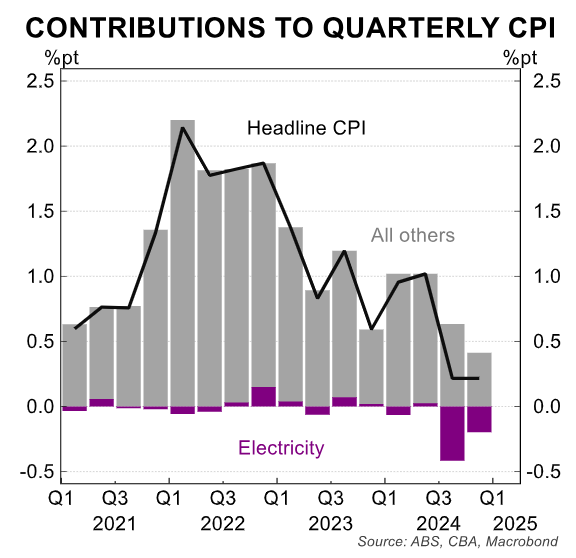

First, Australia’s headline inflation is being artificially suppressed by government energy subsidies, which are set to expire mid-year.

The unwind of electricity rebates will contribute strongly to headline inflation readings, particularly in Q1 25 and in Q3 25, assuming the rebates are not extended as is currently legislated.

While the impact of energy subsidies is excluded from the trimmed mean CPI, they do impact inflation in regulated prices that are pegged to the headline CPI (e.g., excises, welfare payments, minimum and award wages, etc).

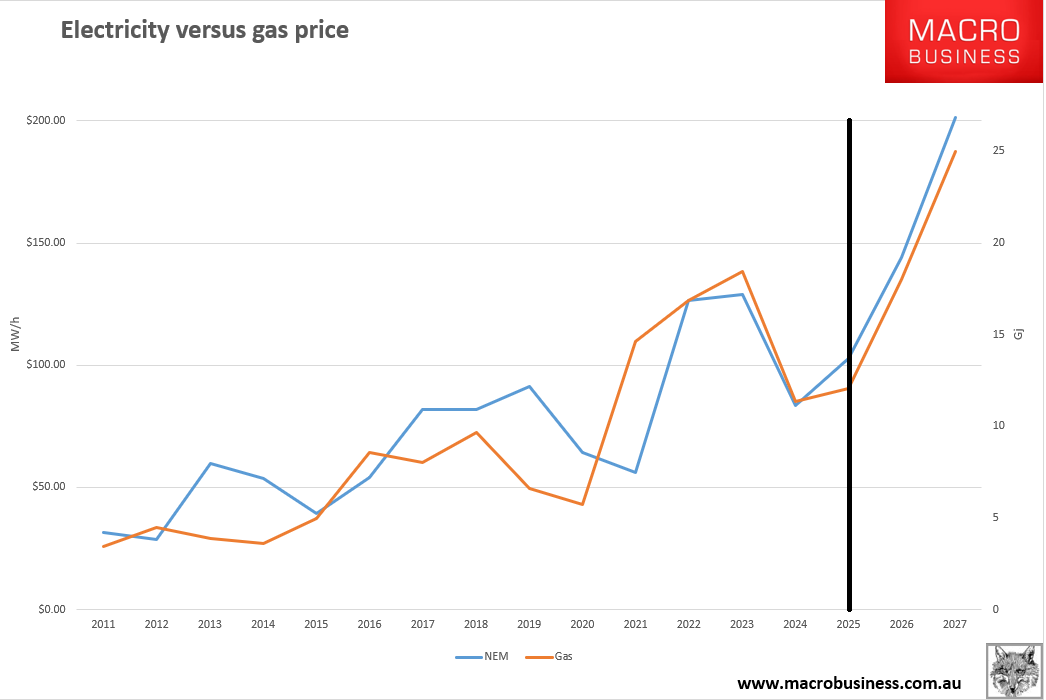

Second, LNG import terminals are expected to come online later this year and early next in New South Wales, Victoria, and South Australia. When this happens, East Coast gas and electricity prices will rise, putting upward pressure on overall inflation.

Moody’s also warned last week that the massive investment in renewables to meet ‘net zero’ targets could drive retail power prices up by 35% over a decade.

Therefore, Australia faces medium- to longer-term inflation shocks via rising energy prices.