Property analysts believe the ‘Fear of Missing out’ (FOMO) will engulf Australia’s housing market once the Reserve Bank of Australia (RBA) cuts interest rates.

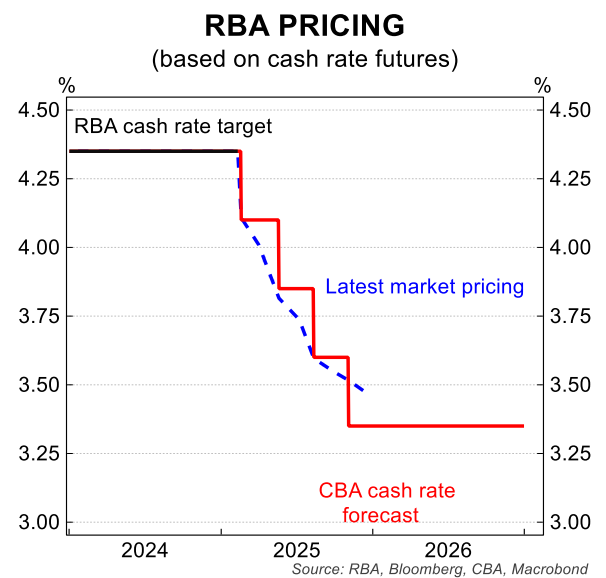

Financial markets believe the RBA will cut the official cash rate by 0.25% next week, followed by three additional cuts throughout the year.

PropTrack has modelled the average savings homeowners would receive from rate cuts.

New house owners in Greater Sydney would save an average of $190 per month from the first 0.25%, while unit owners would save an average of $100.

Sydney house owners would save $770 per month if four cuts were implemented this year, as expected by CBA, Westpac, and NAB, reaching $9,240 for a full year of repayments.

Diaswati Mardiasmo, chief economist of PRD Real Estate, described the mood leading up to the projected rate cut as a race.

“It seems like there is large section of the market waiting for the gun to go off”, she said, adding that many prospective buyers and sellers have been holding off moving until there is a rate cut.

“Market sentiment is going to change and that may make more of a difference then just the mortgage relief”, she said.

Investment adviser George Markoski said the rate cuts could open one of the “biggest floodgates in the history of the market” because many would-be buyers have been waiting for a cut.

However, REA Group economist Angus Moore cautioned that record-low affordability would temper the upswing.

“We’re expecting a price boost, but housing affordability is at the worst level in three decades and that may put a bit of a damper on price rises … they may not be as high as in previous rate cut cycles”, he said.

We have seen signs that homebuyer sentiment has risen ahead of expected rate cuts.

Westpac’s latest consumer sentiment survey noted that “consumers have become much more confident about the prospect of interest rate cuts”.

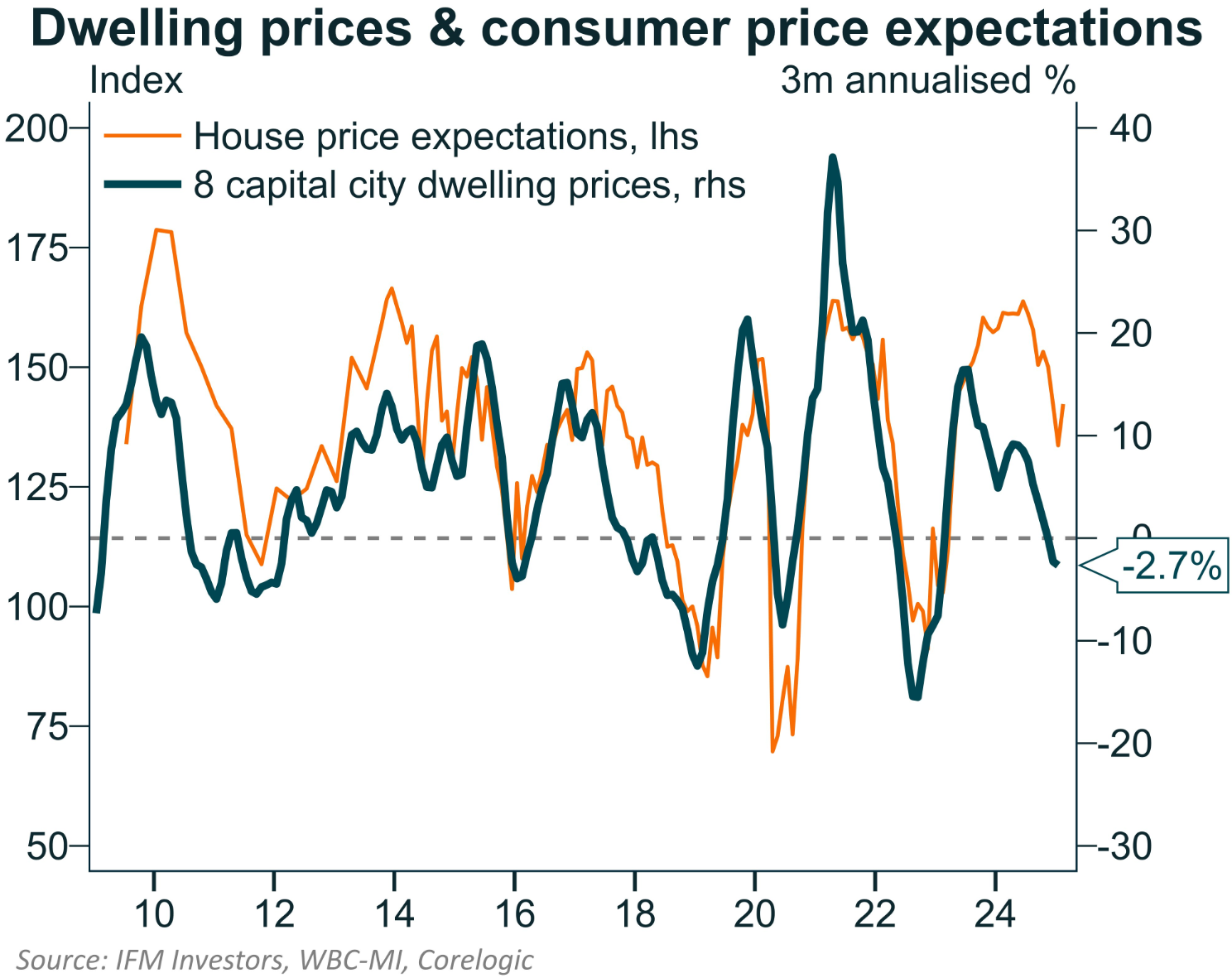

As a result, “house price expectations rose by 6.5% to 142.3 in February, a solid lift, and the first rise since October”.

While it is still early, Australian consumers believe rate cuts will positively impact house prices, as Alex Joiner from IFM Investors illustrates below.

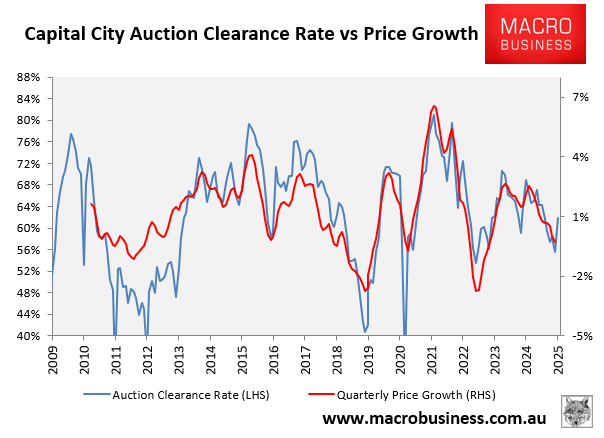

Final auction clearance rates have also strengthened, as illustrated below.

This week, Treasurer Jim Chalmers instructed Australia’s financial regulators to relax home-lending rules for millions of Australians with university debts.

Under these changes, a borrower’s student debt will be discounted from mortgage serviceability tests where a bank expects the borrower to pay off the debt in “the near term”.

Compare the Market analysis shows that a tertiary-educated single professional earning $125,000 could borrow an extra $95,900 based on the announced changes.

The extra borrowing power for some earning $100,000 would be more than $56,000, whereas a person earning $75,000 can borrow an additional $26,800.

The changes will add more fuel to the FOMO fire and help push Australian home values higher.