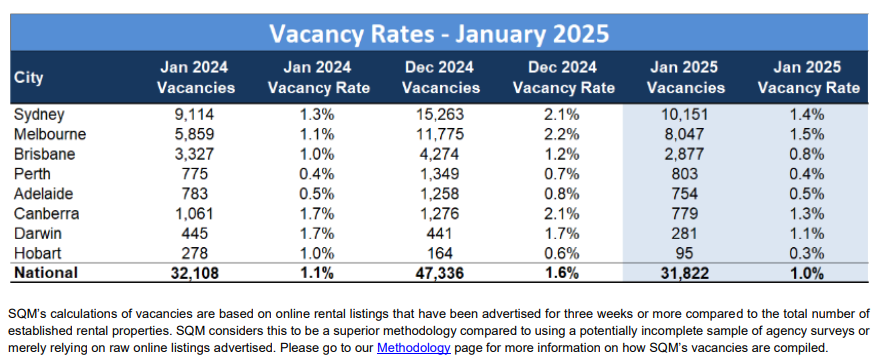

Last week, SQM Research released its January vacancy report, revealing that the national vacancy rate declined to just 1.0%, down 0.1% from January 2024.

Commenting on the results, SQM Research managing director Louis Christopher noted that the rental crisis appears to have reignited, potentially driven by a resurgence of net overseas migration.

“The sharp decrease in rental vacancies strongly indicates Australia’s rental market crisis is not over and has potentially deteriorated at the start of 2025”, Christopher noted.

“Could there have been another surge in migration levels in recent weeks? We don’t know for sure, but clearly something has driven this retreat in rental vacancies”.

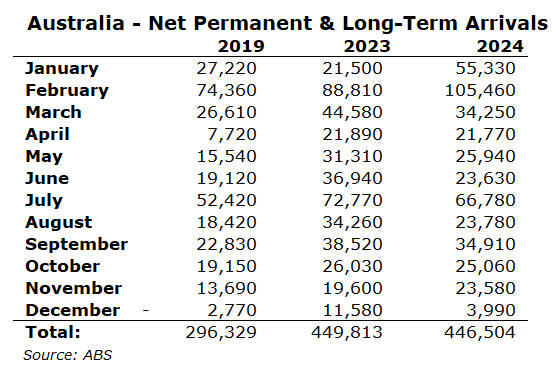

On Friday, the Australian Bureau of Statistics (ABS) released data on net permanent and long-term arrivals for January, suggesting that immigration remains strong.

In the 2024 calendar year, 446,504 net permanent and long-term arrivals landed in Australia. This was only 3,300 fewer than in 2023 and was a whopping 150,175 higher than the pre-pandemic level in 2019.

The 2024 net arrivals figures were also 91,000 higher than the 2009 peak.

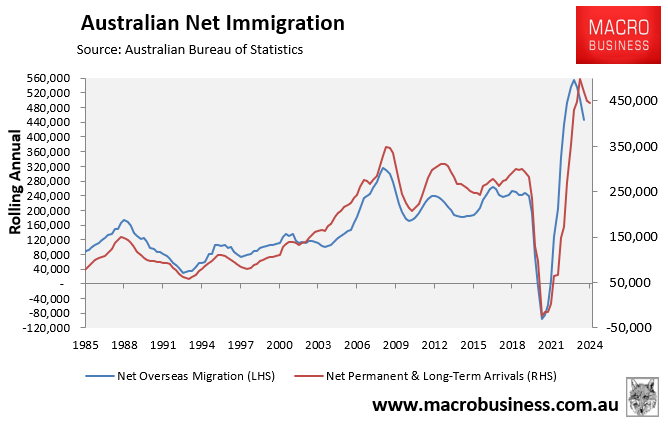

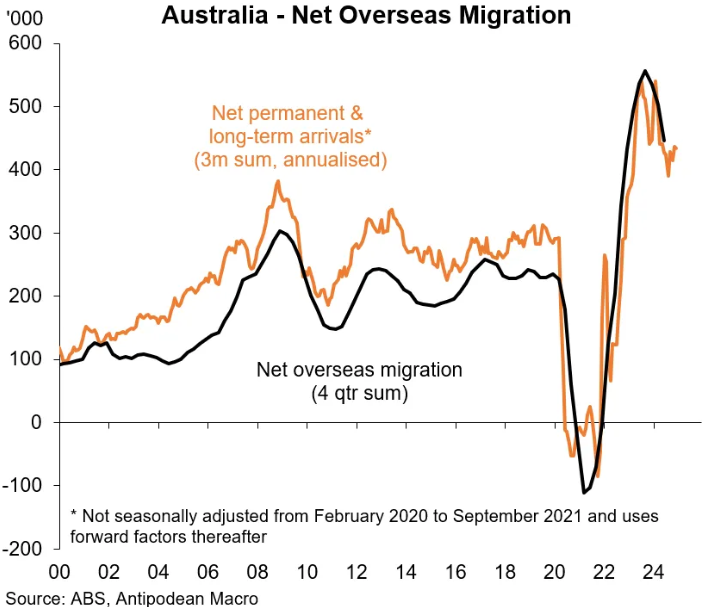

The following chart plots annual net permanent and long-term arrivals against the official quarterly net overseas migration (NOM) figures, which are current to Q2 2024.

The monthly net permanent and long-term arrivals data suggests that NOM remains highly elevated.

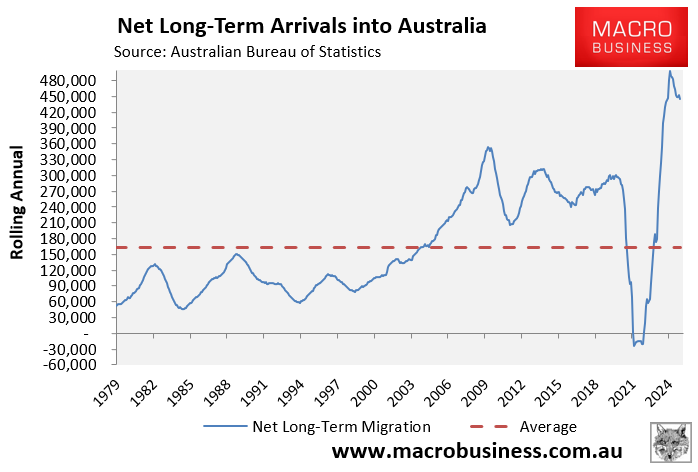

The following chart from Justin Fabo from Antipodean Macro suggests the same.

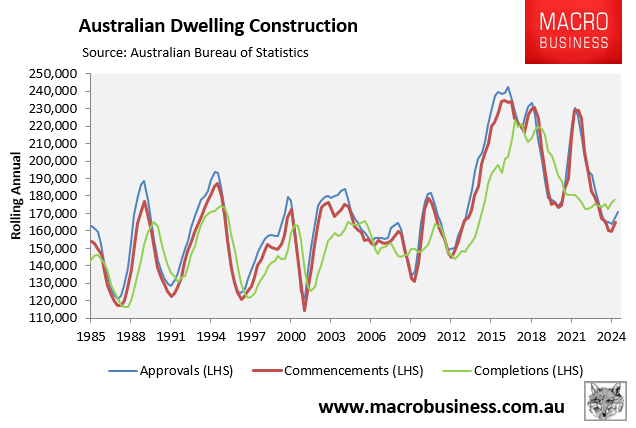

Meanwhile, indicators of housing construction—approvals, commencements, and completions—are tracking near-decade lows.

Australia is importing too much rental demand into a supply-restricted market.

This is a disastrous policy for Australian tenants.