New data from Ray White, published in News.com.au, suggests that property investors continue to flee Victoria following state government land tax hikes.

Ray White claimed that investors owned more than one-third of the 4332 Melbourne homes the agency auctioned in the 12 months to February 6, 2025, and 32.2% of regional Victorian homes auctioned.

Ray White Group’s chief economist Nerida Conisbee said that Victoria now wore the “unenviable title of having the highest property taxes in Australia”.

“The consequences of this high-tax environment are far-reaching”, she said.

“The backbone of the rental market – individual investors – are shying away and limiting the number of rental properties”.

Separate rental bond data from the Victorian Government showed a reduction of 24,726 rental properties (3.6% of total stock) in the year ending 30 September 2024, the sharpest decline in rental bonds on record.

Melbourne lost 23,108 rental properties (4.2% of its stock) over the same period.

I disagree with Nerida Conisbee that the decline in property investors is ‘bad news’ since the investor sell-off has benefited Victorian tenants and first-time home buyers.

Core Logic’s head of research, Tim Lawless, noted the following in December:

“Melbourne rents were down 0.4% through the second half of 2024, mostly due to a 1.1% fall in unit rents, while house rents are unchanged over the past six months”.

“At the same time, we are seeing a rise in rental vacancy rates and an easing in rental growth, suggesting less rental supply is being accompanied by less rental demand”.

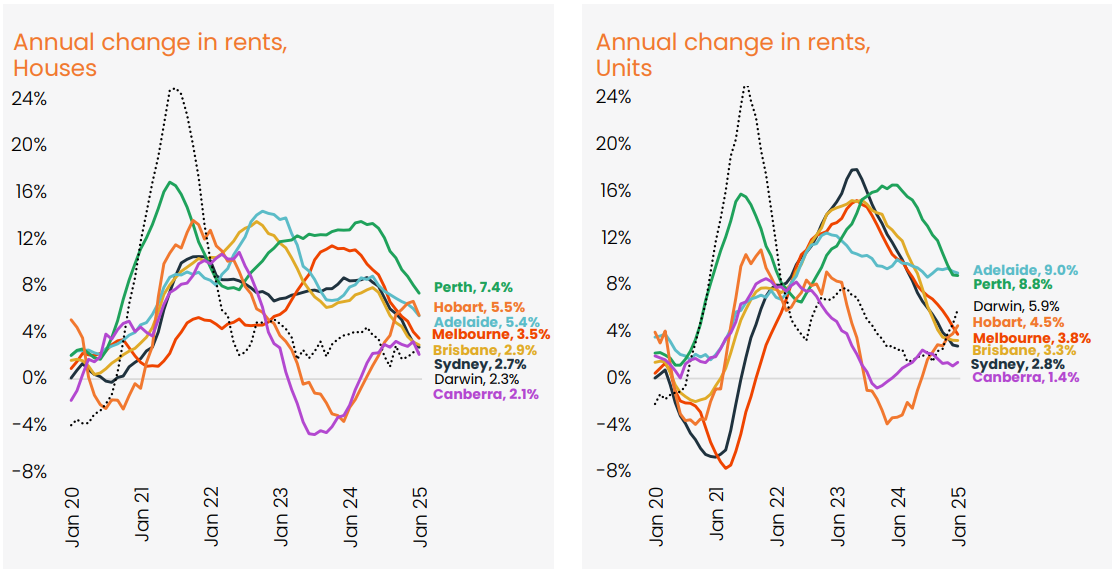

As illustrated below, Melbourne’s asking rents are growing more slowly than the national capital city average.

Source: CoreLogic

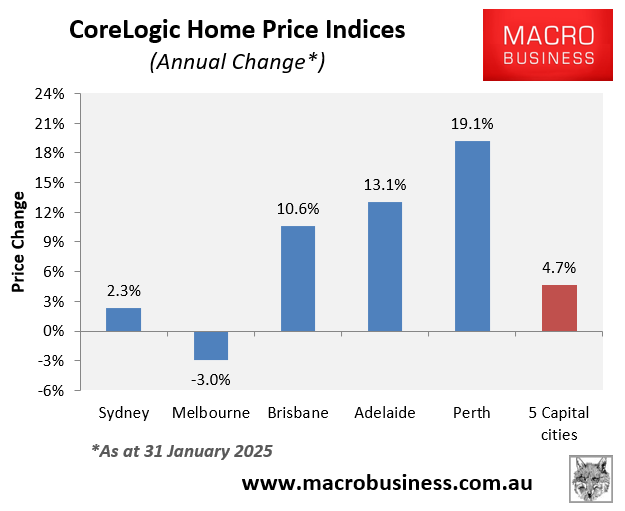

Melbourne’s dwelling values also fell by 3.0% in the year to January 2025, making homes more affordable for first-time buyers.

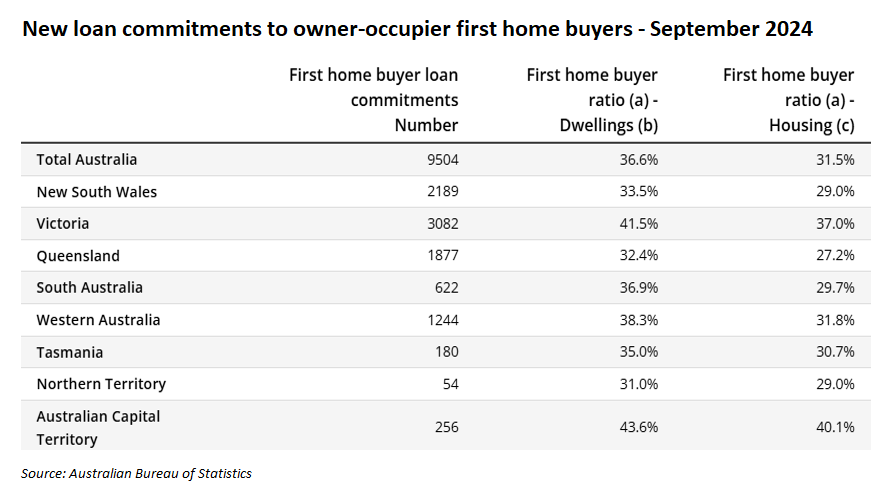

Australian Bureau of Statistics data also shows that Victoria has the highest share of first-time home buyers of any state in Australia.

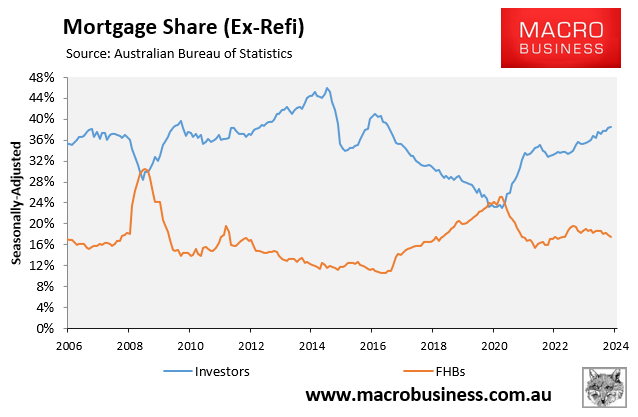

This reflects the historical inverse relationship between investor mortgage demand and first-home buyer mortgage demand.

When investors sell their properties, they do not disappear. They end up in the hands of other investors, upgraders, or first-time home buyers.

A rental property is removed when an investor sells to a first-time homebuyer. However, it also removes a rental household from the market.

As a result, rental supply and demand fall in tandem, leaving the rental market balance unchanged.

If policymakers genuinely want to boost the homeownership rate, they should limit the number of investors in the market.

They should encourage investors to sell to first-time homebuyers, like Victoria does.