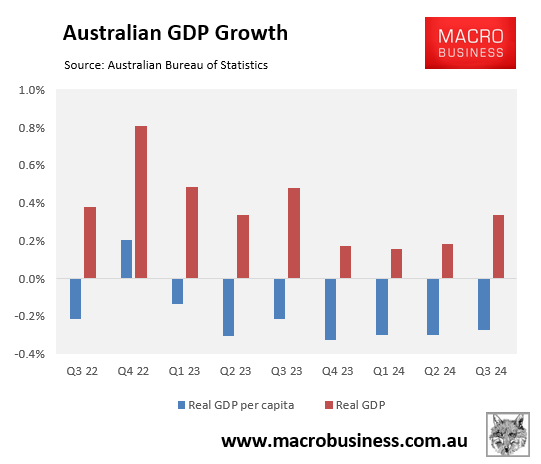

Australians have suffered their longest recession in modern history, with real per capita GDP declining for seven consecutive quarters as of Q3 2024.

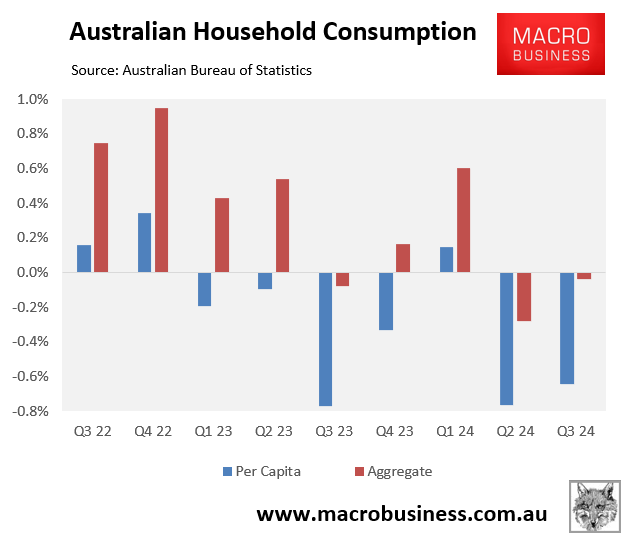

This decline in per capita GDP has been driven by the household sector, where consumption fell for six of the past seven quarters.

This week, the Australian Bureau of Statistics (ABS) has released data suggesting that the household recession could be over.

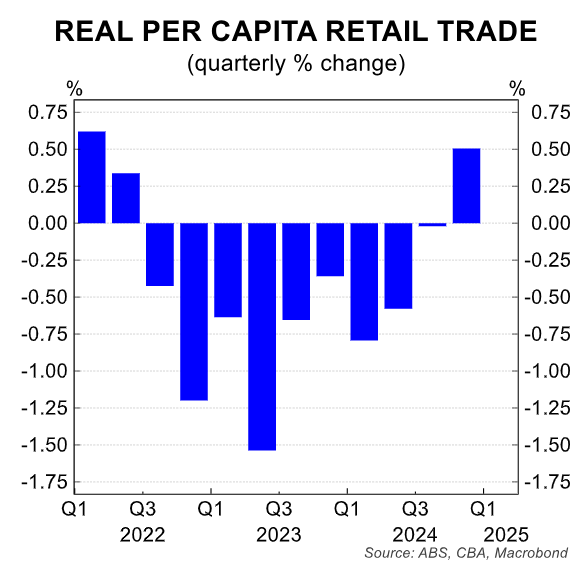

Monday’s retail trade release from the ABS showed that real per capita retail sales lifted by 0.4% in Q4 2024, which was the strongest growth since Q1 2022.

The retail trade release only comprises around 30-35% of household consumption. Therefore, there was a question mark over how this result will translate into the Q4 national accounts.

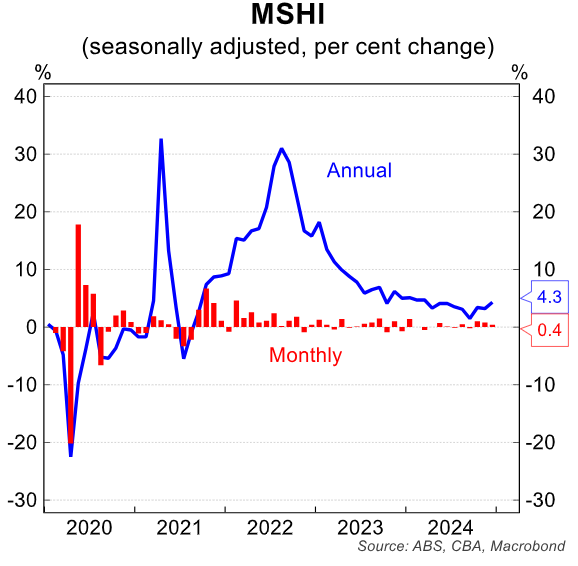

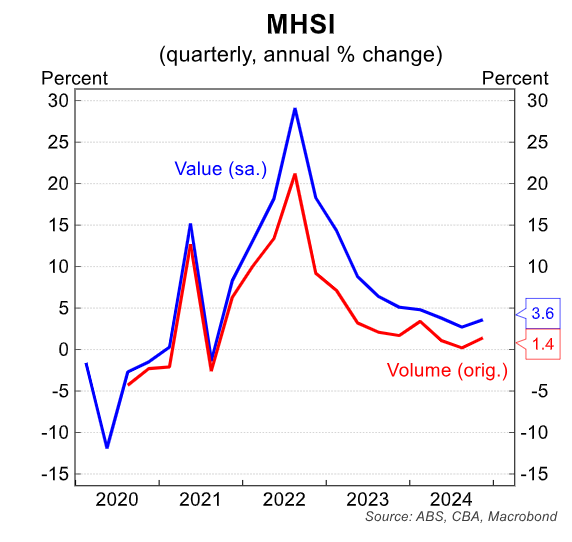

On Tuesday, the ABS released its experimental Monthly Household Spending Indicator (MHSI), which comprises around 68% of household consumption, as represented in the national accounts.

The MHSI rose by 0.4% in December, with the annual rate rising to 4.3% from a revised 3.2% in November. The annual rate has also risen to the highest level since March 2024.

In volume terms, Q4 24 household spending was 1.4% higher year-on-year, up materially from 0.2% annual growth in Q3 24.

Monthly growth also averaged 0.7% in Q4 2024, up from only 0.1% in Q3 24.

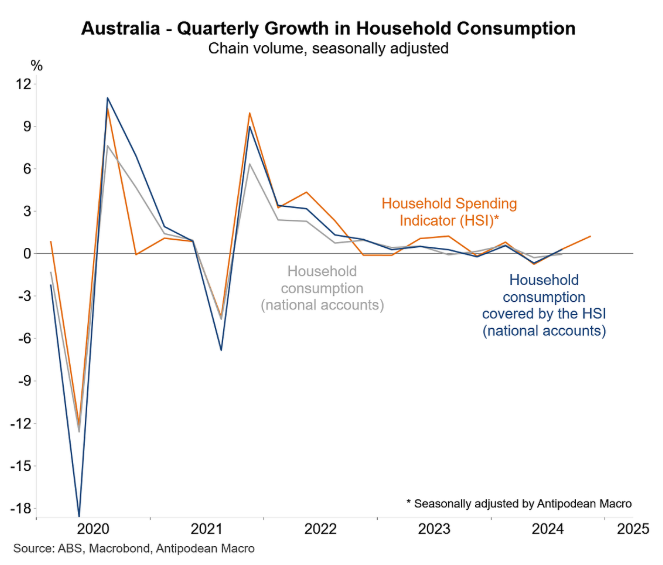

The following chart from Justin Fabo from Antipodean Macro shows that the MHSI augurs well for a rebound in household consumption in the Q4 national accounts.

Indeed, CBA economist Harry Ottley has upgraded the bank’s forecast for household consumption from 0.4% in Q3 2024 to 0.7% in Q4 24.

Given that Australia’s population likely grew by 0.5% in Q4 2024, this would suggest that the consumer recession has finished.

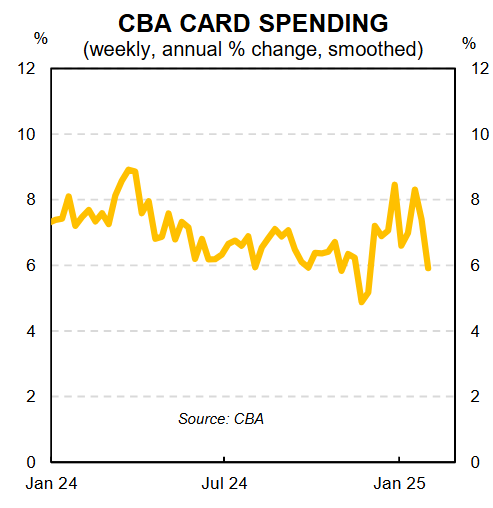

That said, Ottley cautioned that “heavy discounting in the quarter may have boosted spending more than the underlying pulse of consumer momentum warrants. Our high-frequency spending data (to 31-Jan) suggests momentum may ease in January”.

“The timing and expansion of discounting in the quarter and base effects means it is too early to be confident of a sustained upward trend”, Ottley said.