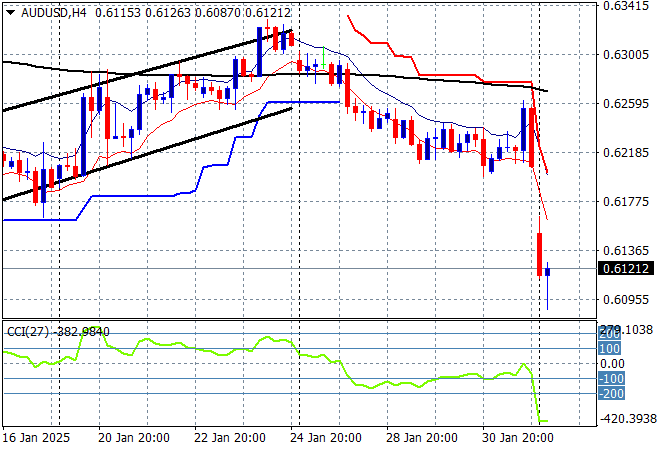

Mind the gap! The new trade war over the weekend, which is set to escalate further as the world pushes back at the Bully-in-Chief sent, well everything risk associated lower with Asian stock markets the first casualties. Currency markets all experienced wide 100-200 pip gaps on the open this morning as the USD soared against all the undollars on the obvious interest rate differential that’s about to dawn on US consumers (aka higher interest rates to tackle import inflation) and the rest of the world. The Australian dollar was a major casualty as it fell immediately below the 61 cent level with a very small reprieve in afternoon trade, giving the RBA a big headache. Oh and Bitcoin collapsed nearly 7% in the last hour or so.

Oil futures are an exception as an energy war will now start between Canada and the US with Brent crude jumping above the $77USD per barrel level while gold was pushed back below the $2800USD per ounce level after finding strong resistance:

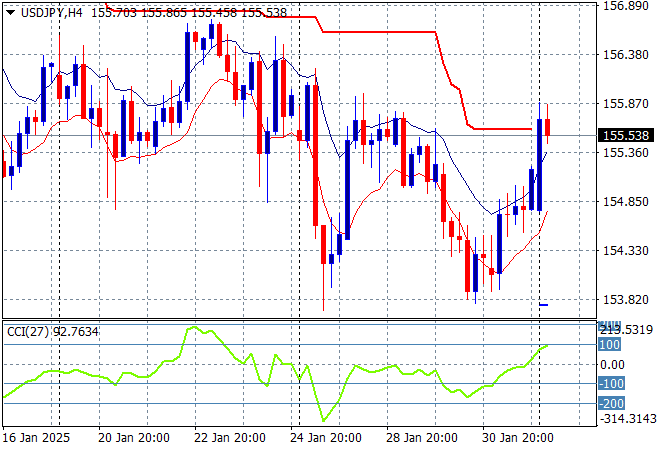

Mainland Chinese share markets remain closed for New Year holidays with the Hang Seng Index also closed. Japanese stock markets felt the heat immediately with the Nikkei 225 finishing nearly 3% lower at 38405 points while the USDPY pair has jumped up above the 155 handle:

Australian stocks also felt the new timewarp back to the 1930’s with the ASX200 closing some 1.9% lower at 8379 points while the Australian dollar gapped over 100 pips lower to below the 61 handle before finding a modicum of support at that level:

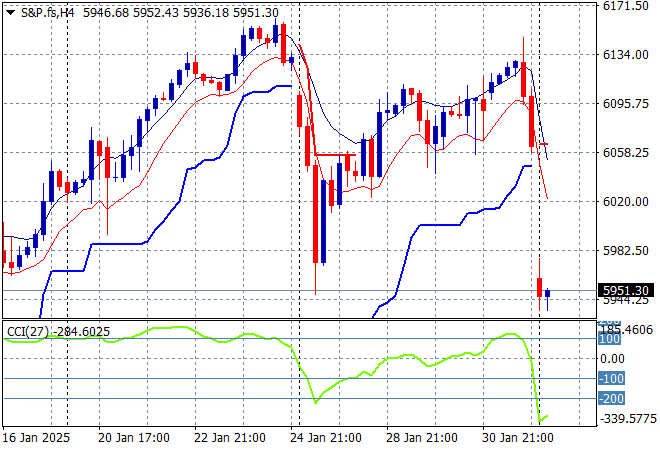

S&P and Eurostoxx futures are looking grim indeed as we head into the London session with the S&P500 four hourly chart showing at least a 100 point or upwards of 2% drop on the open:

The economic calendar starts the week with some flash inflation prints in Europe followed by the latest US ISM manufacturing PMI.