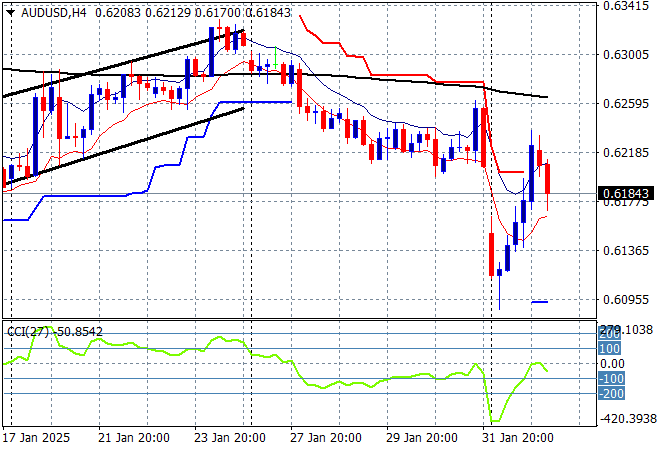

As Trump gets outmaneuvered by both Canada and Mexico, a new front in the trade war opened up against Chyna today which retaliated immediately in kind. Currency markets have reverted almost back to their pre-North American trade war starting points while gold continues to hold at record highs. Meanwhile the latest local consumer confidence figures amid the Chinese tariff news gave the Australian dollar a push higher but its struggling in afternoon trade at just below the 62 cent level.

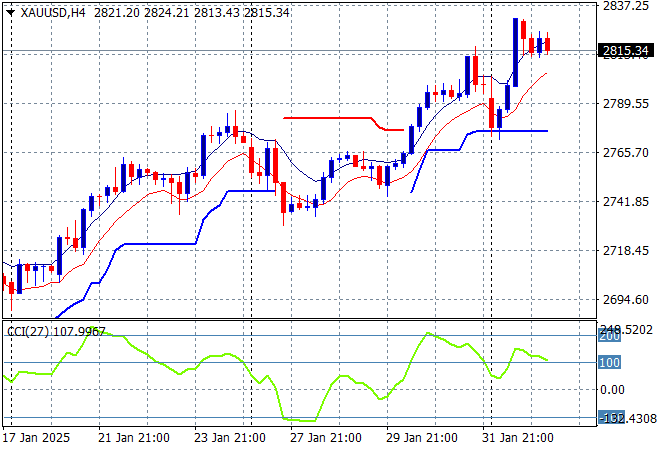

Oil markets are building in volatility with some downside movements in Brent crude about to cross below the $75USD per barrel level while gold has remained steadfast above the $2800USD per ounce level after pushing aside strong resistance:

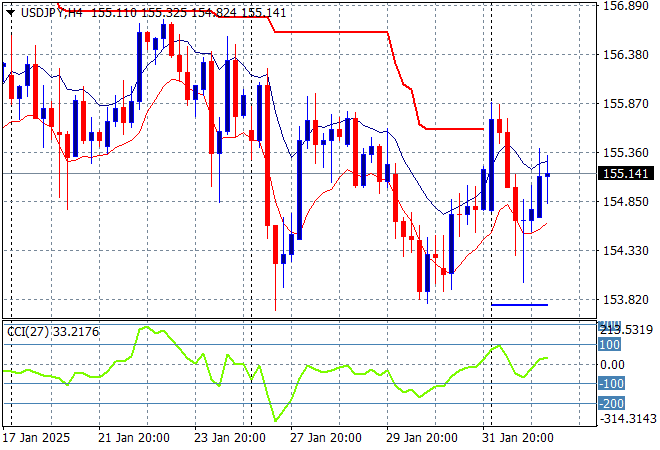

Mainland Chinese share markets remain closed for New Year holidays with the Hang Seng Index also closed. Japanese stock markets bounced back the most in the region, with the Nikkei 225 finishing nearly 0.8% higher at 38802 points while the USDPY pair has stayed above the 155 handle:

Australian stocks however eventually put in a scratch session with the ASX200 closing 0.1% lower at 8374 points while the Australian dollar at first lifted above the 62 handle before slipping in afternoon trade:

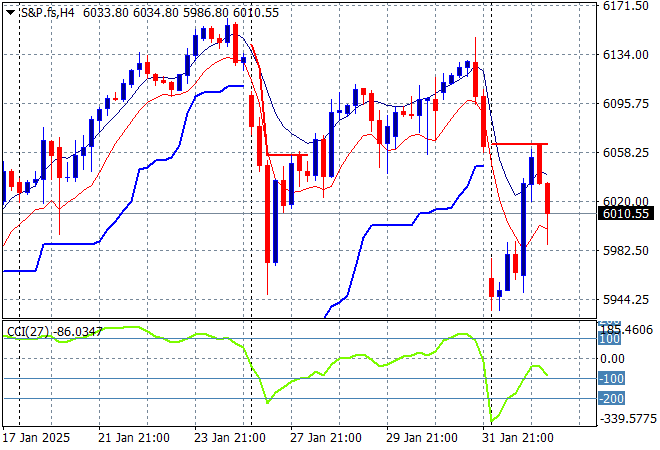

S&P and Eurostoxx futures are looking a little worse for wear again as we head into the London session with the S&P500 four hourly chart showing a clear dead cat bounce here with the 6000 point level under threat again:

The economic calendar is fairly quiet with some US jobs data and some Fed speeches to keep an ear out.