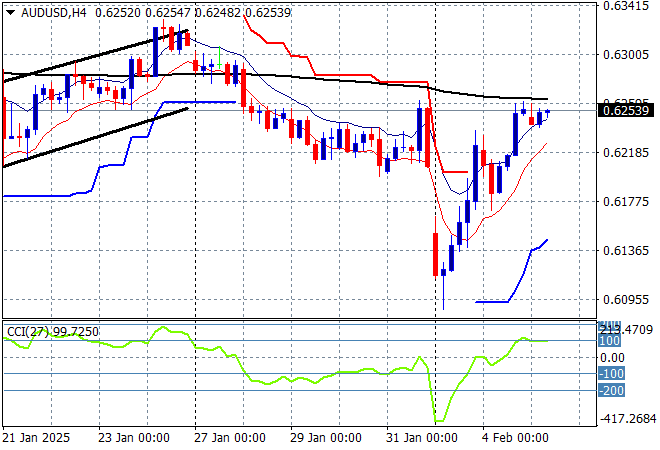

As Trump suggests adding the Gaza Strip to his swag of new States (I think we’re up to 54?), markets are setting up for Friday’s US NFP print with a potential call between Xi and the Orange Mussolini tonight as well. Meanwhile after reverting back to their pre-North American trade war starting points, currency markets are now pivoting on a much stronger Yen due to Japanese labour data while gold continues to build new record highs. The Australian dollar is also enjoying a push higher above the 62 cent level to match its previous weekly high.

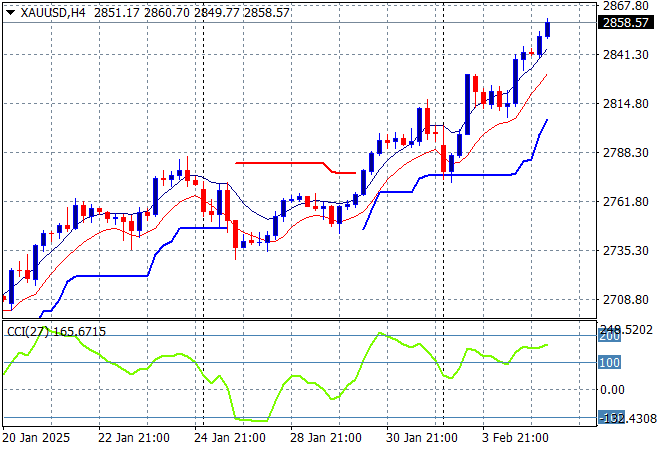

Oil markets are slowly reducing in volatility with Brent crude steady at the $76USD per barrel level while gold has built sharply again above the $2800USD per ounce level after pushing aside strong resistance:

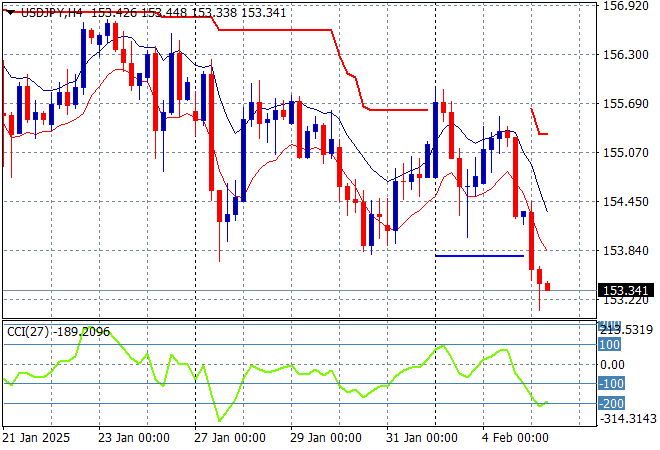

Mainland Chinese share markets have returned from their New Year holidays with the Shanghai Composite down only 0.6% after absorbing the tariff volatility trade. In Hong Kong, the Hang Seng Index lost ground, currently down 1.3% to 20527 points. Japanese stock markets were steady after their recent bounceback as the higher Yen weighed, with the Nikkei 225 finishing nearly 0.2% higher at 38826 points while the USDPY pair has flomped below the 154 handle on the labour figures:

Australian stocks however eventually put in a solid session with the ASX200 closing 0.5% higher at 8416 points while the Australian dollar is basically unchanged as it comes up against strong resistance at the mid 62 cent level in afternoon trade:

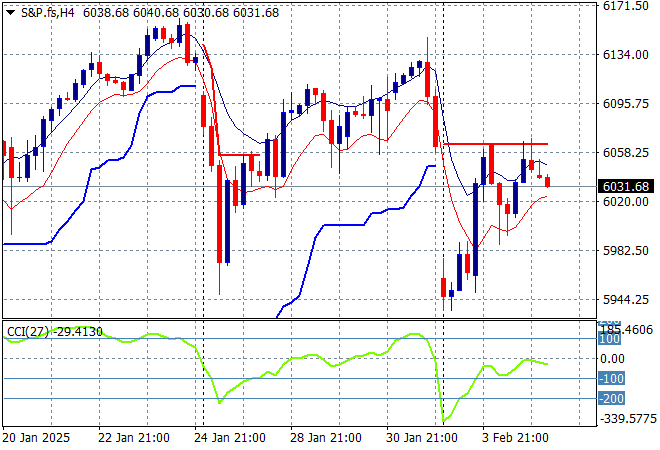

S&P and Eurostoxx futures are looking a little worse for wear again as we head into the London session with the S&P500 four hourly chart showing a clear dead cat bounce here with the 6000 point level under threat again:

The economic calendar will include the latest US ISM Services print plus balance of trade figures.