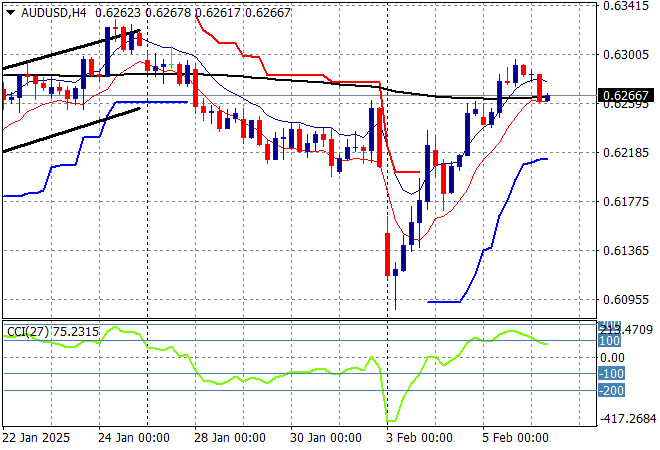

Asian share markets are all in the green as concerns over Trump’s tariffs dissipate while the BOJ hawks are out spruiking more rate hikes, sending Yen higher against everything. In fact currency markets are now back above their pre-Canadian/Mexican blank fire tariff shots with the Australian dollar also enjoying a push higher to almost cross the 63 cent level to exceed its previous weekly high.

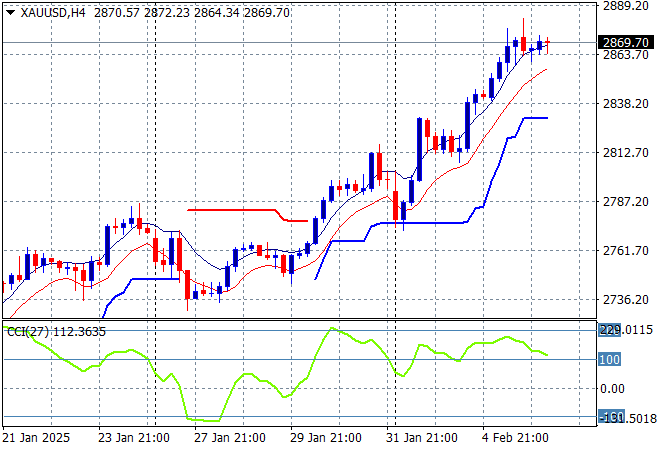

Oil markets are slowly deflating with Brent crude falling below the $75USD per barrel level while gold has held at its recent record highs well above the $2800USD per ounce level after pushing aside strong resistance:

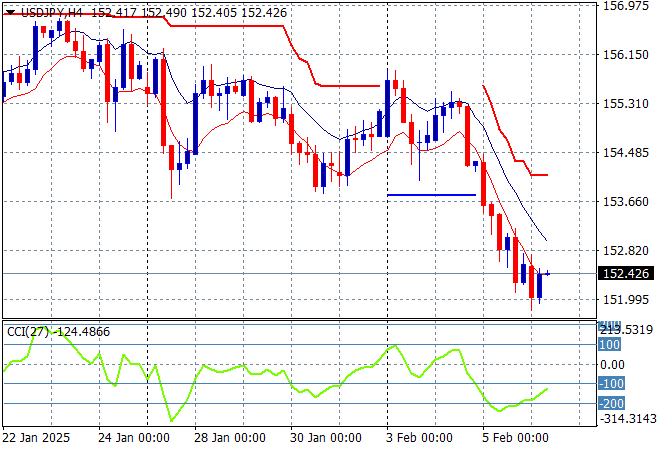

Mainland Chinese share markets have bounced back with vigour as the Shanghai Composite shoots more than 1% higher while the Hang Seng Index has also made up lost ground, currently up 0.7% to 20748 points. Japanese stock markets were also able to clawback some recent losses despite the higher Yen, with the Nikkei 225 finishing nearly 0.6% higher at 39056 points while the USDPY pair was almost crushed below the 152 handle in a strong selloff:

Australian stocks were the best in the region with the ASX200 closing 1.2% higher at 8520 points while the Australian dollar pulled back ever so slightly after almost crossing the 63 handle as tariff concerns evaporate:

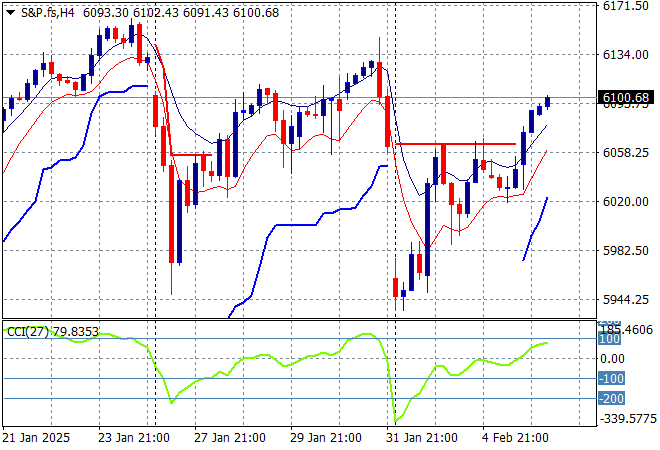

S&P and Eurostoxx futures are looking a lot better as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce putting on a lot more life with the 6100 point level now under threat in this bounceback:

The economic calendar includes the weekly initial jobless claims in the US followed by quite a few Fed speeches as we head into the next NFP print.