Asian share markets are somewhat mixed with only Chinese shares really advancing as local markets dip into the red for the week on the back of a much stronger Australian dollar while Japanese shares are suffering despite some good domestic economic prints.

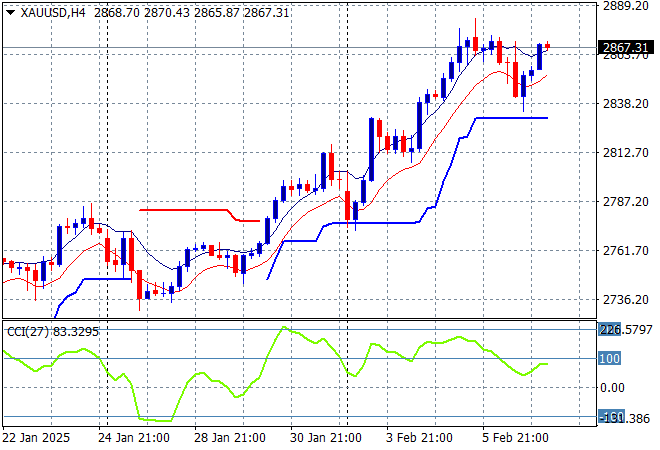

Oil markets are slowly decelerating from their recent falls with Brent crude still below the $75USD per barrel level while gold has held at its recent record highs well above the $2800USD per ounce level after recently having a small dip:

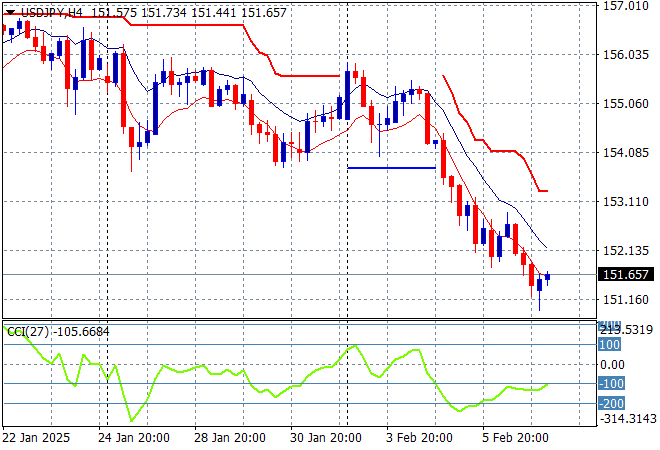

Mainland Chinese share markets have continued their strong bounceback with as the Shanghai Composite launches more than 1% higher while the Hang Seng Index has also made up lost ground, currently up 1.5% to 21210 points. Japanese stock markets however have fallen back with the Nikkei 225 about to finish nearly 0.6% lower at 38830 points while the USDPY pair has finally steadied after almost getting crushed in this strong selloff:

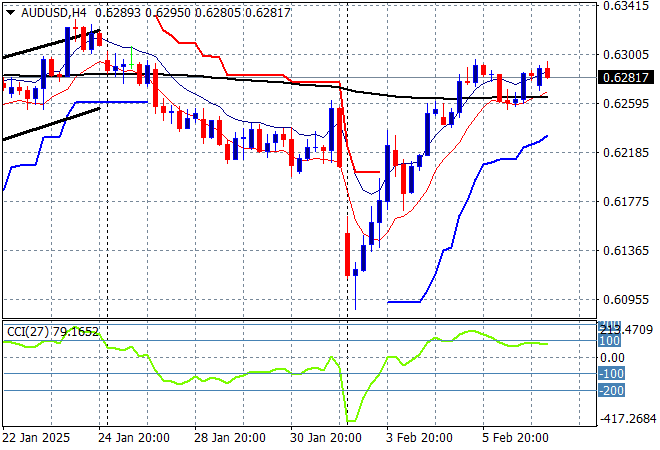

Australian stocks were the worst in the region with the ASX200 closing dead flat at 8520 points while the Australian dollar was able to almost match its mid week highs, currently sitting just below the 63 cent level going into tonight’s US jobs print:

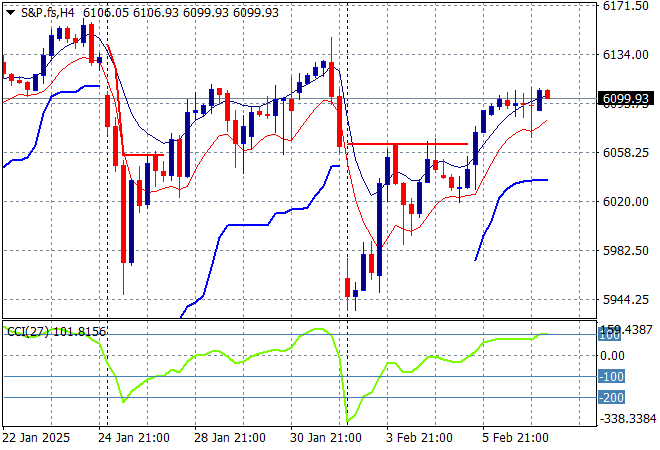

S&P and Eurostoxx futures are holding on to their overnight gains as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce putting on a lot more life with the 6100 point level now under threat in this bounceback:

The economic calendar will focus squarely on tonight’s NFP aka non farm payrolls aka US unemployment print.