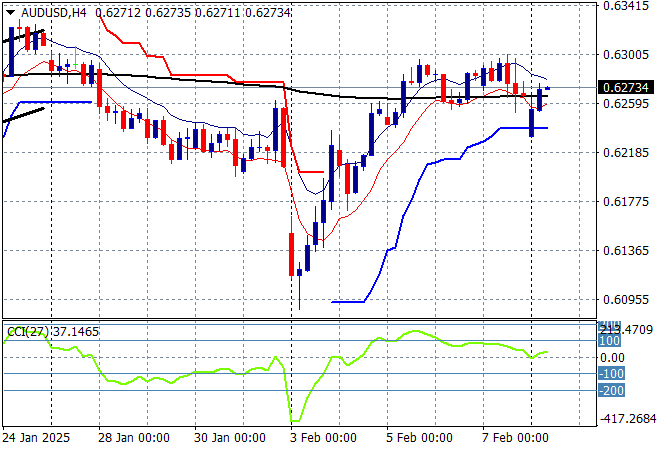

Asian share markets are somewhat positive despite another spray of tariff demands from the Orange Mussolini with Chinese shares brushing off the reciprocal reactions as the trade war heats up domestically, affecting Australian exports. Luckily the local economy is broad, diverse and robust to deal with cuts to primary exports…..Anyway, the USD gapped higher against most of the undollars over the weekend with the latest Chinese inflation figures overshadowed by Friday nights US jobs report with the Australian dollar at first almost down below the 62 cent level before recovering in late trade.

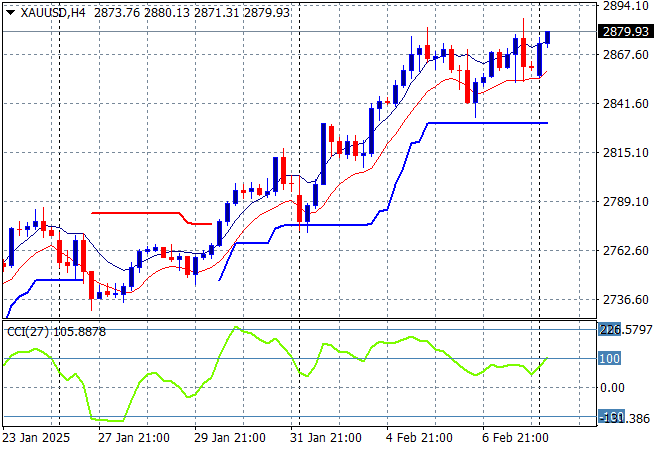

Oil markets are slowly decelerating from their recent falls with Brent crude lifting slightly above the $75USD per barrel level while gold has held at its recent record highs well above the $2800USD per ounce level and wants to make another run at the $2900 level:

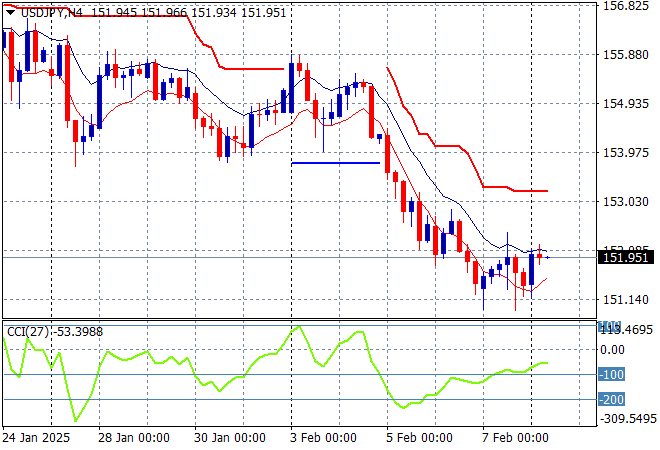

Mainland Chinese share markets have continued their strong bounceback with the Shanghai Composite now above the 3300 point level while the Hang Seng Index has also made up lost ground, currently up 1.6% to 21484 points. Japanese stock markets however are somewhat steady with the Nikkei 225 finishing just 0.2% higher at 38857 points while the USDPY pair has steadied after almost getting crushed in last week’s strong selloff:

Australian stocks were the worst in the region on the back of the steel and aluminum tariffs with the ASX200 closing 0.4% lower at 8482 points while the Australian dollar was able return to just below the 63 cent level following Friday’s US jobs print and the widening trade war:

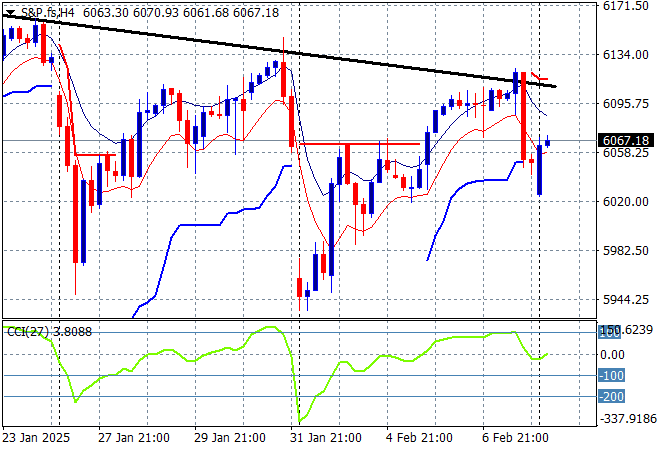

S&P and Eurostoxx futures are somewhat frenetic given the tariff reaction and the somewhat firm NFP print on Friday night as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce putting on a lot more life with the 6100 point level now under threat in this bounceback:

The economic calendar is always quiet following the US unemployment print with no major releases this evening.