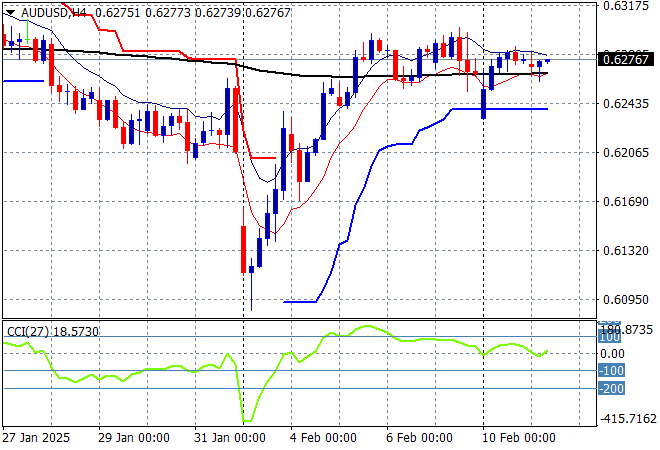

Asian share markets are mixed in reaction to the latest round of tariff demands from King Trump with Chinese shares this time pulling back while Japanese equity markets are closed for yet another holiday. The USD remains strong against most of the undollars over the weekend gap following last weeks US jobs report with the Australian dollar holding steady just below the 63 cent level as trader’s gear up for next week’s RBA meeting.

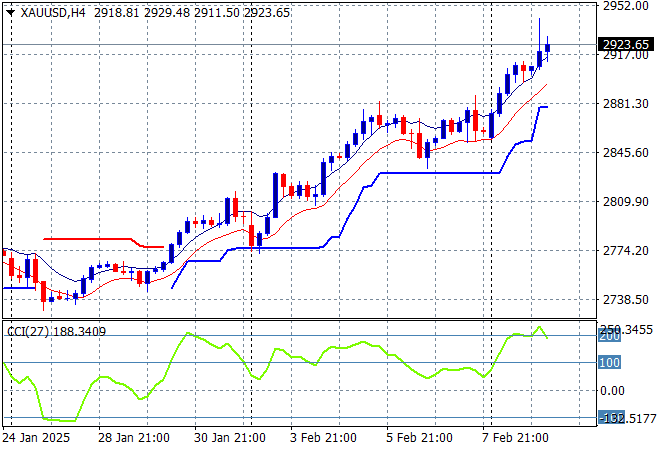

Oil markets are slowly decelerating from their recent falls with Brent crude lifting slightly above the $76USD per barrel level while gold has extended its recent record highs well above the $2900USD per ounce level:

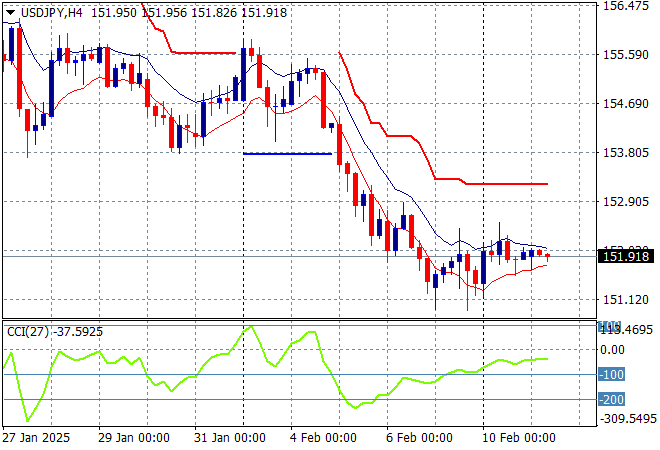

Mainland Chinese share markets have paused their strong bounceback with the Shanghai Composite falling 0.3% but still above the 3300 point level while the Hang Seng Index has done the same, currently down 0.4% to 21439 points. Japanese stock markets are closed with trading in the USDPY pair muted as it remains somewhat steady after almost getting crushed in last week’s strong selloff:

Australian stocks were dead flat in the wake of the latest consumer confidence figures with the ASX200 closing at 8484 points while the Australian dollar was stable just below the 63 cent level following Friday’s US jobs print and the widening trade war:

S&P and Eurostoxx futures are somewhat flat again as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce putting on a lot more life with the 6100 point level now under threat in this bounceback:

The economic calendar includes quite a few BOE and Fed speeches plus Fed Chair Powell’s testimony to Congress.