Asian share markets are much more positive in today’s session with shares in Hong Kong rebounding while the Felon-in-Chief in the Oval Office backtracks another round of tariff threats. Last night’s testimony by Fed Chair Powell is seeing some volatility in bond markets and interest rate futures while the USD is diverging in fortune across the undollars with Yen falling back while the Australian dollar is holding strong steady just below the 63 cent level as trader’s gear up for next week’s RBA meeting.

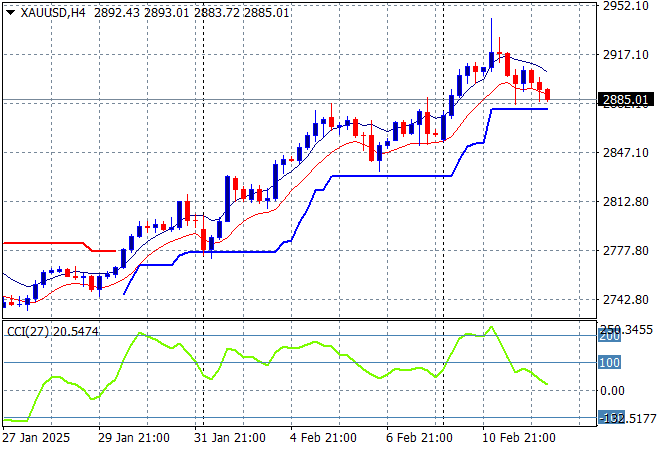

Oil markets are slowly decelerating from their recent falls with Brent crude lifting slightly above the $76USD per barrel level while gold has pulled back from its recent record highs back below the $2900USD per ounce level:

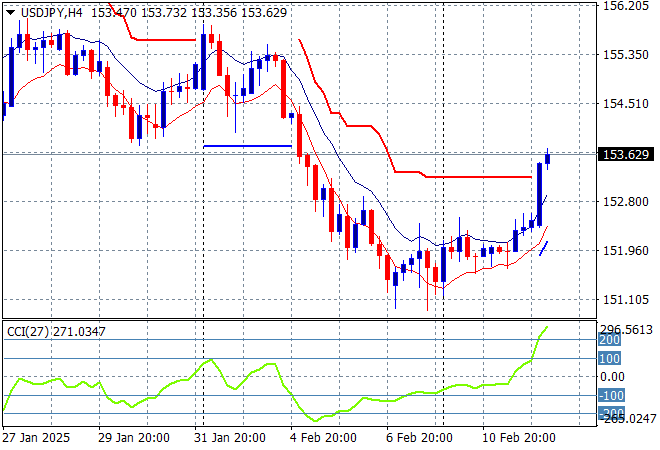

Mainland Chinese share markets have paused their strong bounceback with the Shanghai Composite only up slightly in afternoon trade to remain above the 3300 point level while the Hang Seng Index has bounced back stronger, currently up 1.6% to 21639 points. Japanese stock markets have reopened with the Nikkei 225 up 0.3% while trading in the USDPY pair has shifted from steady to breakout with a big move above the 153 handle to clawback last week’s strong selloff:

Australian stocks were able to shove off tariff threats again with the ASX200 closing 0.6% higher at 8484 points while the Australian dollar continues to climb and wants to break free above the 63 cent level:

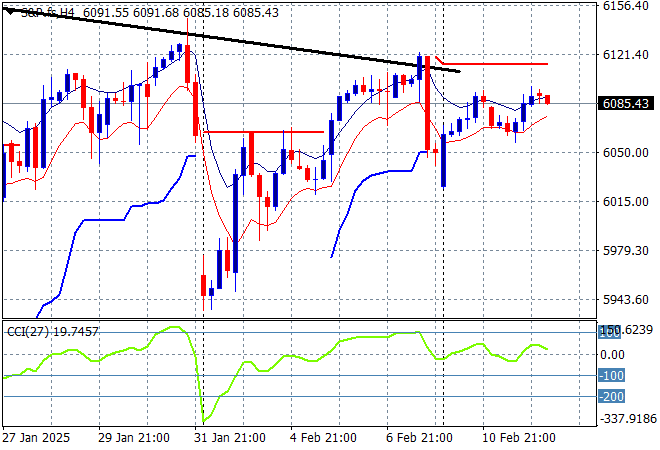

S&P and Eurostoxx futures are somewhat flat again as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce trying to get back on trend above the 6100 point level:

The economic calendar includes the closely watched US inflation print.