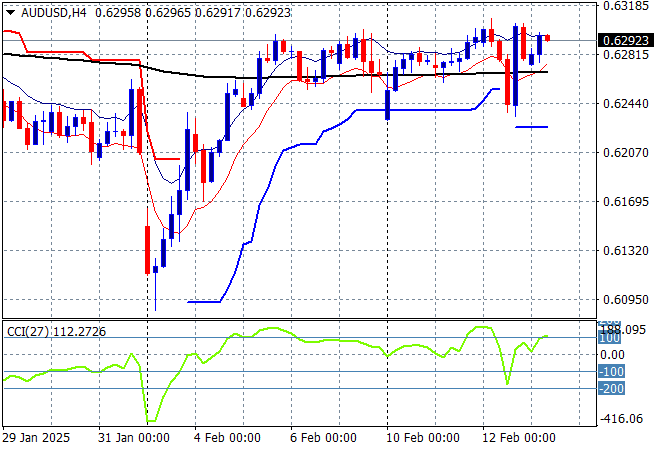

Asian share markets are much more positive in today’s session with shares continuing to rebound in Hong Kong rebounding while local markets are dead flat. Last night’s US CPI print is seeing currency markets move every which way as they also navigate more tariff volatility with Yen firming while the Australian dollar is holding strong steady just below the 63 cent level as trader’s gear up for next week’s RBA meeting.

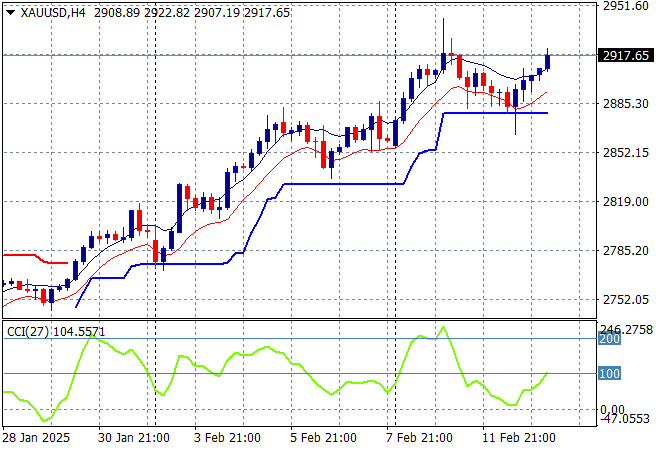

Oil markets are breaking down again with Brent crude drifting below the $75USD per barrel level while gold has re-engaged to the upside above the $2900USD per ounce level:

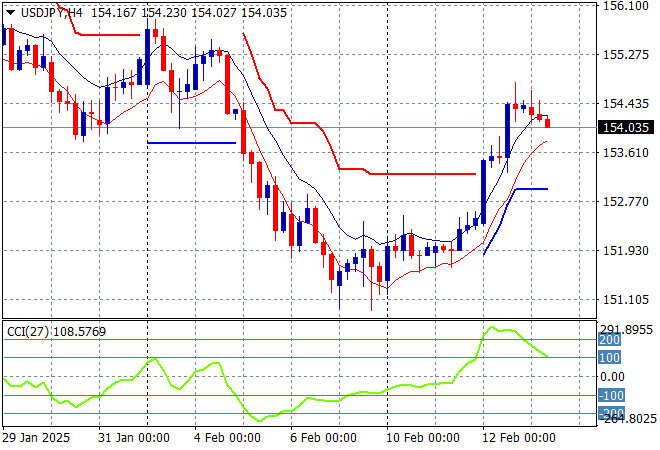

Mainland Chinese share markets have paused their strong bounceback with the Shanghai Composite only up slightly in afternoon trade to remain above the 3300 point level while the Hang Seng Index has bounced back even stronger, currently up more than 2% to 22402 points. Japanese stock markets have also surged with the Nikkei 225 up 1.4% while trading in the USDPY pair has steadied slightly from its overnight breakout as it stays around the 154 handle:

Australian stocks were the worst performers with a dead flat finish for the ASX200 which closed at 8484 points while the Australian dollar continues to steady but seems like it wants to break free above the 63 cent level:

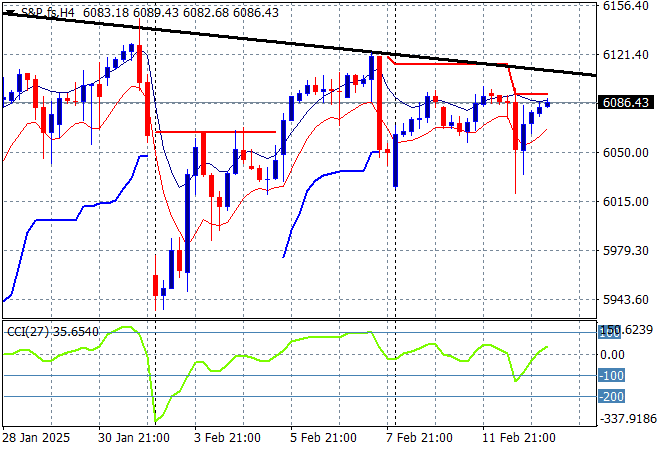

S&P and Eurostoxx futures are somewhat flat again as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce trying to get back on trend above the 6100 point level:

The economic calendar is pretty full tonight with UK GDP, German inflation, EU industrial production and the latest US PPI print.