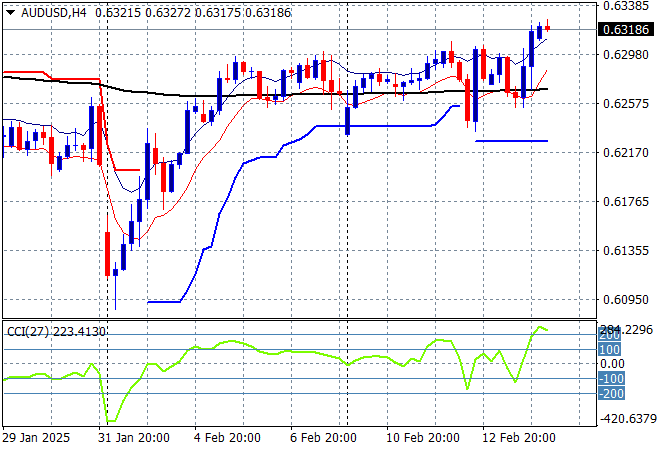

Asian share markets are fairly positive across the region although Japanese shares are suffering from a reversal in Yen strength and reports about more tariff diarrhea from the Felon in Chief while currency markets are still in flux but effectively rebuffing the continued trade war. The Australian dollar is now back to its mid January high above the 63 cent level as trader’s gear up for next week’s RBA meeting.

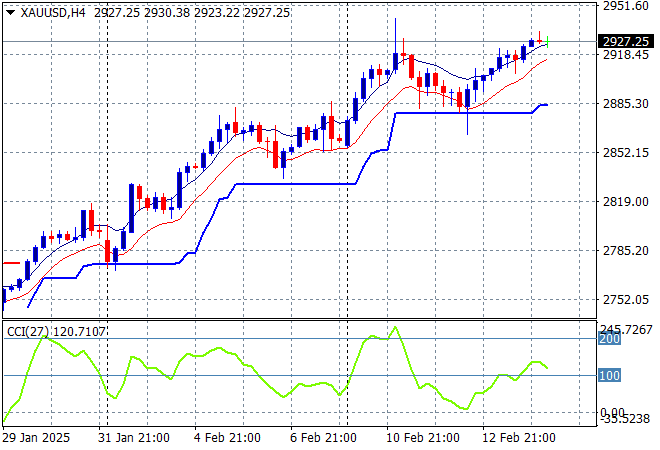

Oil markets are steadying after breaking down mid week with Brent crude drifting around the $75USD per barrel level while gold is trying to re-engagedto the upside above the $2900USD per ounce level but momentum is waning:

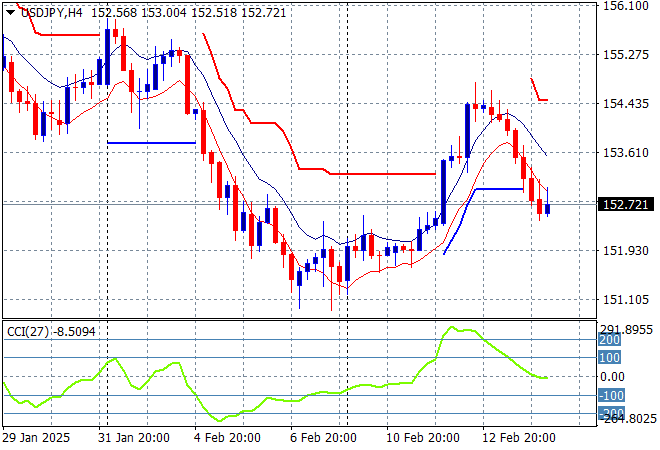

Mainland Chinese share markets are trying to re-engage their strong bounceback with the Shanghai Composite pushing slightly higher in afternoon trade to remain above the 3300 point level while the Hang Seng Index has bounced back even stronger, currently up more than 2% to 22302 points. Japanese stock markets however reacted to the overnight rise in Yen with the Nikkei 225 falling more than 0.6% while trading in the USDPY pair has seen a return below the 153 handle:

Australian stocks are having a modest session due to some mixed earnings reports with the ASX200 about to close 0.4% higher at 8572 points while the Australian dollar has finally broke free above the 63 cent level:

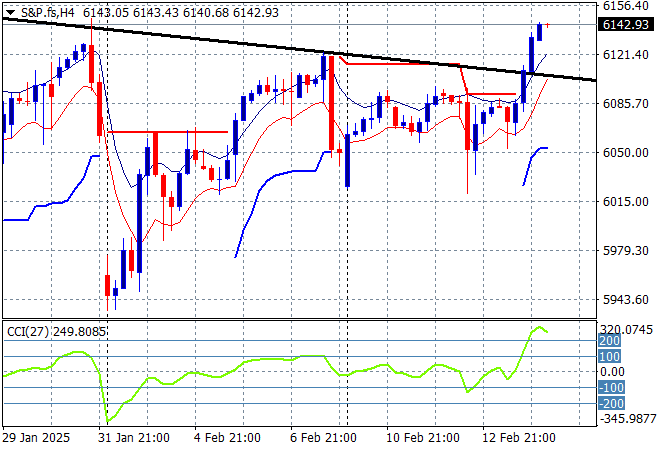

S&P and Eurostoxx futures are heading higher as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce negated fully as price action gets back on trend above the 6100 point level:

The economic calendar ends the week with European unemployment then US retail sales and industrial production prints.