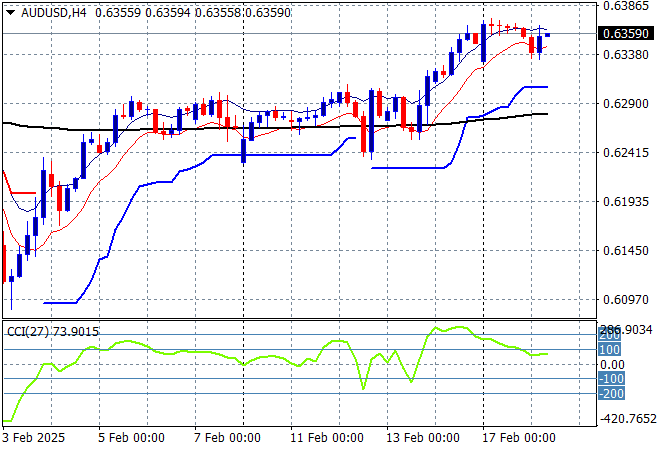

The trading week continues in a mixed mood for most Asian share markets without a solid from Wall Street enjoying a long weekend. All eyes were on the RBA today which finally cut rates after four years although the messaging does seem somewhat mixed with the Australian dollar barely changed to remain slightly above the 63 cent level.

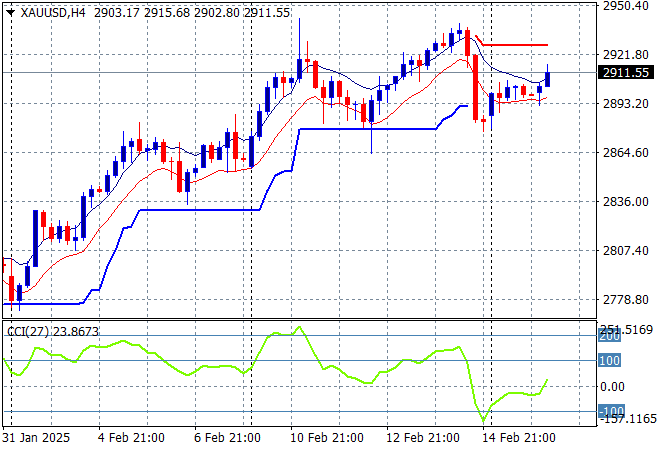

Oil markets are trying to steady after breaking down last week with Brent crude drifting back above the $75USD per barrel level while gold has finally got back above the $2900USD per ounce level after a violent snapback on Friday night as momentum is waning:

Mainland Chinese share markets are losing ground fast in afternoon trade with the Shanghai Composite just above the 3300 point level while the Hang Seng Index has gone the other way to surge more than 1% higher to 22868 points. Japanese stock markets are trying to bounce back on the slightly lower Yen with the Nikkei 225 closing 0.4% higher at 39356 points while trading in the USDPY pair has seen a slight lift back above the 152 handle after a deceleration phase:

Australian stocks are having a sook with another pullback session despite the RBA cutting with the ASX200 closing 0.6% lower at 8481 points while the Australian dollar has barely moved after anticipating the cut, still staying well above the 63 cent level:

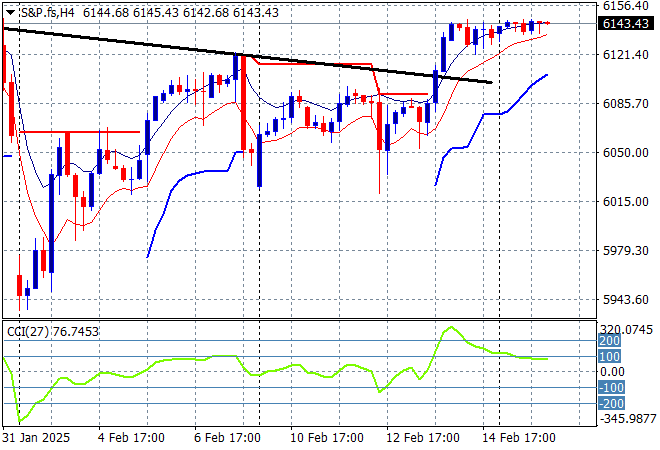

S&P and Eurostoxx futures are heading higher as we head into the London session with the S&P500 four hourly chart showing a complete pause to price action due to the US long weekend with a breakout above the 6100 point level likely:

The economic calendar has another quiet one with the German ZEW survey followed by more Fed speeches and some US house price data.