Its a sea of red across most Asian share markets as His MAGA-Sty tries yet another round of tariffs following the falling in line behind Russia over Ukraine, although other risk markets have been able to absorb this new volatility a little better. The USD is back on the ropes again with Yen sharply higher while the Australian dollar is also firming nicely above the 63 cent level.

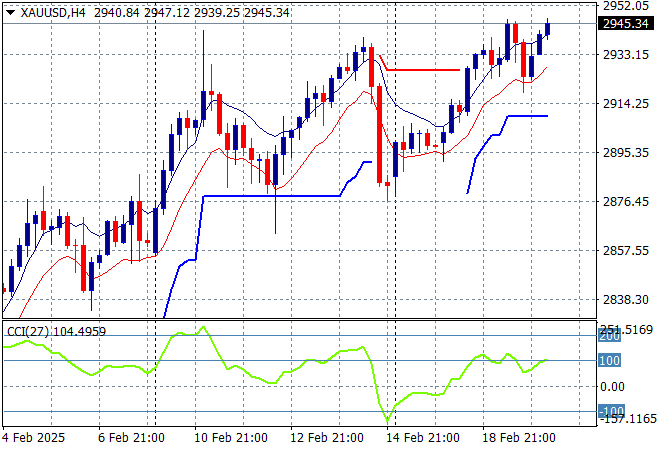

Oil markets are barely moving after breaking down last week with Brent crude drifting around the $76USD per barrel level while gold has pushed higher above the $2900USD per ounce level after a violent snapback on Friday night as momentum begins to pick up again:

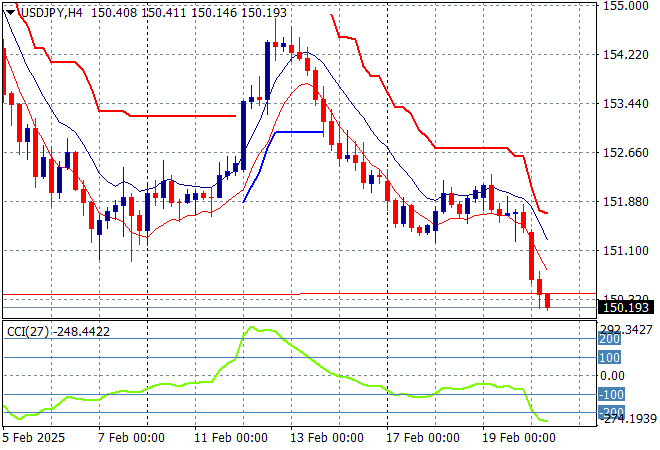

Mainland Chinese share markets are barely higher in afternoon trade with the Shanghai Composite still trying to hold above the 3300 point level while the Hang Seng Index has gone down more than 1% to 22694 points. Japanese stock markets are also deep in the red on the higher Yen with the Nikkei 225 closing 1.4% lower at 38603 points while trading in the USDPY pair has seen a sharp pull back right down to the 150 handle after a failed deceleration phase:

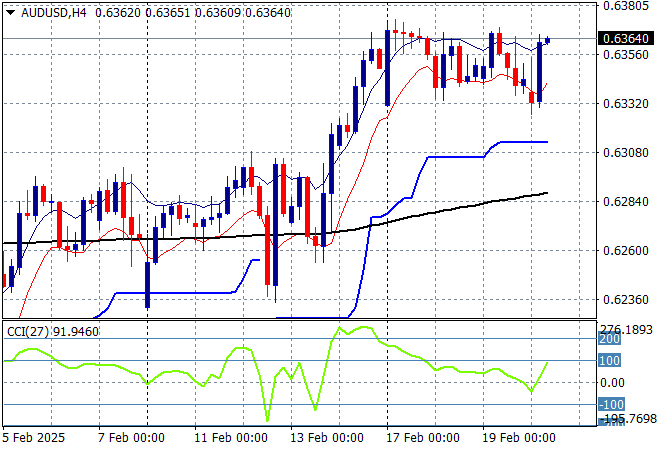

Australian stocks are continuing their post RBA retracement with the ASX200 closing more than 1% lower at 8322 points while the Australian dollar steadied and then moved slightly higher after the mid morning Trump tariff news to push back above the mid 63 cent level:

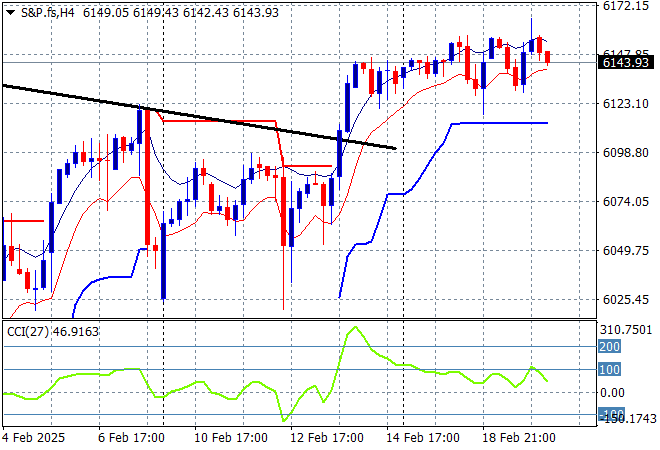

S&P and Eurostoxx futures are heading slightly lower as we head into the London session with the S&P500 four hourly chart showing a breakout above the 6100 point level still likely despite a pause in momentum:

The economic calendar includes US initial jobless claims plus some important oil data.