Asian share markets are generally doing well after a big drop on Wall Street from Friday night, but have absorbed the volatility out of the German election result from the weekend. Local shares are still flopping around due to the latest rate cut that wasn’t really a rate cut from the RBA while the Australian dollar has steadied just below the 64 cent level after a slightly resurgent USD from Friday night.

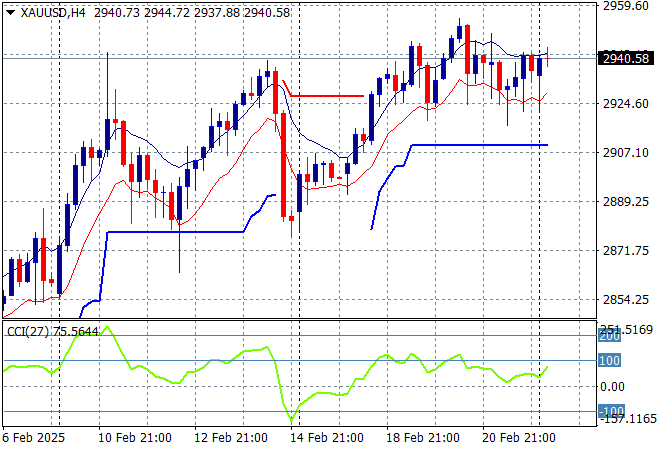

Oil markets have gapped lower over the weekend despite some OPEC promises about production cuts with Brent crude now well below the $74USD per barrel level while gold is failing to push higher above the $2940USD per ounce level but momentum remains broadly positive:

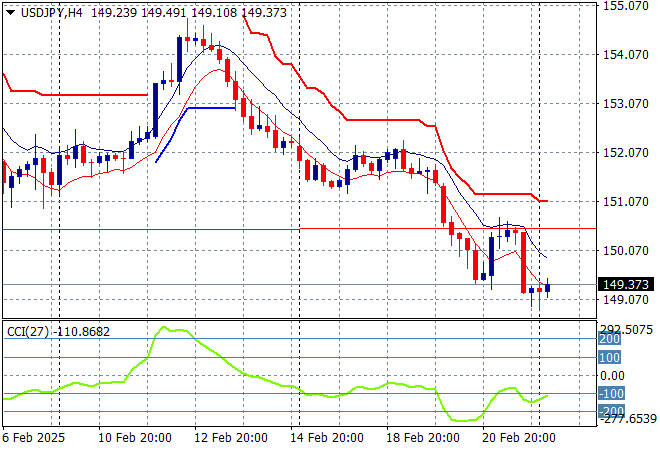

Mainland Chinese share markets are down slightly in afternoon trade after the stonking Friday session with the Shanghai Composite down 0.2% to remain well above the 3300 point level while the Hang Seng Index has retraced somewhat to be down 0.7% after its 4% surge on Friday, still well above the 23000 point level. Japanese stock markets are having yet another holiday with Nikkei 225 futures down slightly while trading in the USDPY pair has seen a post weekend hold well below the 150 handle after the recent hot inflation print:

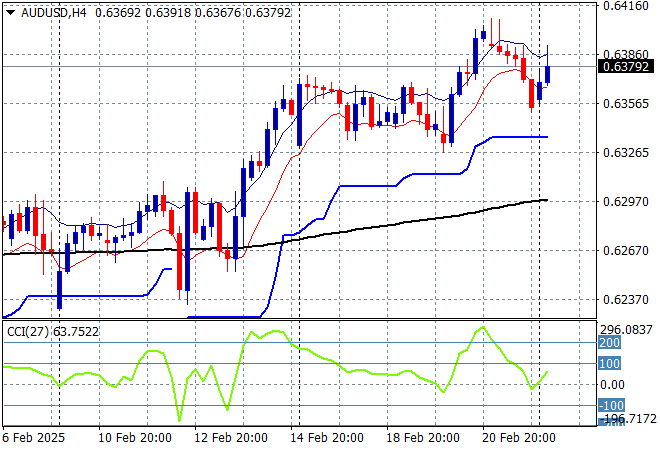

Australian stocks are finally putting on some runs but its meagre at best with the ASX200 closing just 0.2% higher at 8303 points while the Australian dollar has steadied after almost breaking down on Friday night as it remains just below the 64 cent level with resistance building here:

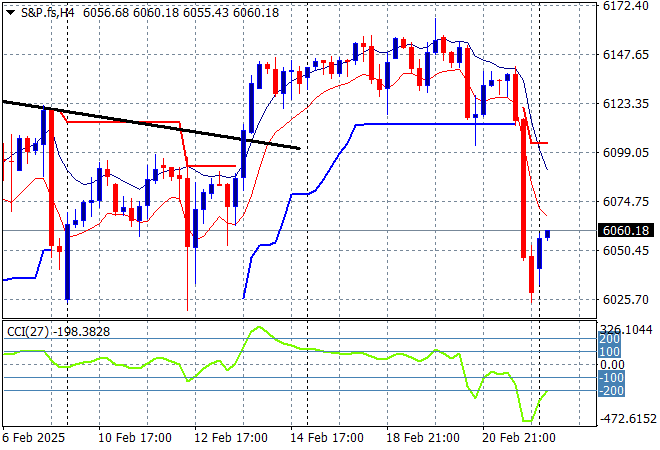

S&P and Eurostoxx futures are heading slightly higher as we head into the London session with the S&P500 four hourly chart showing the big breakdown below the 6100 point level trying to bounce vainly off the January lows – more volatility is likely ahead here:

The economic calendar starts the week with the closely watched German IFO survey then Euro core inflation numbers followed by some US Treasury auctions to watch out for.