Asian share markets are very mixed with Chinese shares lifting while the rest of the region is playing along with the downtrend on Wall Street as the upcoming Canadian/Mexican tariffs look like starting soon, although that’s clear as mud due to the ongoing clownshow at the White House. Meanwhile locally the latest monthly CPI print wasn’t cool enough to give the RBA a clear signal for another cut anytime soon but the Australian dollar fell back anyway in line with other currency pairs as the USD makes a comeback.

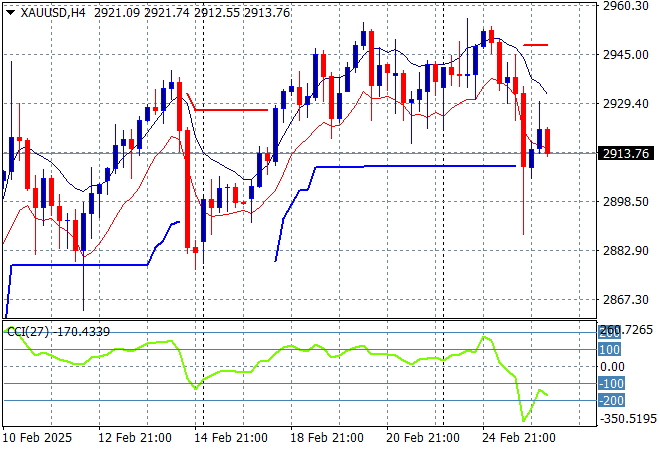

Oil markets are failing to recover with Brent crude now down at the low $72USD per barrel level after losing nearly 3% overnight while gold is trying to regain lost ground to push higher above the $2900USD per ounce level but momentum remains quite negative in the short term:

Mainland Chinese share markets are up firmly in afternoon trade with the Shanghai Composite around the 3360 point level while the Hang Seng Index has surged again to be up more than 2% at well above the 23000 point level. Japanese stock markets are again on the backfoot with Nikkei 225 losing more than 1% in a sharp down session while trading in the USDPY pair has seen a post weekend hold that is still well below the 150 handle but at least not making any further session lows:

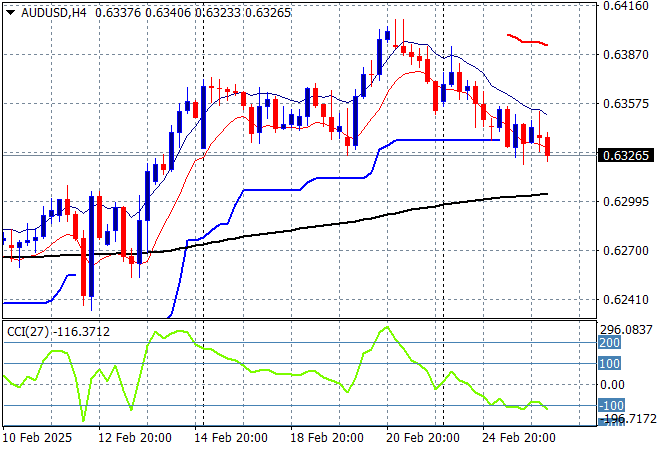

Australian stocks are still failing to put on some runs with the ASX200 closing 0.2% lower at 8236 points while the Australian dollar has continued to steadily droop lower after almost breaking down on Friday night as it drifts to the low 63 level with support now really building here:

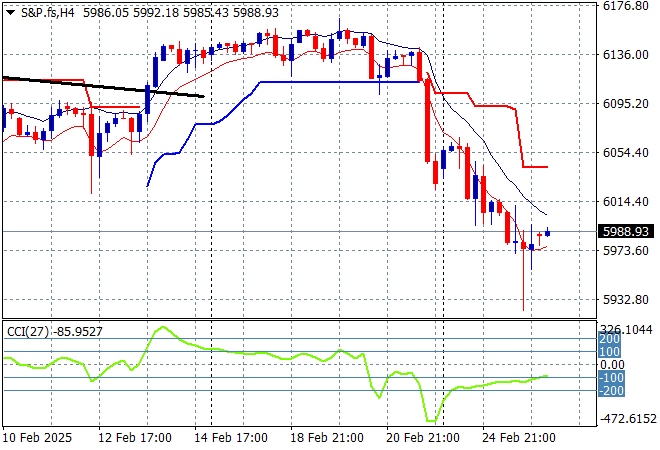

S&P and Eurostoxx futures are heading only very slightly higher as we head into the London session with the S&P500 four hourly chart showing this breakdown potentially pausing at or slightly below the 6100 point level with the possibility of a bounce here:

The economic calendar includes the latest new US home sales plus German consumer confidence figures.