Asian share markets are doing slightly better on the back of somewhat mixed sessions on Wall Street and in Europe overnight, absorbing the post close NVIDIA earnings and the new tariff announcements on Europe by the Orange Mussolini. Meanwhile the USD is firming up slightly against some of the majors with the Australian dollar still falling back, now below the 63 cent level to make a new weekly low.

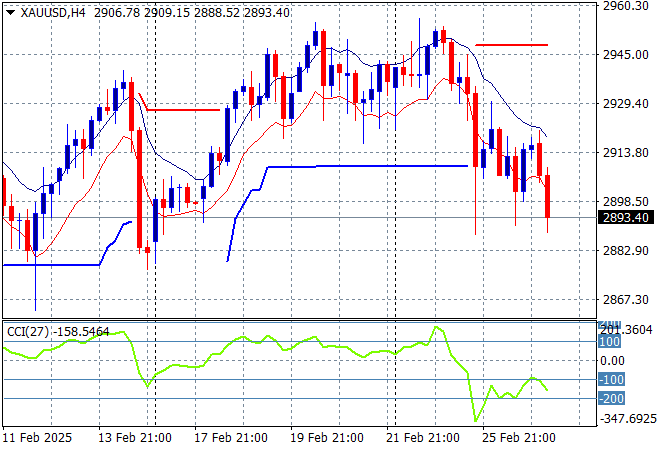

Oil markets are failing to recover with Brent crude now down at the $72USD per barrel level while gold is also unable to regain lost ground as it moves below the $2900USD per ounce level as momentum remains quite negative in the short term:

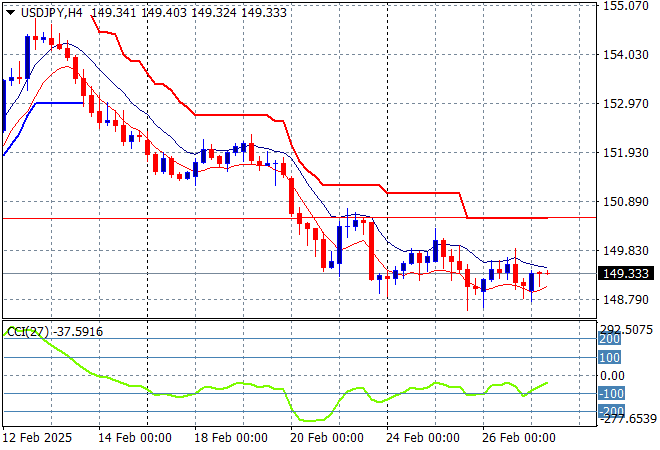

Mainland Chinese share markets are barely moving in afternoon trade with the Shanghai Composite around the 3380 point level while the Hang Seng Index has finally slowed down with a mild retracement to stay above the 23000 point level. Japanese stock markets are trying to lift higher after successive failing sessions with Nikkei 225 gaining some 0.4% to be over 38240 points while the USDPY pair is still pushing well below the 150 handle but negative momentum is slowly down here:

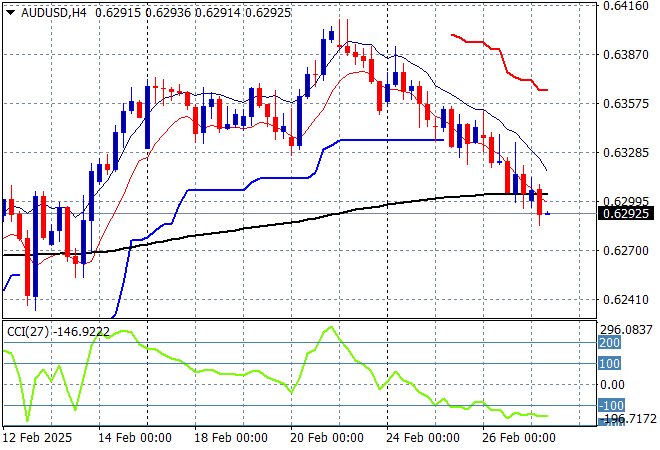

Australian stocks are finally putting on some runs with the ASX200 closing 0.3% higher at 8268 points while the Australian dollar has continued to go lower after almost breaking down on Friday night as it now drifts below the 63 level with support evaporating there:

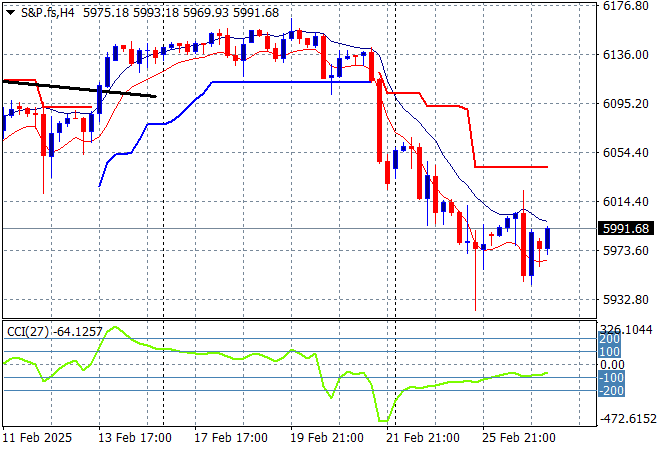

S&P and Eurostoxx futures are slowly heading higher as we head into the London session with the S&P500 four hourly chart showing this breakdown potentially pausing at or slightly below the 6100 point level with the possibility of a bounce here:

The economic calendar includes the latest US durable goods orders and initial jobless claims.