Asian share markets are slumping across the board as confidence evaporates from risk markets due to continued selloffs on Wall Street as bond markets rally in fear of US recessions and the new global trade war. The USD is firming up against some of the majors with the Australian dollar still falling back, about to crack the 62 cent level to make a new monthly low.

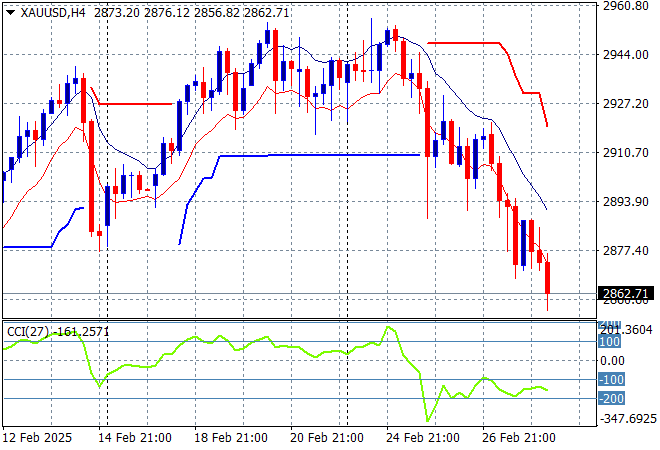

Oil markets are failing to recover with Brent crude now down at the $73USD per barrel level while gold has also been unable to regain lost ground as it moves below the $2900USD per ounce level as momentum remains quite negative in the short term:

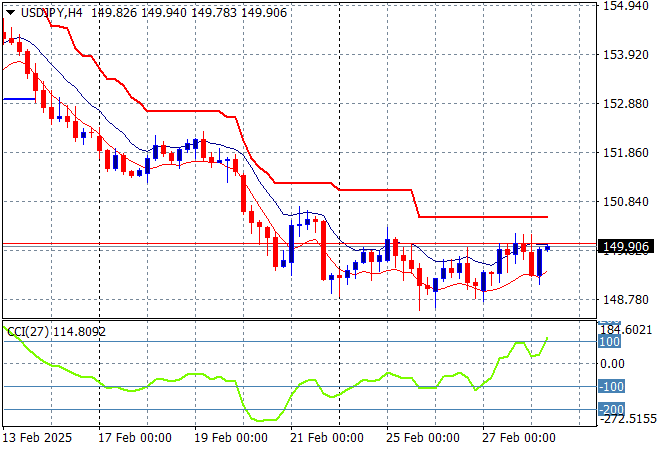

Mainland Chinese share markets have moved sharply lower in afternoon trade with the Shanghai Composite down more than 1.8% while the Hang Seng Index has slumped more than 3% lower to finally crack below the 23000 point level. Japanese stock markets are also in crashing mode with the Nikkei 225 losing nearly 2.8% to close at 37174 points while the USDPY pair is still pushed below the 150 handle but momentum is normalising here:

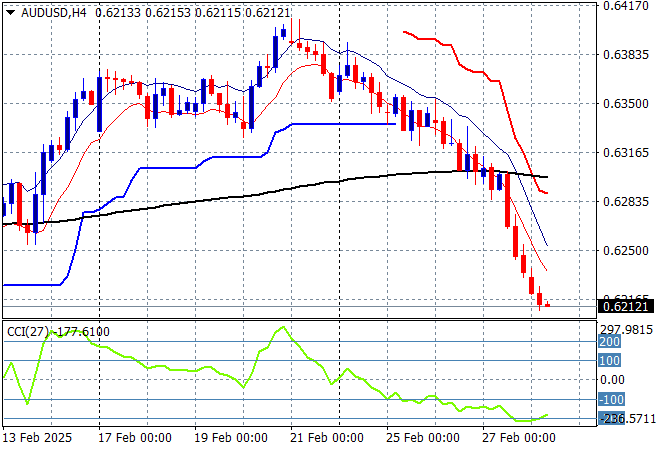

Australian stocks are the best in the region relatively speaking with the ASX200 closing 1.1% lower at 8172 points while the Australian dollar has continued to go lower after almost breaking down on Friday night as it now drifts down to the 62 level with support evaporating there:

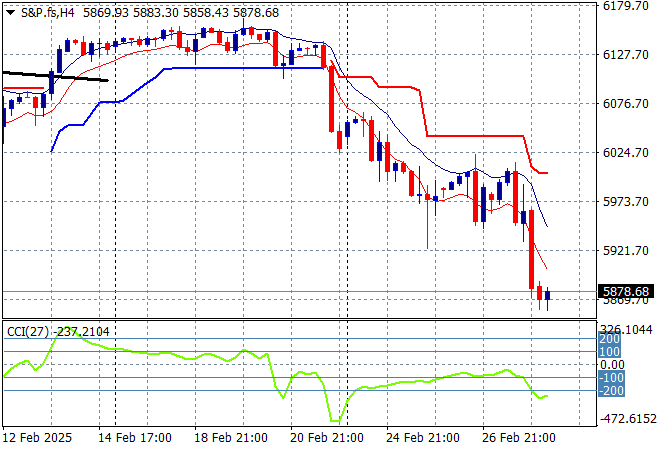

S&P and Eurostoxx futures are heading lower as we head into the London session with the S&P500 four hourly chart showing this breakdown potentially gaining momentum below the 5900 point level as the possibility of a bounce starts to evaporate:

The economic calendar includes the latest German unemployment and inflation figures while in the US the latest PCE and personal spending numbers will be released.