The latest US CPI print caused some volatility on currency markets and another wobbly finish on Wall Street overnight but European share markets were less reactive. The USD ended up broadly higher against Yen but other undollars remain somewhat steadfast as it looks like the trade war over tariffs might be a nothing burger. The Australian dollar initially pushed through the 63 cent level before retracing in late trade this morning as traders continue to weigh up next week’s long awaited RBA meeting.

10 year Treasury yields moved higher again on the somewhat hot CPI print to well above the 4.6% level while trading in oil saw both markers pull back on Russian supply as Brent crude almost finished below the $75USD per barrel level. Gold had previously pushed through to a new record high above the $2900USD per ounce level but had a small pullback on buying exhaustion.

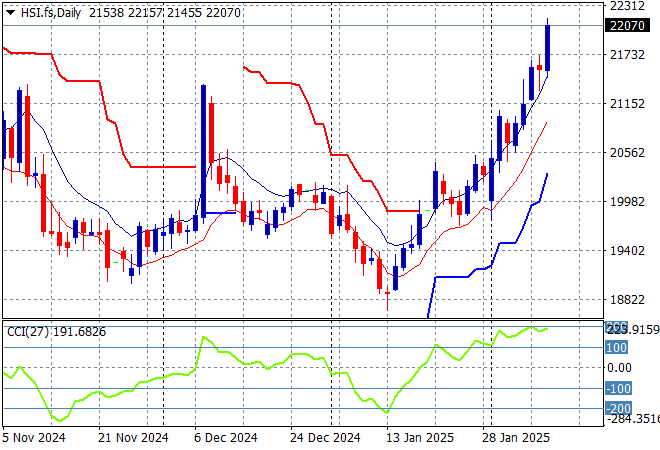

Looking at stock markets from Asia in yesterday’s session, where mainland Chinese share markets looked like pausing their strong bounceback with the Shanghai Composite up slightly in afternoon trade but then surged at the close to push 0.8% higher while the Hang Seng Index also bounced back stronger, surging 2.6% higher to 21857 points.

The Hang Seng Index daily chart shows how resistance formed around the 21000 point level with only one false breakout in late November squashed back to the 20000 point level where price action has stayed since. This was setting up for another potential breakdown here as price oscillated downward but has turned into an impressive bounce and looks like continuing as markets reopened after the NY break with the previous monthly highs at the 21500 point now beaten:

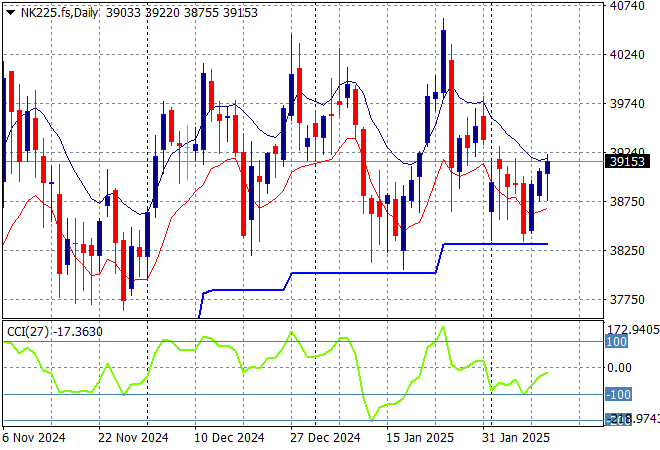

Japanese stock markets have reopened with the Nikkei 225 up 0.4% to 38943 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June the support level that must be supported for another run higher:

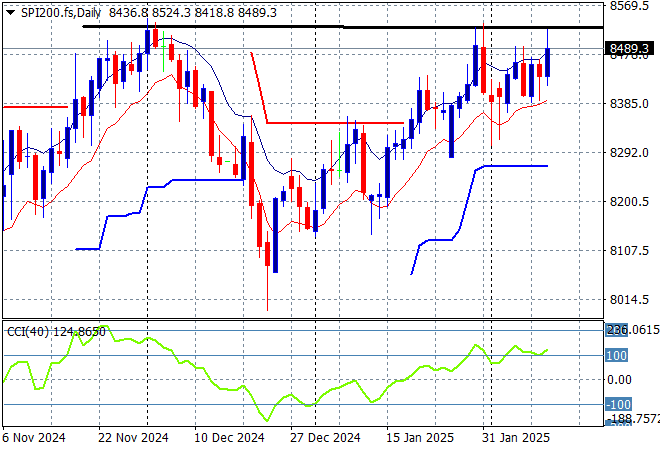

Australian stocks were able to shove off tariff threats again with the ASX200 closing 0.6% higher at 8484 points.

SPI futures are also flat again due to the uneasy finish on Wall Street overnight. The daily chart pattern and short price action suggests resistance overhead at the 8300 point level is starting to weigh on the market with a big push through required soon to get back to the 2024 highs. I’m a bit concerned about those negative candlesticks going into the RBA meeting but watch out for a breakout here as Trump’s bluff is called yet again:

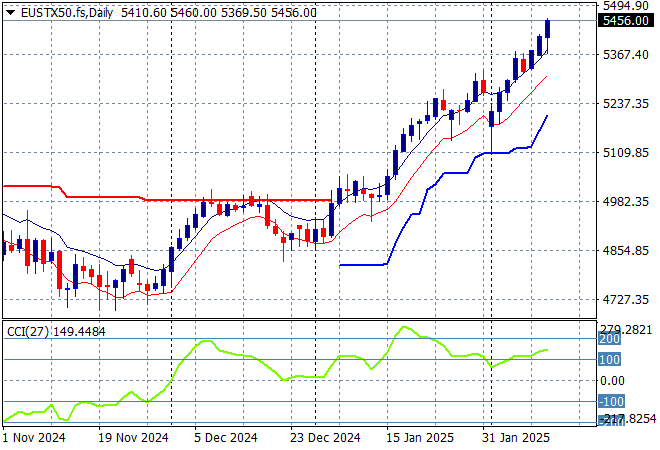

European markets continue to do a lot better than expected with a solid run higher across most of the continent as the Eurostoxx 50 Index gained 0.3% to close at 5405 points.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance unable to breach the 5000 point barrier in recent months. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs as momentum picks up strongly here with the 5000 point level turning into very strong support:

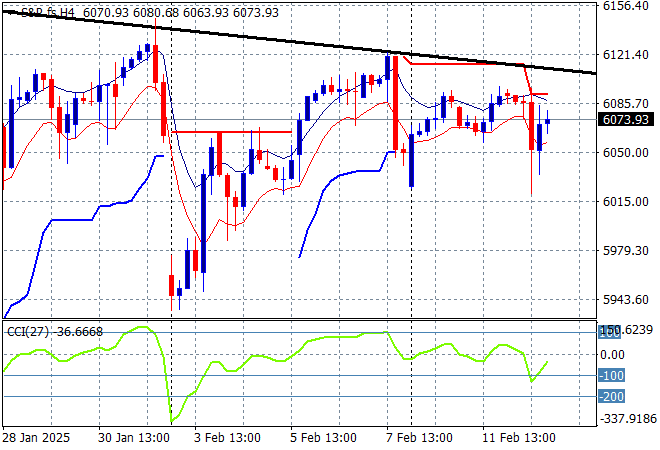

Wall Street however struggled with the latest inflation print and were quite wobbly as the NASDAQ flat lined while the S&P500 fell back 0.3% to close at 6052 points.

Price action had all the trademarks of a continuation below the 6000 point support level as the potential to overshoot and overreact to the FOMC meeting going into the NFP print tonight is building. This should have set up a rally into the 6200 point area but could the first stage of a pump and dump scheme although overhead resistance is weakening:

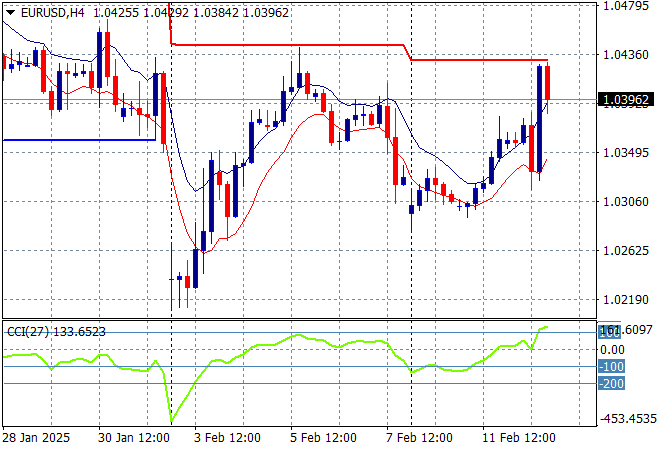

Currency markets had already started to really diverge in fortune with the USD only marginally strong across the board but the hot CPI print overnight gave some volatility across the complex as Euro pushed well above the 1.04 handle before retracing below after looking to threaten overhead resistance at the 1.045 level next as momentum goes overbought in the short term.

The union currency deflated all week before the previous Friday night slam dunk into the mid 1.03 area on the tariff troubles as daily momentum remained to the downside. Short and medium term support is still under threat here and requires a significant move higher or we could see a return to the 1.02 level:

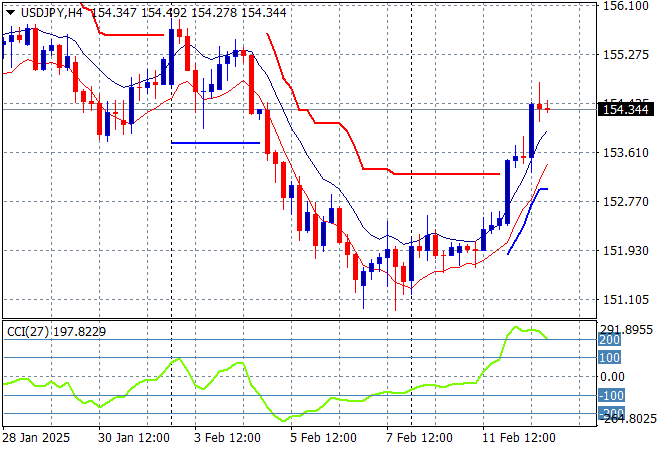

The USDJPY pair has truly got out of its funk with Yen pulling back from its recent very strong position with a strong surge back above the 154 level in the wake of the US CPI print overnight.

Short term momentum was extremely oversold before the start of week bounce but requires price action to at least get over the 156 level to call this a proper trend higher for USD and this hasn’t come to pass as USD weakens structurally overall and domestic policies continue to strengthen Yen:

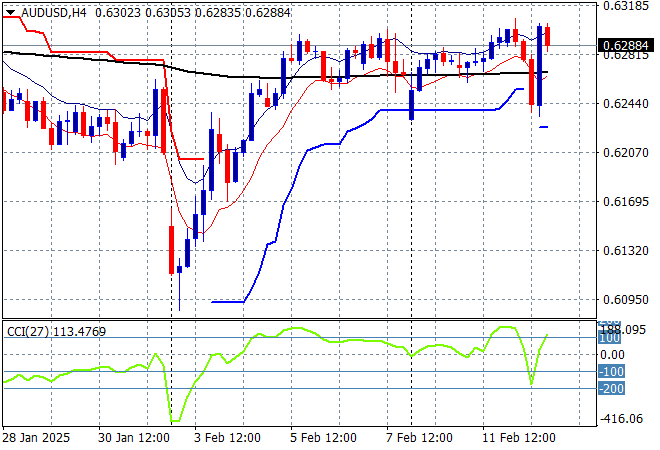

The Australian dollar should be one of the biggest casualties of the trade war as the Pacific Peso gapped down to the 60 handle recently but continues to fight back as that battle fizzles. The US CPI print gave some volatility around the 63 handle but it basically finished where it started overnight.

The recent follow through to the high 62’s and low 63’s was always high risk going into the live February RBA rate meeting and after the Trumpian tariff crusade although this bounceback could shot over the 200 day MA (moving black line) with a clear inverted head and shoulders pattern:

Oil markets are heating up with the possibility of increased Russian supply as Putin’s bitch in the Oval Office turns over again with both WTI and Brent crude pulling back sharply overnight, the latter almost finishing below the $75USD per barrel level.

The daily chart pattern shows the post New Year rally that got a little out of hand and now reverting back to the sideways action for the latter half of 2024. The potential for a new rally to form above the $77USD per barrel level from here is dwindling as recessionary fears mount:

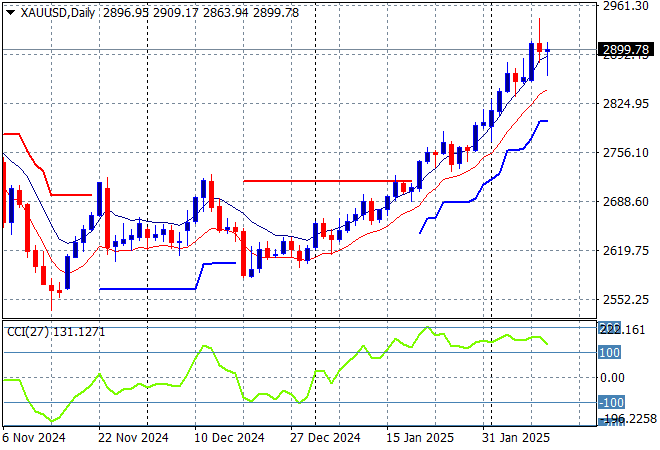

Gold wanted to continue its surge above the $2900USD per ounce level but as I warned yesterday was well overextended and had another small dip overnight to just below that level.

Price action had been accelerating in confidence in early December as new levels of support were being created regardless of USD strength but this pullback and rebound both had been fighting too much under the $2700 zone so I have been skeptical of any upside potential. However this is looking more interesting as the previous weekly high is now surpassed although momentum is quite overbought:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!