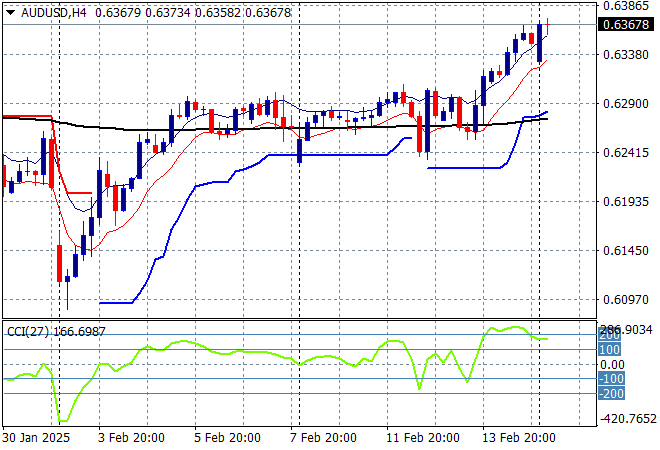

An uneasy start to the trading week as most Asian share markets pull back after a mixed return on Wall Street from Friday night due to the weaker than expected retail sales print. This is likely to continue as its a long weekend for US markets. The USD is still under the pump with most of the major currency pairs surging including Euro, while the Australian dollar has exceeded its mid January high well above the 63 cent level as trader’s gear up for tomorrow’s RBA meeting.

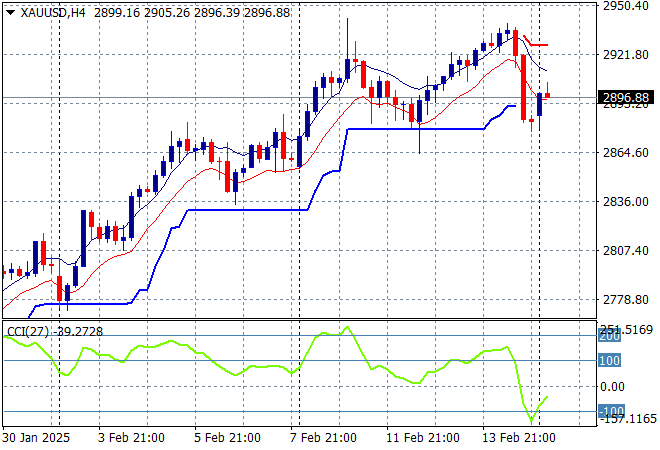

Oil markets are steadying after breaking down last week with Brent crude drifting under the $75USD per barrel level while gold is trying to get back above the $2900USD per ounce level after a violent snapback on Friday night as momentum is waning:

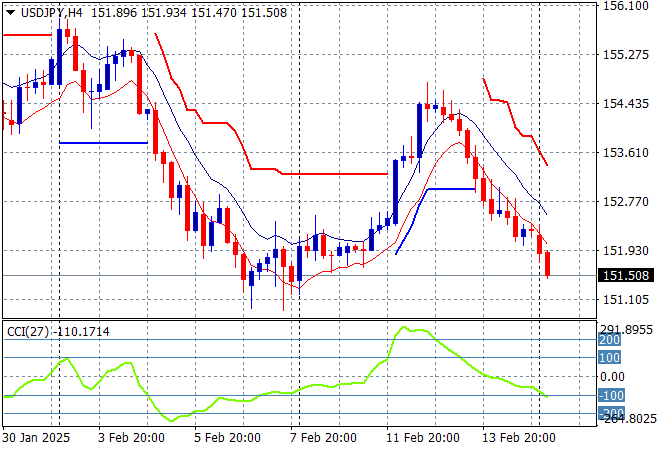

Mainland Chinese share markets are losing ground in afternoon trade with the Shanghai Composite just above the 3300 point level while the Hang Seng Index has pulled back from its well overbought position from Friday, down 0.8% to 22447 points. Japanese stock markets are dead flat despite the higher Yen with the Nikkei 225 closing at 39156 points while trading in the USDPY pair has seen a sharp drop below the 152 handle after the weekend gap:

Australian stocks are having a pullback session as well due to some mixed earnings reports with the ASX200 closing 0.2% lower at 8537 points while the Australian dollar has continued its breakout to almost clear the 64 cent level:

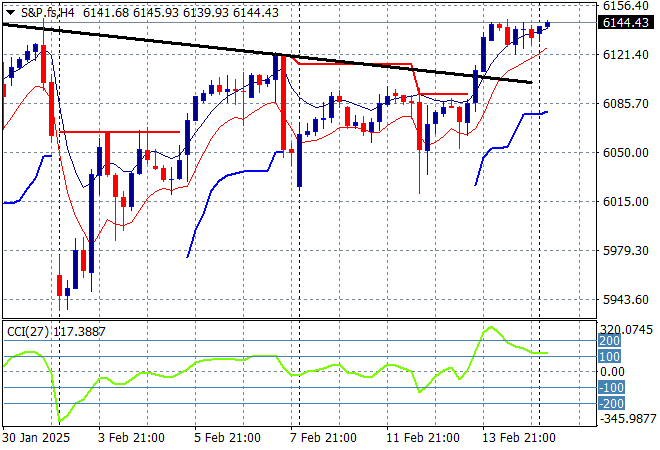

S&P and Eurostoxx futures are heading higher as we head into the London session with the S&P500 four hourly chart showing the dead cat bounce negated fully as price action gets back on trend above the 6100 point level:

The economic calendar starts the week quietly with a few Fed speeches overnight.

some videos