Goldman is still bullish DXY but not so bearish AUD.

USD: Tariff-fried.We see three key takeaways from a frenzied week.

First, the recent back and forth headlines have not altered our view that tariffs are coming and this will materially impact exchange rates.

In fact, our economists now expect a larger increase in the effective tariff rate than they had previously envisioned, though not quite as high as what was threatened a week ago.

Second, it is clear that FX is responding strongly to tariff risks in both directions.

This had been somewhat in question a few weeks ago, when investors were asking whether tariffs were “priced in” to FX already, and whether the Dollar could outperform rate differentials on tariff risks to the same extent as in 2018-19.

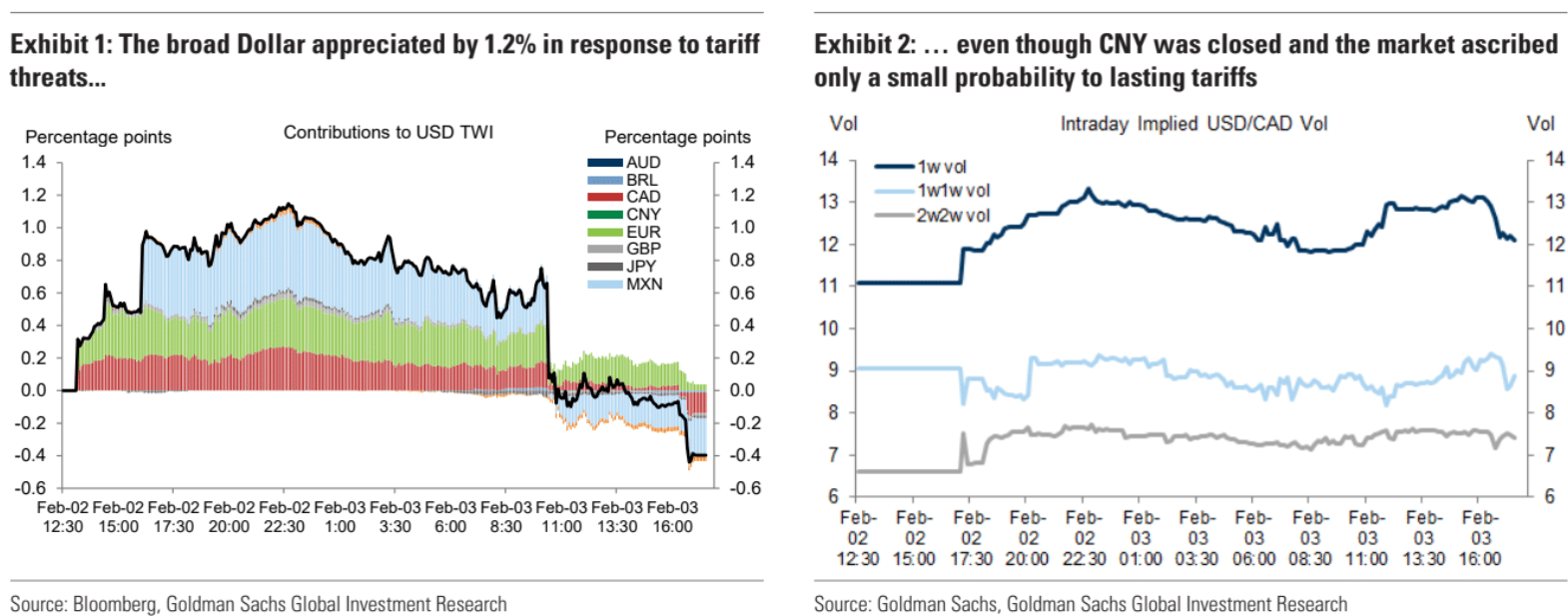

But the broad Dollar strengthened by around 1.2% in response to headlines over the weekend (Exhibit 1), even though markets seemingly only ascribed a small probability to these tariffs being implemented for an extended period (Exhibit 2) and the onshore CNY market was closed for the Lunar New Year holiday.

Third the solid payrolls report demonstrates that economic performance is still putting a floor under the Dollar.

While we remain closely focused on risks to our forecasts stemming from tariff under-delivery and more balanced global economic performance, at least for now the US continues to set a high bar, and much of the Dollar’s strength in recent months can be attributed to shifting macro outcomes rather than tariff expectations.

Goldman sees the AUD at 0.62 over three, six, and twelve-month horizons, then climbing from there.

I am neutral to bullish for now on the massive market short.

I still see lower over the longer term as iron ore, the Aussie economy, and interest rates slowly collapse.