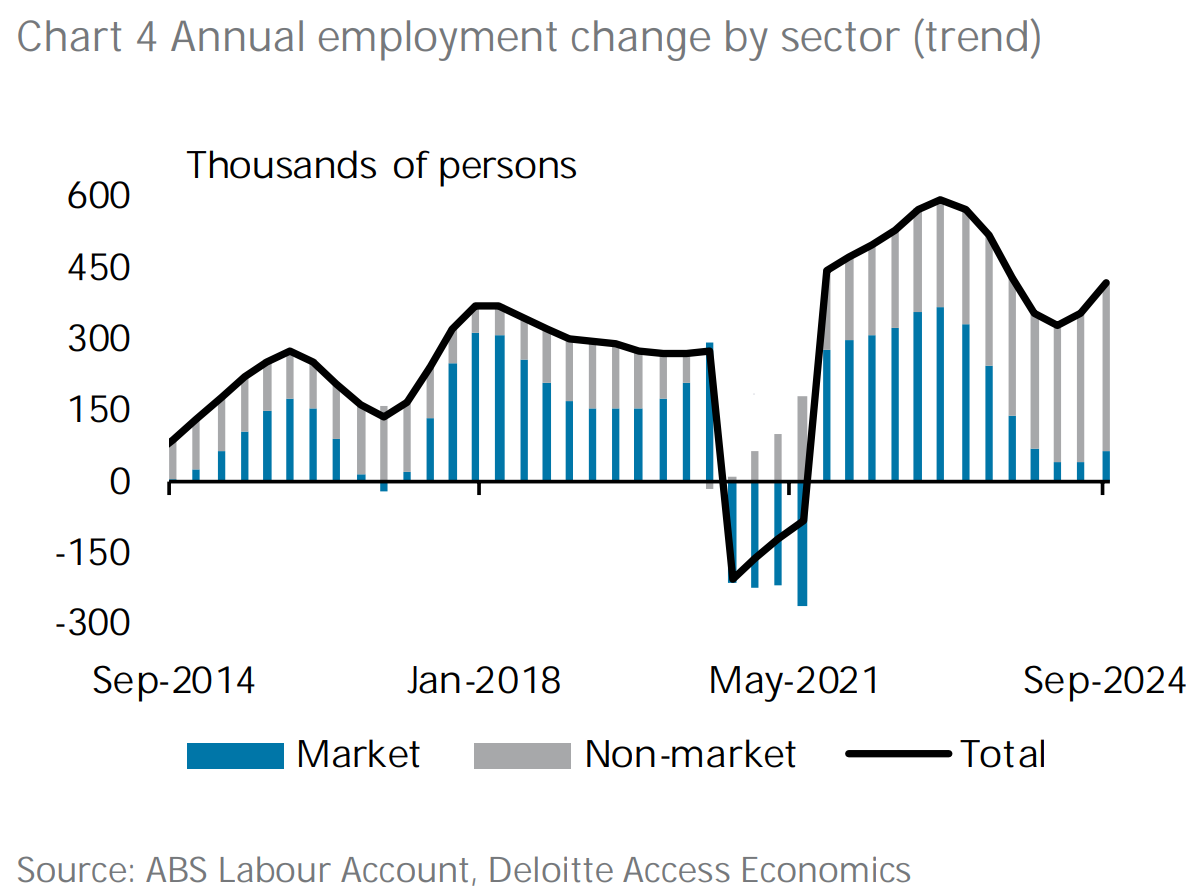

Deloitte Access Economics has released its latest Employment Forecasts, which noted that “the market sector workforce experienced modest employment growth in 2024 with most job growth very much sponsored by the public sector”.

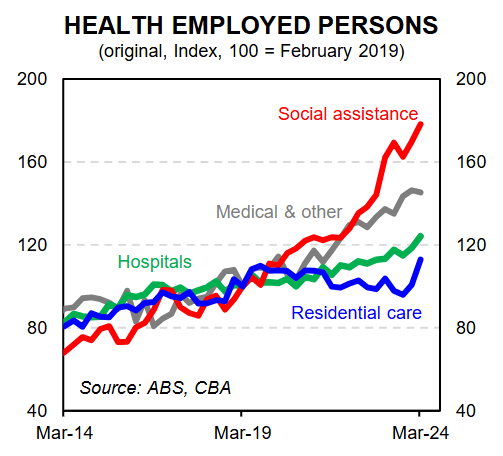

“The non-market sector (health care, education, and public admin) drove most of the growth in the past year. An ageing population has boosted demand for aged care and health services, while the expansion of the $49 billion NDIS has increased jobs in social services”.

“Over the year to September 2024, the ABS Labour Account data showed some 85% of job gains are estimated to have come from the non-market sector”.

The rise in non-market jobs has been overwhelmingly driven by the NDIS-related hiring.

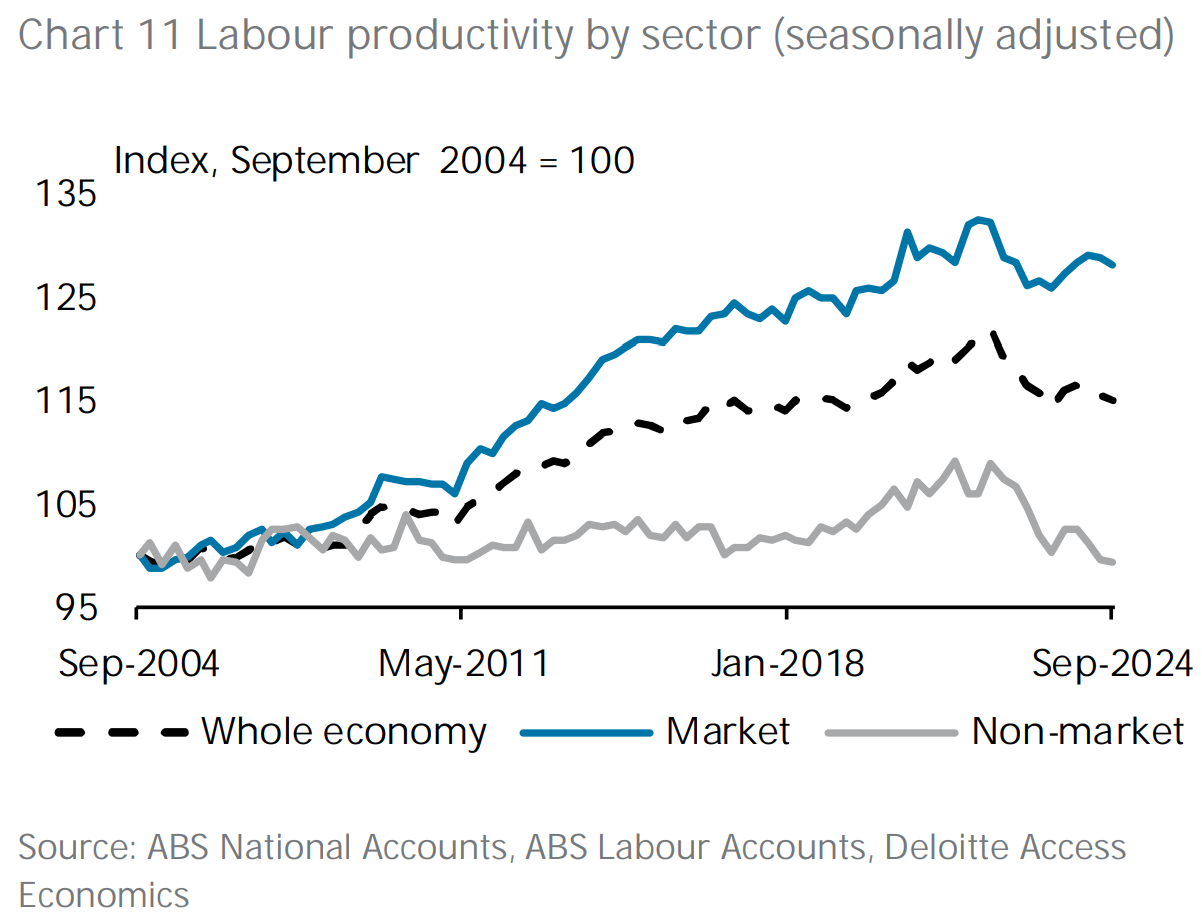

Deloitte notes that the pivot to non-market-based jobs is contributing to Australia’s poor labour productivity growth.

“Australian labour productivity has fallen considerably over the past three years. Since its peak in March 2022, Australia’s labour productivity has fallen by 5.7%, which comprises a 3.1% fall in market sector productivity, and a 9.0% reduction in non-market labour productivity”.

“Labour productivity in the non-market sector now sits at a near 20-year low”.

“Labour productivity is a key determinant of economic growth and overall living standards”.

“Three years of near consistent declines has become a key concern. Australia needs a productivity boost – from the market sector via investment, particularly in technology, and from the non-market sector via economic reforms”.

Deloitte also notes that the “private sector doesn’t yet appear to be in a position to resume large-scale hiring”.

“Jobs and Skills Australia data shows the proportion of employers expecting to increase staffing levels over the next three months sits at a near series low”.

“This is supported by the latest Deloitte CFO Sentiment survey which finds that Australian CFO’s expectation for their future headcount is evenly split between rise, fall, or stay the same”.

As a result, Deloitte expects employment growth to slow.

“National employment growth is forecast to slow from 2.6% (357,900 workers) in calendar year 2024 to 1.8% (257,400 workers) in 2025, moderating further to 1.2% (180,000 workers) in 2026, as public spending slows, net overseas migration trends downward, and macroeconomic conditions (while improved) are still relatively subdued”.