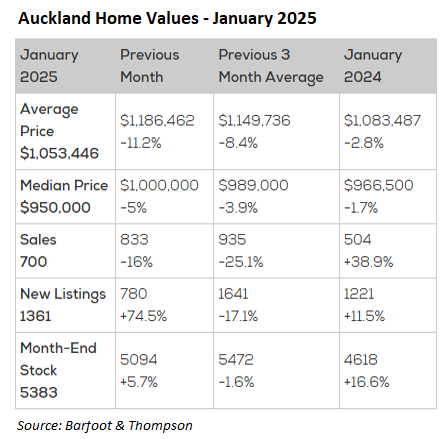

In January, Auckland’s largest real estate agency, Barfoot & Thompson, reported a hefty decline in median and average sale prices.

“The median sales price for the month at $950,000 was down 5% on that for December, while the average price at $1,053,446 was down 11.2% and sales numbers at 700 were down 16%”, Peter Thompson, Managing Director of Barfoot & Thompson noted.

As illustrated above, median and average prices also fell over the quarter and year, albeit by less than January’s decline.

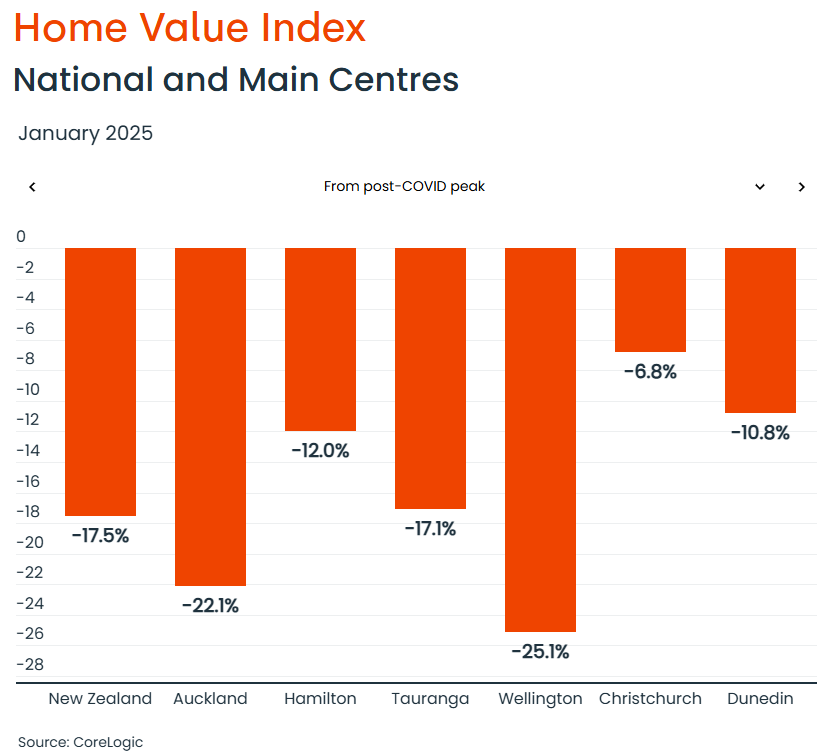

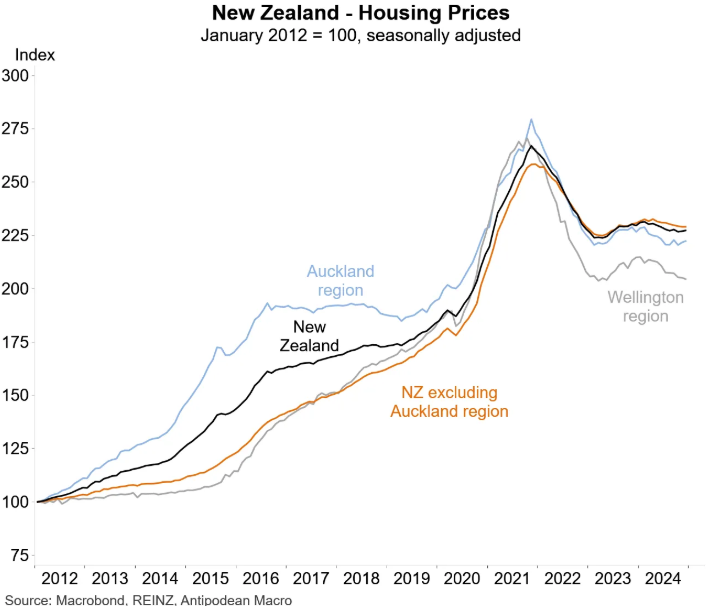

Broader data on New Zealand’s housing market shows that prices have fallen heavily from their post-pandemic peak.

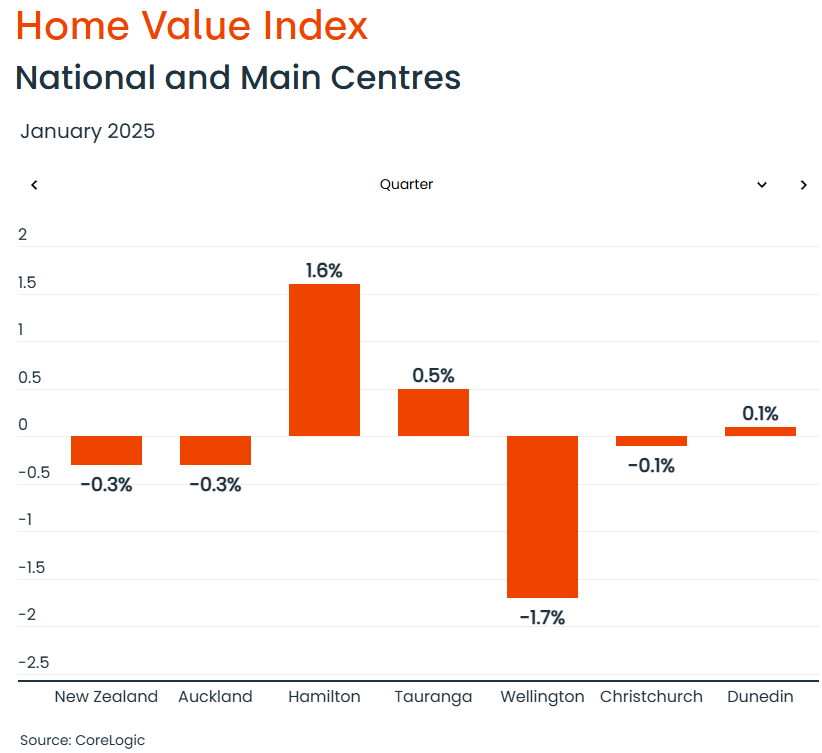

CoreLogic’s home values index shows that prices nationally fell by 0.3% over the quarter, led by Wellington.

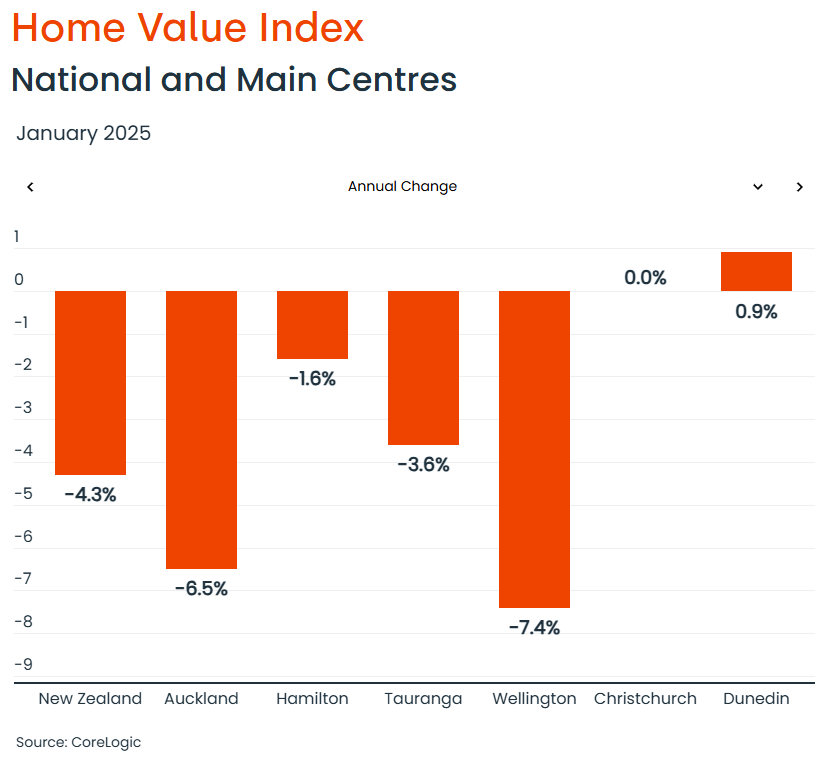

In 2024, CoreLogic reported a 4.3% decline in New Zealand home values, led by Wellington (-7.4%) and Auckland (-6.5%).

New Zealand home values have crashed by 17.5% from their post-pandemic peak, led by Wellington (-25.1%) and Auckland (-22.1%).

The Real Estate Institute of New Zealand’s (REINZ) home values index, presented below by Justin Fabo from Antipodean Macro, also shows a hefty decline from the post-pandemic peak.

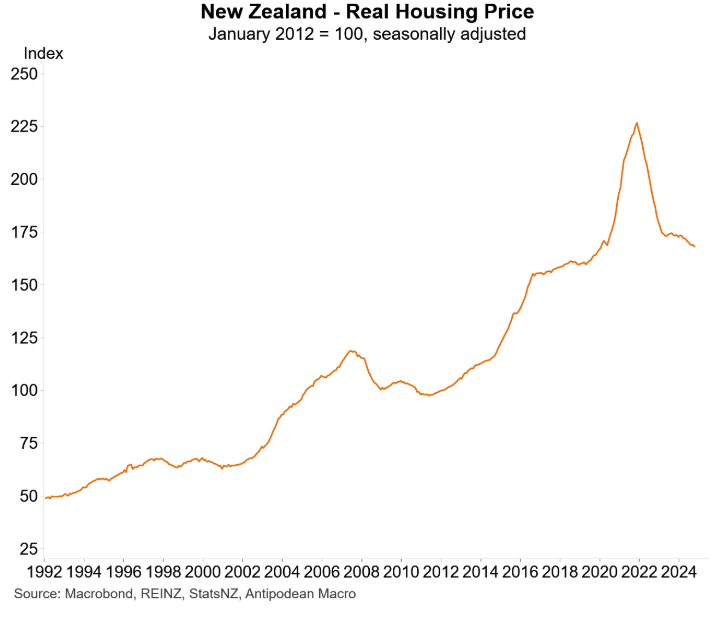

This has taken real values back to pre-pandemic levels.

The decline in home values has been driven by the Reserve Bank of New Zealand’s aggressive monetary tightening, which saw the official cash rate peak at 5.50% last year.

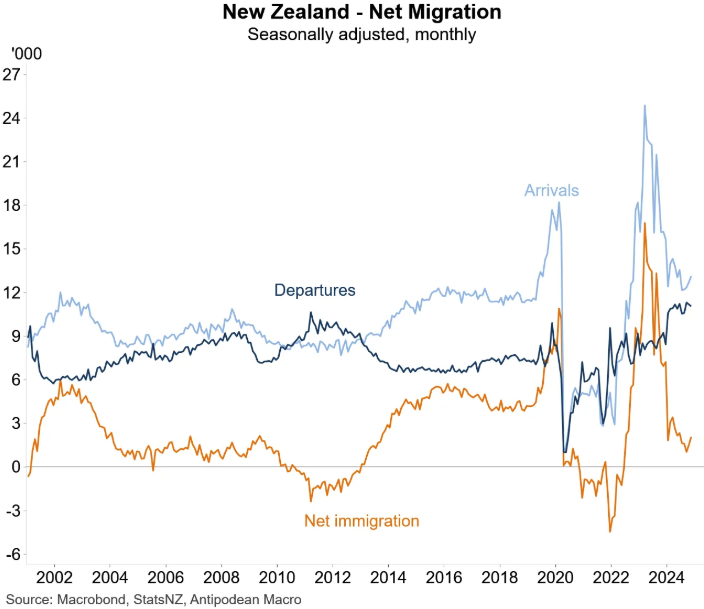

New Zealand has also seen a sharp decline in net overseas migration, which has tempered housing demand.

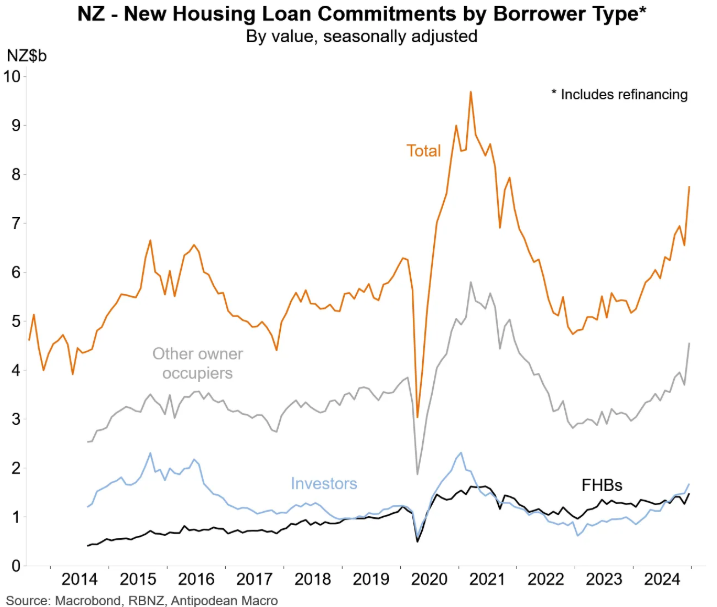

The picture is brightening, however. The decline in home values and the recent lowering of interest rates have seen mortgage affordability significantly improve.

New Zealand mortgage commitments have rebounded strongly.

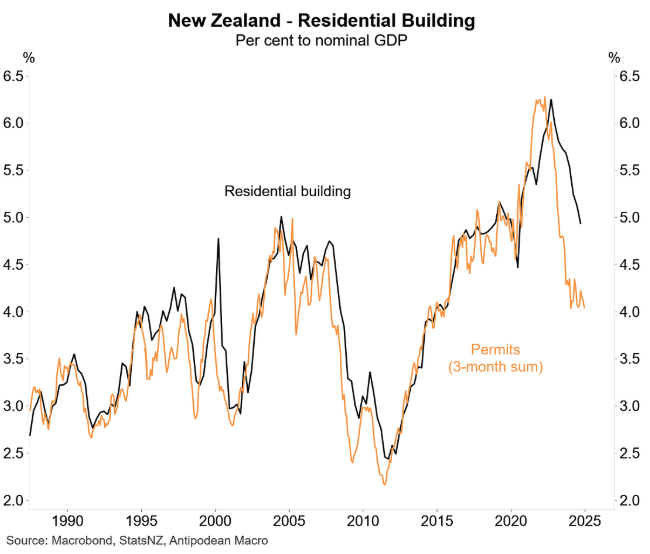

Finally, fundamental supply could tighten amid the sharp fall in residential building activity.

New Zealand house prices should, therefore, rebound this year.