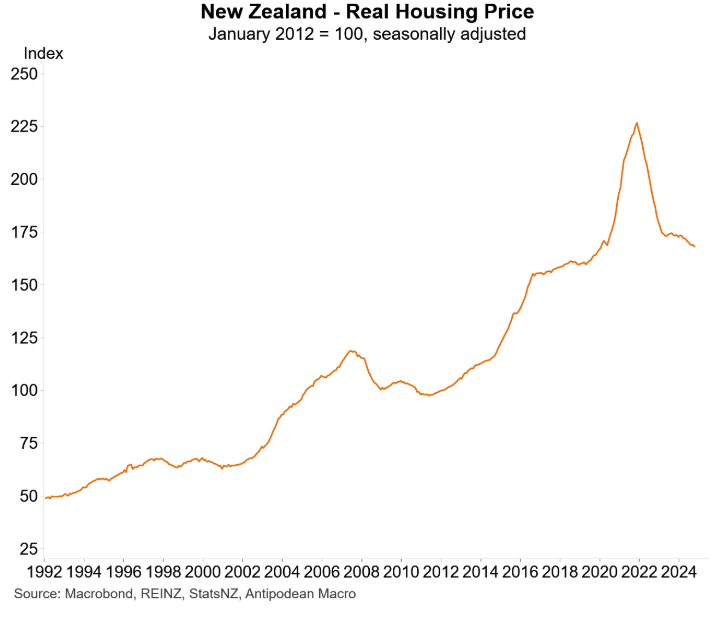

New Zealand’s housing bubble has burst after recording one of the world’s largest house price increases during the pandemic.

According to the Real Estate Institute of New Zealand, real inflation-adjusted national home values have collapsed to their pre-pandemic level.

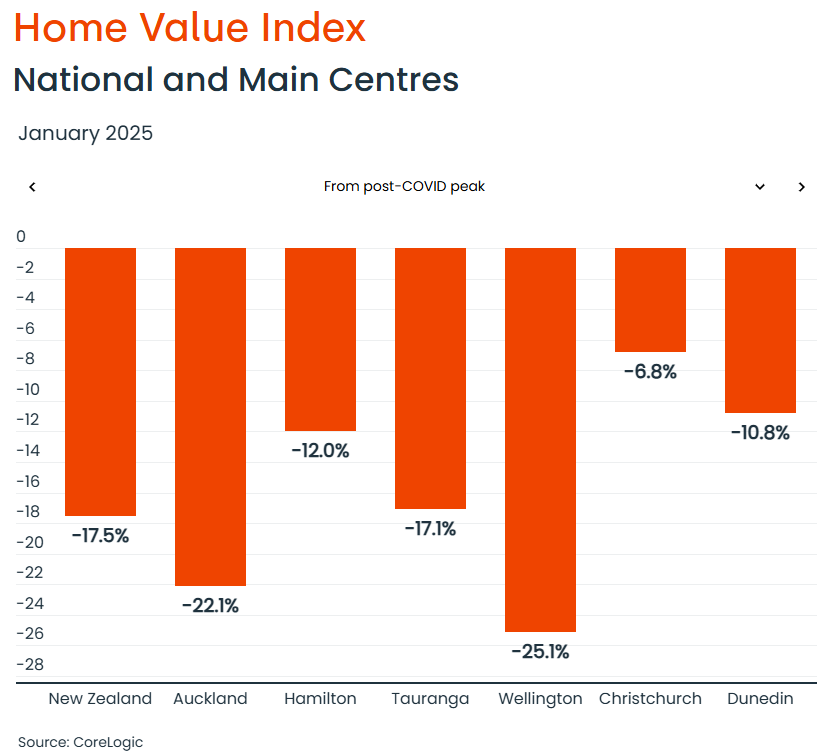

CoreLogic has also recorded a 17.5% decline in national values from their post-pandemic peak, led by Wellington (-25.1%) and Auckland (-22.1%).

Recent high-frequency indicators suggest that New Zealand house prices could fall further, despite hefty interest rate cuts by the Reserve Bank and vastly improving mortgage affordability.

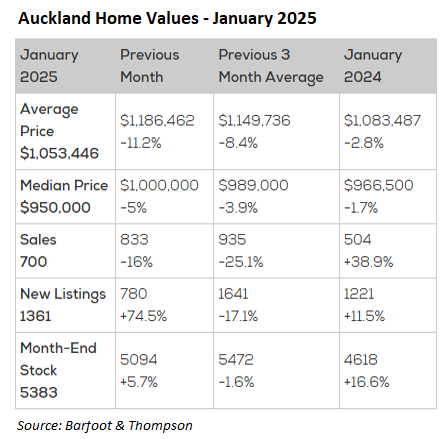

In January, Auckland’s largest real estate agency, Barfoot & Thompson, reported a sharp 5% decline in median home values, with average prices plunging by 11.2%.

This follows a substantial increase in for-sale listings on both a quarterly and annual basis.

The latest sales and listing results from Trade Me Property tell a similar story.

Residential listings on the portal hit a five-year high of 39,000 in January. This was up 17% compared to January 2024 and the most for the month of January in five years.

The Wellington region led the annual increase in listings (up 28%), while Canterbury (up 23%) and Auckland (up 17%) also recorded hefty increases.

“It seems that a lot of vendors have come back from the break and are ready to make a move in 2025, which is great news for buyers, who now have more properties and more choice”, Trade Me Property Customer Director Gavin Lloyd said.

Asking prices also continued to decline.

The national average asking price on Trade Me Property was $842,900 in January, down 0.8% from December last year.

The combination of rising listings in an already oversupplied market and lower asking prices suggests that rate cuts have failed to stimulate demand.

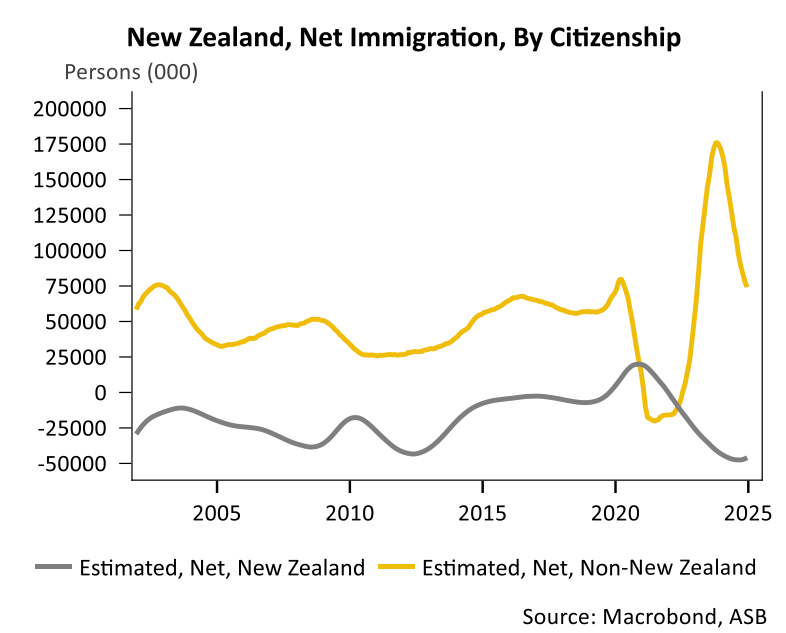

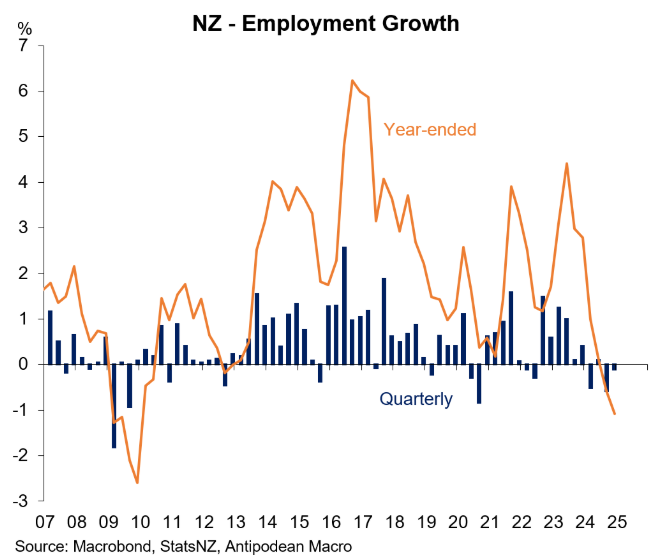

The downturn in property is also being assisted by the sharp slowing of net overseas migration, led by the exodus of New Zealand citizens, as well as the worsening of the labour market.

After a period of housing insanity during the pandemic, rationality has returned.