Ross Gittins claims, “The nation is finally coming to grips with home affordability”.

“I’ve been watching and writing about the steady worsening in housing affordability for the best part of 50 years, and I’m more optimistic today than I’ve ever been”, Gittins wrote.

“At every level, from governments at the top to mums and dads and angry young people at the bottom, we’re realising that house prices just can’t be allowed to keep going up and up forever”.

“Politicians, treasuries, economists and parents are coming to grips with the problem”.

“Now we’ve finally realised the problem is multi-faceted and needs to be attacked at every level from every angle”.

That’s why the Albanese government’s National Housing Accord with the states is a big advance… The accord is important because it represents both levels of government accepting responsibility for housing affordability and being willing to co-operate in making progress”, Gittins wrote.

I would like to know what Ross Gittins is smoking.

Australia’s housing minister, Clare O’Neil, literally said via an interview in December 2024 that the government wants house prices to rise.

Interviewer:

What is the goal here in terms of these policies? Is it to bring down house prices?

Clare O’Neil:

We want to bring house price growth into something sustainable. So we are not trying to bring down house prices.

But we don’t want to see some of the growth that we’ve seen in some parts of the country, where you are getting double-digit increases in house prices year-on-year.

Interviewer:

Why don’t you want to see house prices drop? Because if you’re a young person looking at what’s ahead of you, you definitely want to see house prices come down.

Clare O’Neil:

Well, that may be the view of young people. That’s not the view of our government. We want to see sustainable price growth…

Interviewer:

But minister, if house prices don’t come down. Doesn’t that this system is stacked against young people. And it is just not going to work for them?

Clare O’Neil:

Our government’s policies are not going to reduce house prices and we want house prices to grow sustainably.

Rising house prices are the antithesis of improving housing affordability, I would have thought.

Meanwhile, Treasurer Jim Chalmers this week ordered financial regulators to soften home-lending rules for millions of Australians with university debts and developers to help “unlock more finance from the banks”.

The Coalition opposition has also promised to allow home buyers to raid their superannuation savings for a deposit, and it has committed to watering down responsible lending obligations.

These policies would boost housing demand and increase mortgage debt, driving prices higher. As a result, they would make the affordability situation worse.

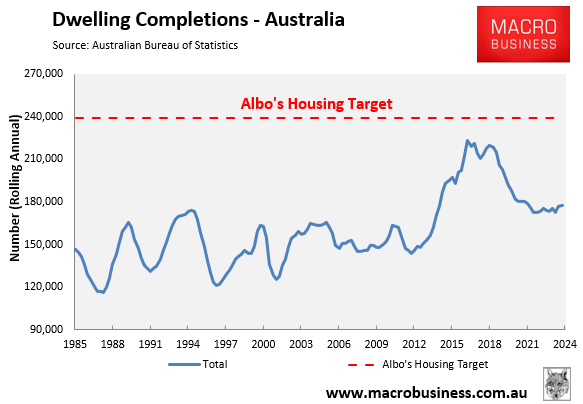

The National Cabinet’s target to build 1.2 million homes over five years is pure tokenism and has zero chance of being achieved.

Actual construction rates have collapsed amid high interest rates, high construction costs, builder shortages, and widespread builder insolvencies.

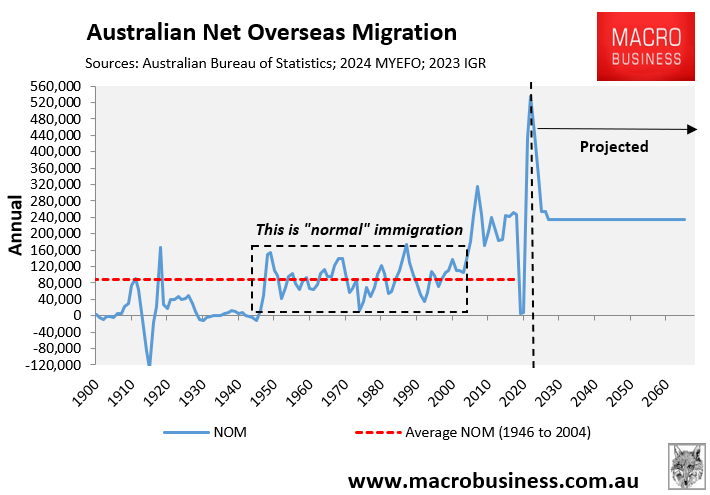

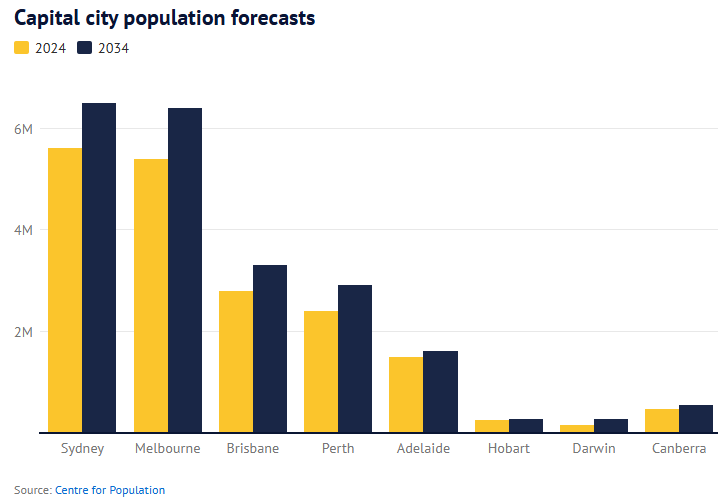

Meanwhile, the federal government’s Centre for Population has projected that Australia’s population will balloon by 4.1 million over the next decade due to permanently high net overseas migration.

Most of these 4.1 million new residents will land in the major capital cities, worsening housing shortages.

Melbourne is projected to grow by one million people over the next decade, while Sydney will gain 900,000 and Brisbane and Perth will add 500,000 each.

Ross Gittins failed to mention immigration in his Panglossian spruik article. This is curious because Gittins said the following about immigration and housing in October 2021:

“The more governments use high immigration to increase the size of cities, the more competition there is to buy a detached house, and the more people will pay to get a place that’s close to the CBD”.

“Ever-rising house prices is a demand story more than a supply story”.

The only thing that changed was Ross Gittins’ credibility.