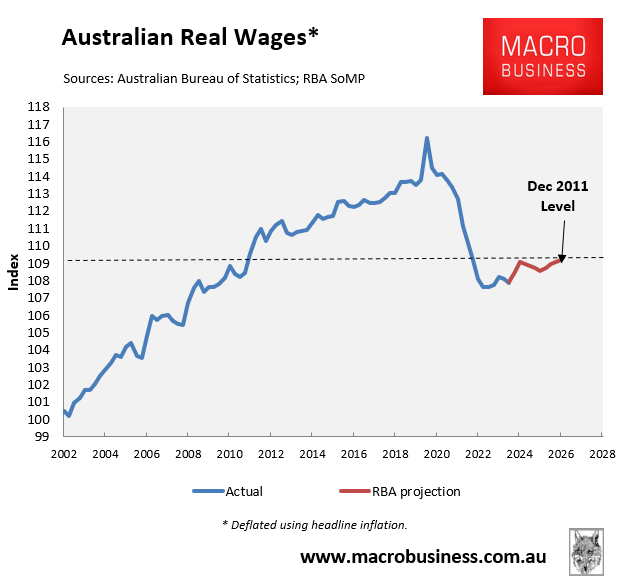

The Australian Bureau of Statistics (ABS) shows that as of Q3 2024, real wages had fallen 6.7% from the June 2020 peak.

The Reserve Bank of Australia’s (RBA) latest Statement of Monetary Policy forecasts that real wages would still be 6.0% below the peak by the end of 2026, as illustrated below.

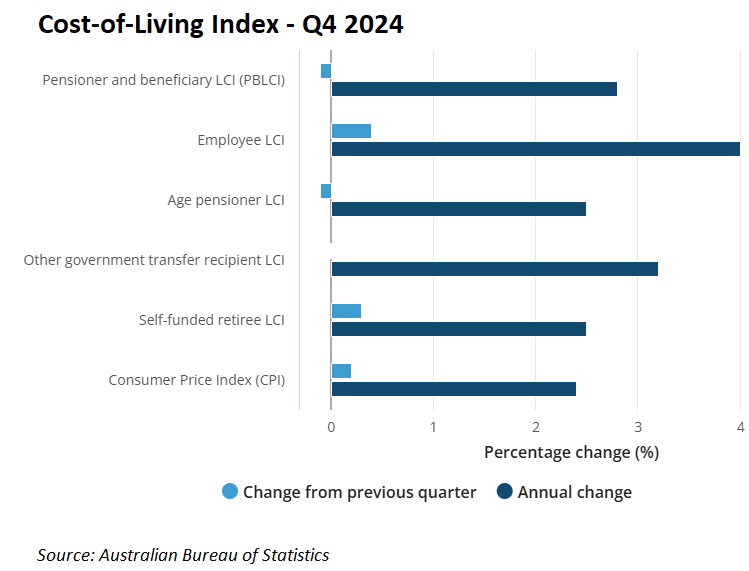

On Tuesday, the ABS released its Cost of Living Index for Q4 2024, which shows that the cost of living for employee households grew by 4.0% in 2024, above headline CPI inflation of 2.4% and annual wage growth of 3.5% as of Q3 2024 (latest available data)

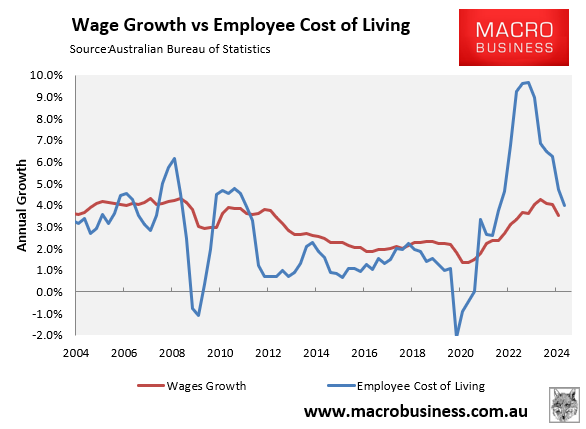

The following chart shows how employee households’ living costs have exceeded wage growth since Q2 2021.

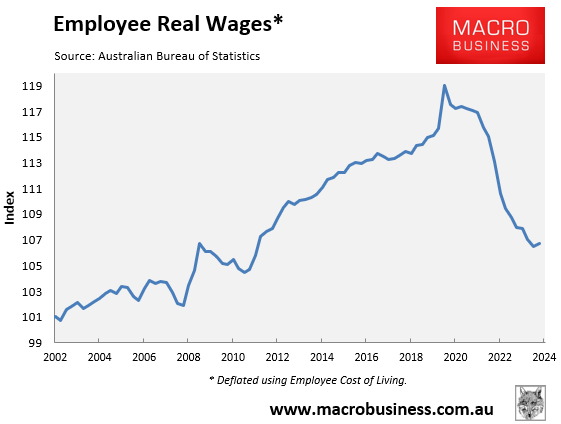

Real wages for employee households have collapsed by 10.3% since the Q2 2020 peak and were tracking at late 2021 levels as of Q3 2024 (latest available data).

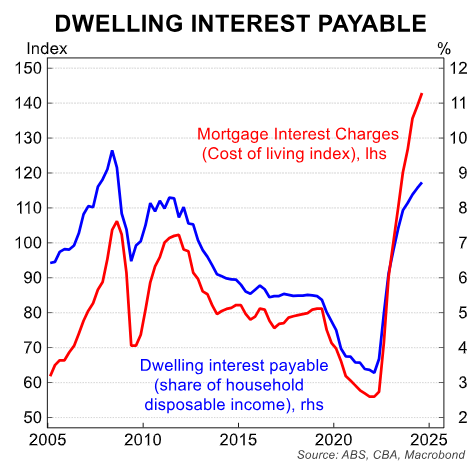

Employee households have experienced larger real wage losses than suggested by the first chart above, mainly because of the strong rise in interest payments following the RBA’s interest rate hikes.

Interest payments are excluded from the calculation of CPI inflation but are included in the employee cost of living index.

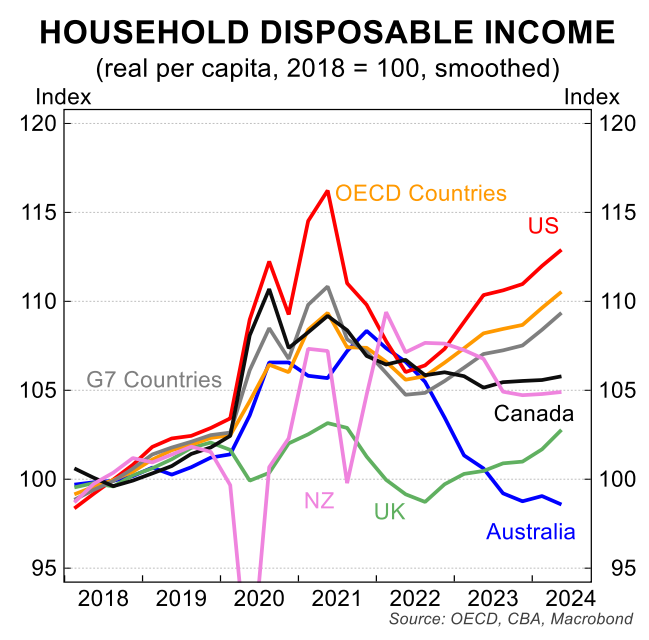

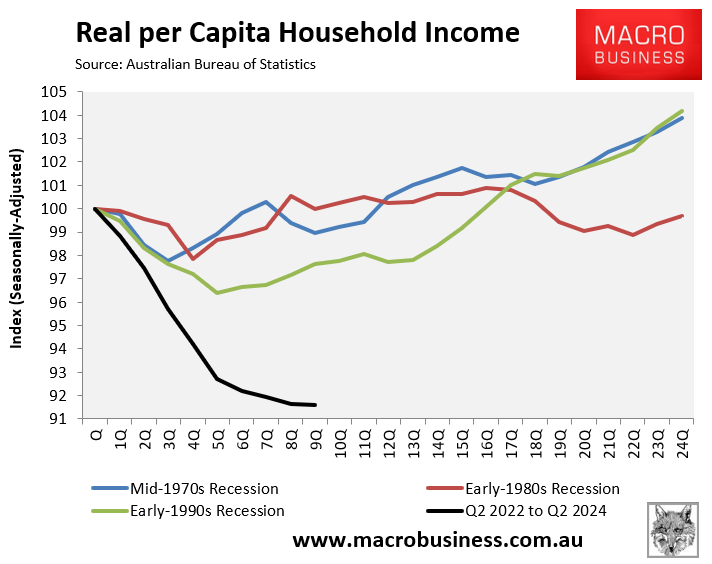

The fall in real wages combined with soaring interest payments also explains why Australian households have experienced the developed world’s most significant decline in real per capita household incomes.

Australian real per capita household disposable incomes have fallen by around 8% since Q2 2022, the largest decline on record.

Working Australians have been hit especially hard by the rising cost of living.

This helps to explain why voters have turned against the Albanese government. Voters are angry about the decline in their standard of living.