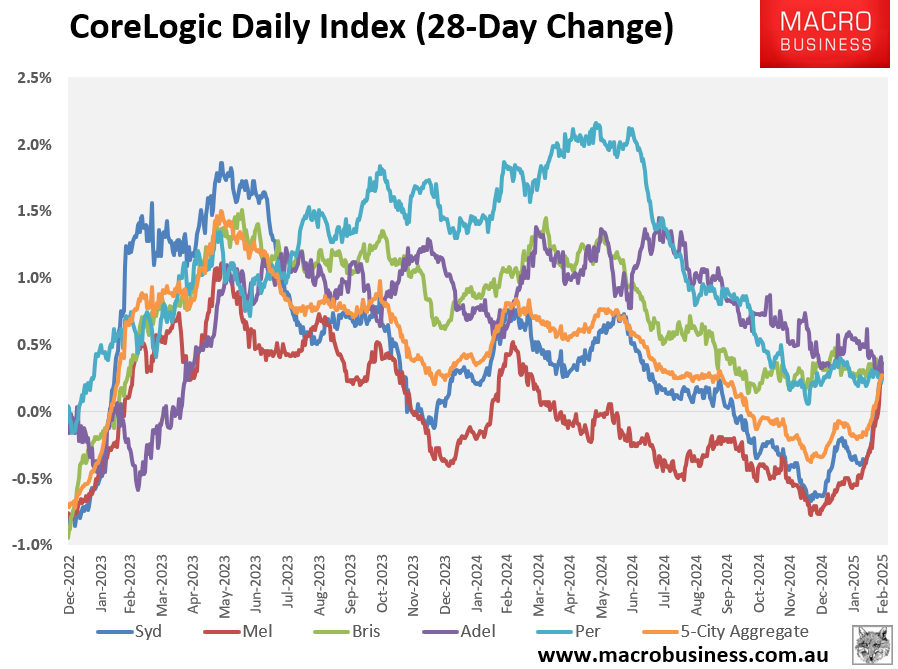

The Reserve Bank of Australia’s (RBA) 0.25% interest rate cut and expectations of more easing have delivered a strong rebound in Australian home prices, driven by Sydney and Melbourne.

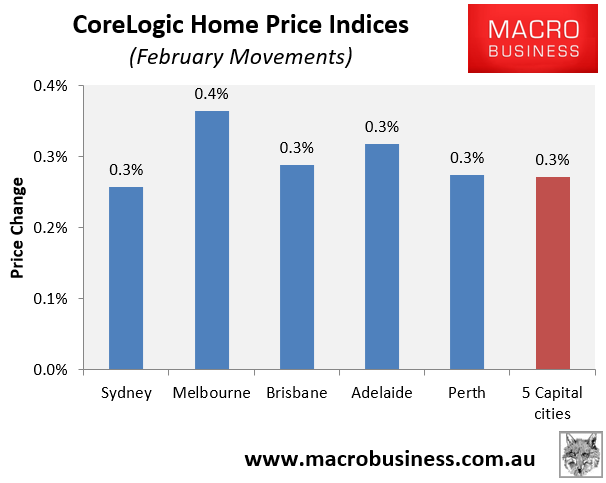

After declining for three consecutive months, Australian dwelling values recorded a 0.3% increase in dwelling values across the five major capital cities in February, with each capital recording similar gains.

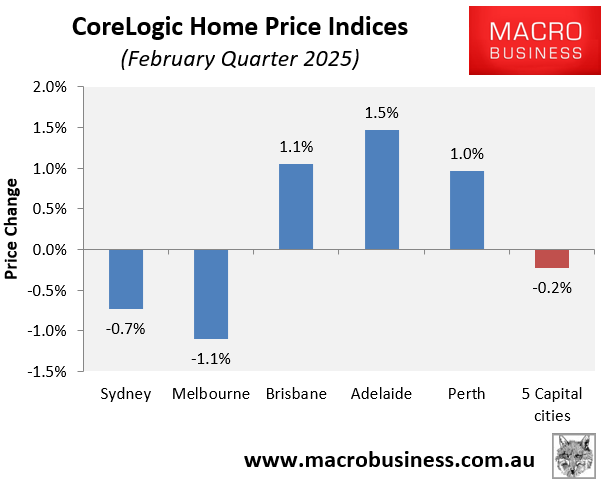

However, dwelling values at the 5-city aggregate level were down 0.2% on a quarterly basis, pulled down by Melbourne (-1.1%) and Sydney (-0.7%).

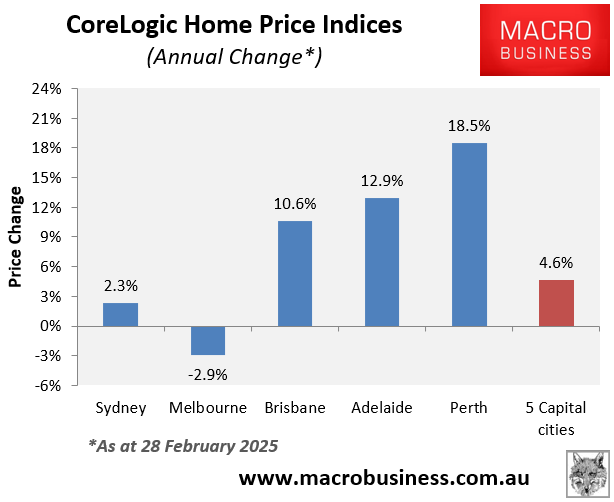

In the year to February 2025, home values at the 5-city aggregate level rose by 4.6%, with Melbourne the only major capital to record a decrease in values (-2.9%).

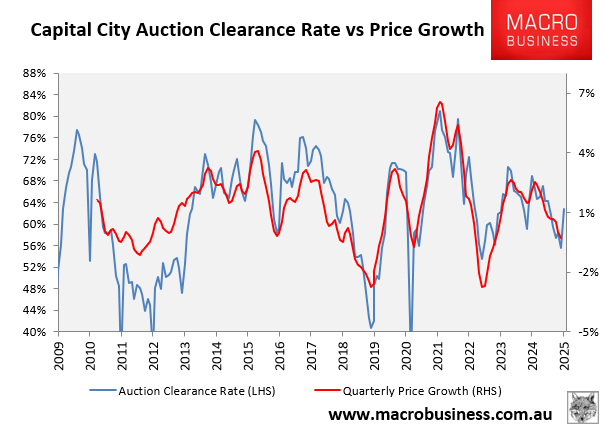

The rebound in home values in February was also reflected in the auction market, which recorded a strong rebound in clearance rates, driven by Melbourne and Sydney.

As illustrated above, auction clearance rates and home prices tend to follow each other.

With most economists and home buyers expecting further interest rate cuts throughout 2025, expect to see further house price appreciation.

Australian housing is about to become even more expensive.