The prospect of interest rate cuts from the Reserve Bank of Australia (RBA) has engineered a rebound in Australian house prices.

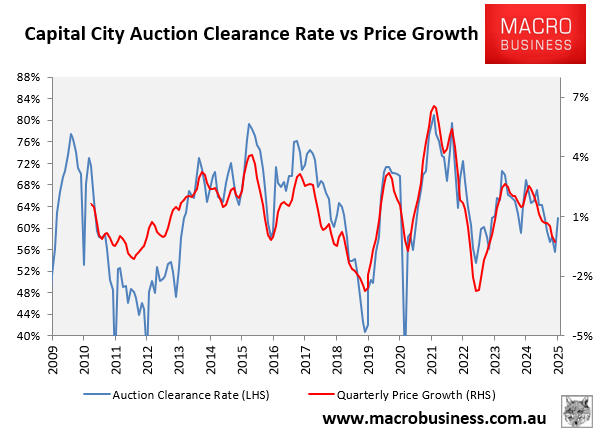

This year’s final auction clearance rates have rebounded strongly, which historically is associated with an uplift in prices.

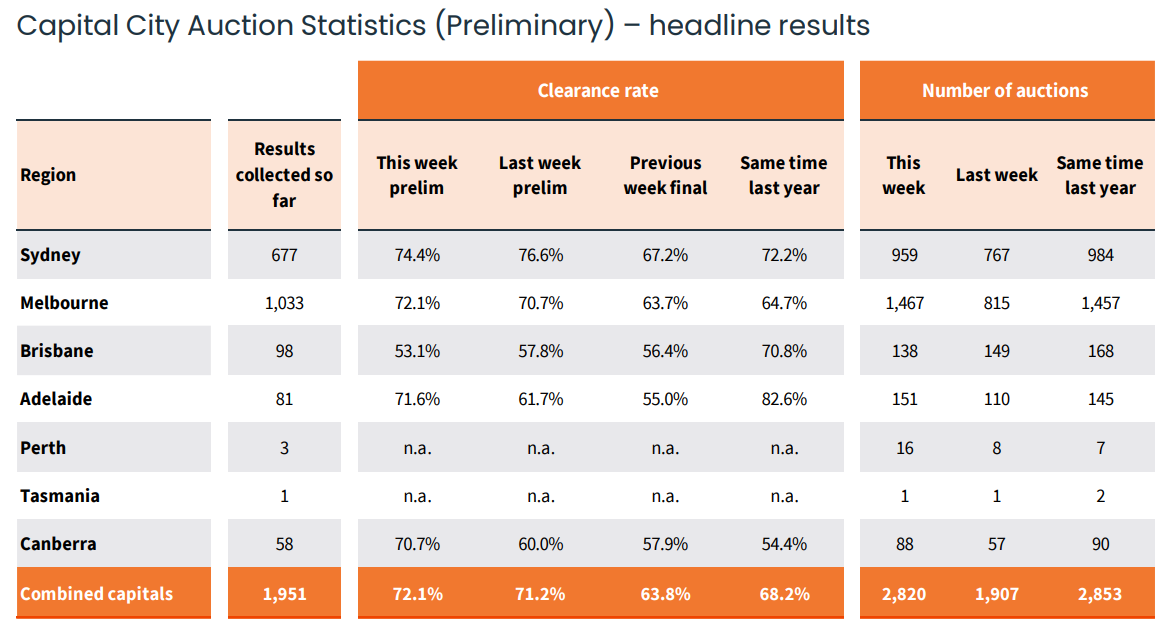

This weekend’s preliminary auction clearance results from CoreLogic suggest that the auction rebound continued, with a national preliminary clearance rate of 72.1% recorded, up from 71.2% a week ago (revised down to 63.8% on final numbers).

This was the highest preliminary clearance rate since the last week of July 2024 (72.2%). It was also the second week running where the preliminary clearance rate was above 70%.

Melbourne recorded a preliminary clearance rate of 72.1%, up from 70.7% a week earlier (revised to 63.7% on final numbers) and the highest preliminary clearance rate since the week ending July 14th last year.

Sydney recorded a preliminary clearance rate of 74.4%. Although thiis was down from 76.6% a week ago (revised down to 67.2% on final numbers), it was the third consecutive week where the preliminary clearance rate has been above 70%.

The recent jump in auction clearances is being replicated by dwelling values.

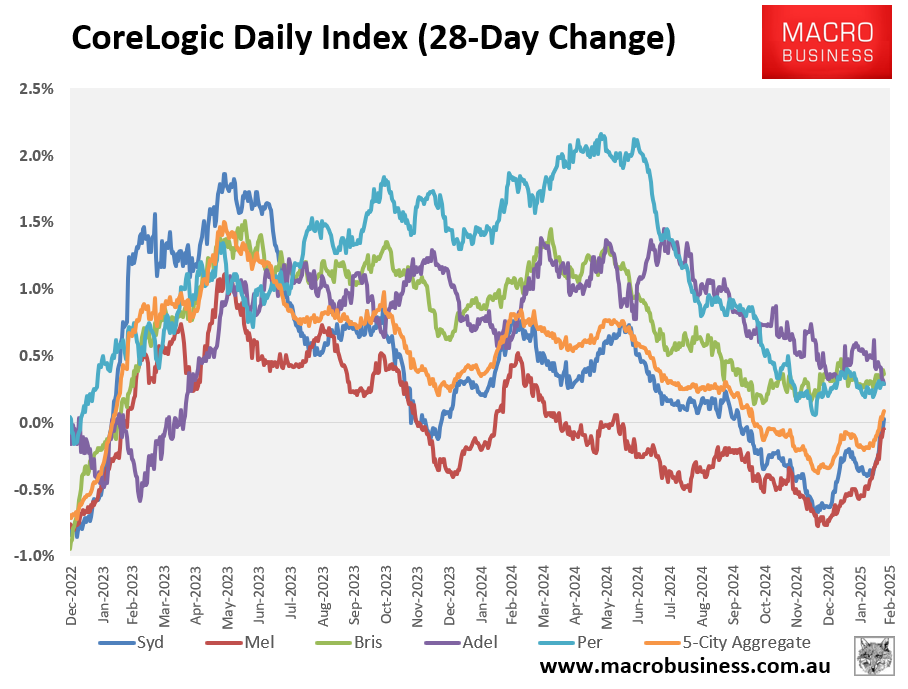

CoreLogic’s daily dwelling values index has recorded a strong rebound over the past month, driven by Sydney and Melbourne.

The price rebound is likely to continue.

Most economist’s expect the RBA to follow up last week’s 0.25% rate cut with a further three reductions in the official cash rate this calendar year.

Indeed, the latest Statement of Monetary Policy (SoMP) lowered the estimated neutral cash rate—the level where interest rates are not adding or subtracting from demand—to around 2.9%.

With a cash rate of 4.10% currently, monetary policy remains in restrictive territory.

Therefore, it is likely the RBA will continue to cut rates, which will push home prices higher.