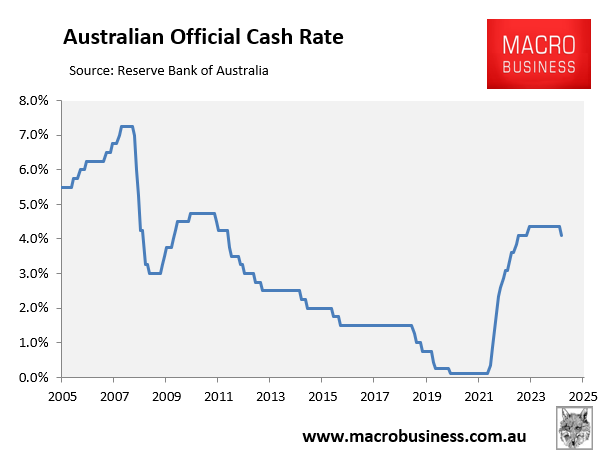

As widely anticipated by the financial market and economists, the Reserve Bank of Australia (RBA) cut the official cash rate (OCR) by 0.25% at Tuesday’s monetary policy meeting.

It was the first cut since the RBA commenced its monetary tightening cycle in May 2022 and took the OCR down to 4.10%.

The decision could be considered a “hawkish cut” with the RBA warning that inflationary pressures remain and the cash rate could still rise if data worsens.

While the RBA noted that inflationary pressures have eased:

Inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.

In the December quarter underlying inflation was 3.2%, which suggests inflationary pressures are easing a little more quickly than expected.

There has also been continued subdued growth in private demand and wage pressures have eased…

Some of the upside risks to inflation appear to have eased and there are signs that disinflation might be occurring a little more quickly than earlier expected…

These factors give the Board more confidence that inflation is moving sustainably towards the midpoint of the 2–3% target range.

It also warned that “upside risks remain”:

Some recent labour market data have been unexpectedly strong, suggesting that the labour market may be somewhat tighter than previously thought.

The central forecast for underlying inflation, which is based on the cash rate path implied by financial markets, has been revised up a little over 2026.

So, while today’s policy decision recognises the welcome progress on inflation, the Board remains cautious on prospects for further policy easing.

The RBA also explicitly noted that the “outlook remains uncertain”.

There are notable uncertainties about the outlook for domestic economic activity and inflation.

The central projection is for growth in household consumption to increase as income growth rises. But there is a risk that any pick-up in consumption is slower than expected, resulting in continued subdued output growth and a sharper deterioration in the labour market than currently projected.

Alternatively, labour market outcomes may prove stronger than expected, given the signal from a range of leading indicators.

More broadly, there are uncertainties regarding the lags in the effect of monetary policy and how firms’ pricing decisions and wages will respond to the slow growth in the economy and weak productivity outcomes while conditions in the labour market remain tight.

Uncertainty about the outlook abroad also remains significant…

The RBA also noted that “monetary policy has been restrictive and will remain so after this reduction in the cash rate… the Board acknowledges that progress has been made but is cautious about the outlook”.

Looking ahead, the RBA stated that it will remain data-dependent and will base future decisions upon how the data evolves.

The happiest people in Australia right now are likely to be Prime Minister Anthony Albanese and Treasurer Jim Chalmers.

With Labor trailing in the polls amid cost of living pressures, the Albanese government will be desperately hoping that the rate cut turns the electoral tide.

I expect the government to call an election within days.