The rotten fish head is back, trying to poison the interest rate pond with politicised garbage.

John Kehoe is the stinker today.

The decision by the Reserve Bank of Australia board on Tuesday is the most eagerly awaited monetary policy call in many years – both for home borrowers and politicians on the eve of a federal election.

For the nine RBA board members, it will be a close call between trimming the 4.35 per cent cash rate and holding their nerve by keeping rates steady against unprecedented community and political pressure. Market pricing of a 90 per cent chance of an immediate rate cut seems overblown and the balance of probability is more likely closer to a 50/50 coin toss for the board as a collective.

But even if the cash rate is immediately inched lower, borrowers should not anticipate that a second rate reduction will automatically come at the RBA’s next meeting on April 1. Neither should the Albanese government, as the prime minister considers the best election date to maximise Labor’s chance of retaining power.

Back-to-back rate changes are usually executed at the start of an RBA rates cycle, but there is good reason to think this time could be different. Whenever the RBA does reduce the 13-year high cash rate, governor Michele Bullock will want to signal that only a shallow rate trimming cycle is expected because the inflation fight is not won.

This is garbage analysis. Inflation has been crushed and is going lower. The RBA will cut because it is not a total moron. Although it probably won’t signal more cuts, it will signal data dependence.

Moreover, the data is going lower, so back-to-back cuts are probable.

Check out the following charts from the excellent Andrew Boak at Goldman.

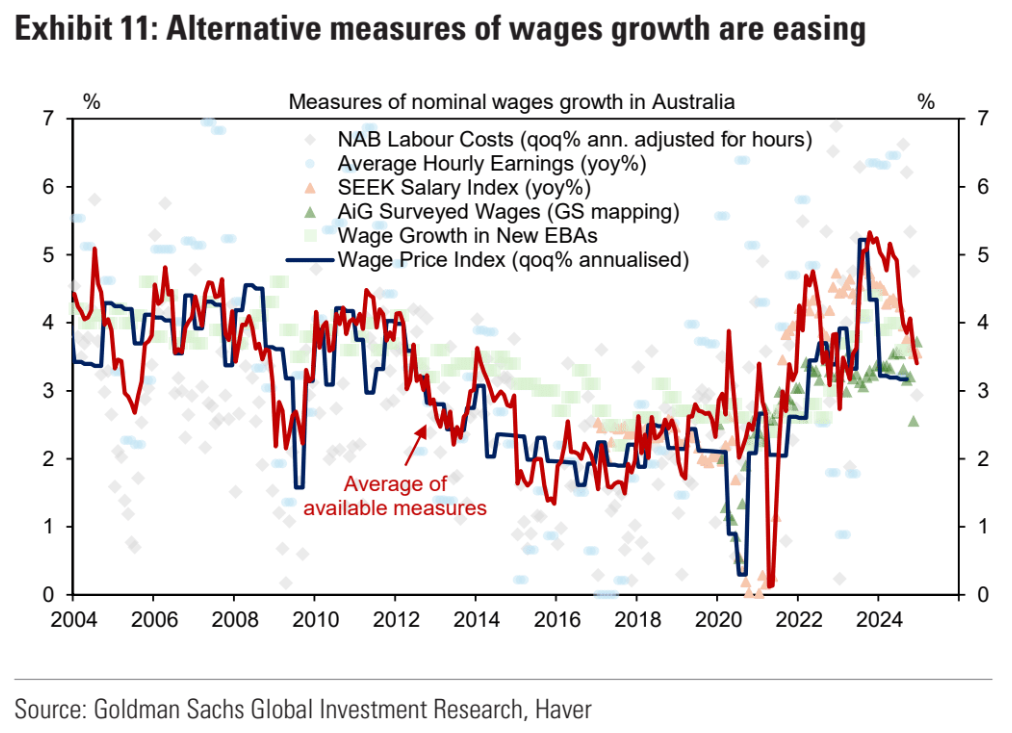

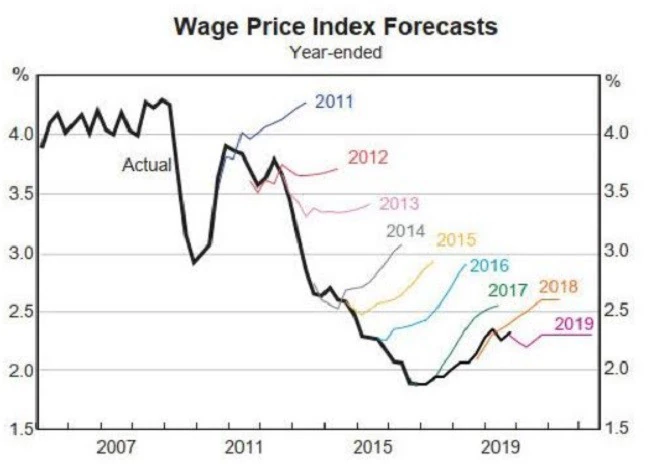

From the top, again, the immigration-led, labour market growth economic model does not do wage growth. It will shortly have a 2-handle.

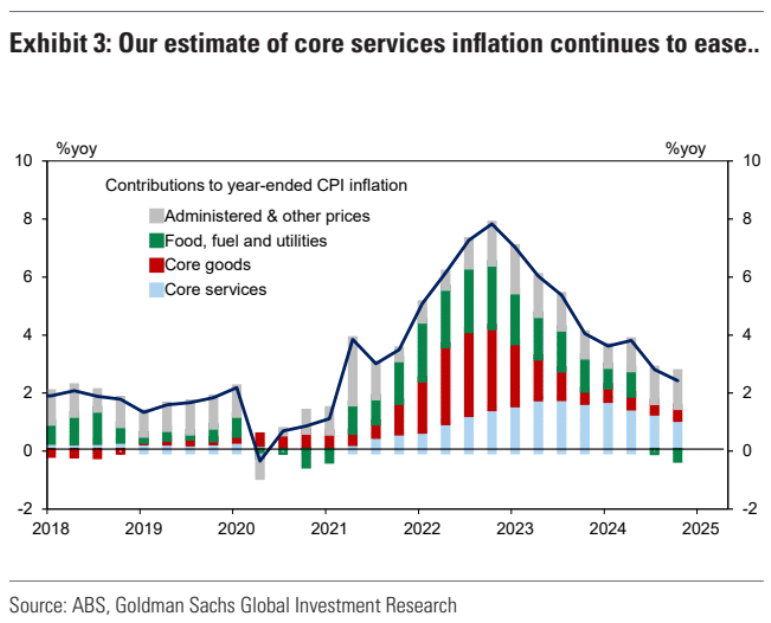

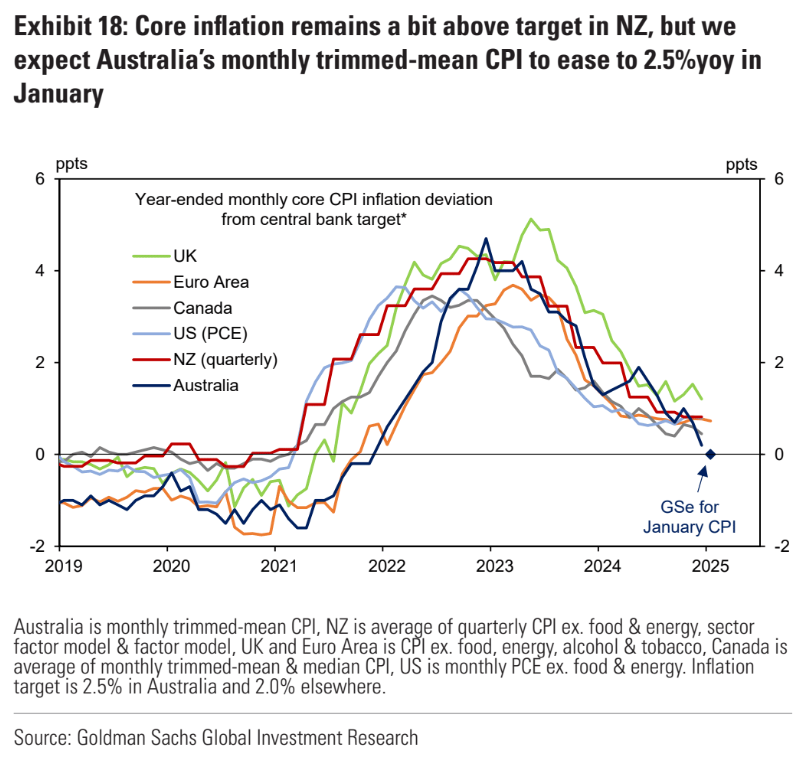

It is therefore no surprise to see wage-dependent services inflation in free fall. Goods inflation is gone.

Administered prices will all reset lower this year, tracking crushed headline inflation.

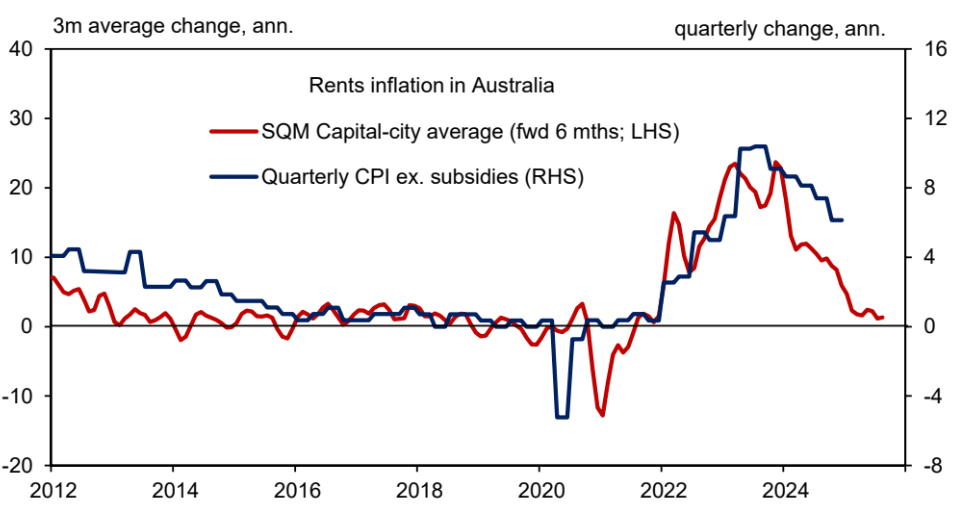

Rents are in free fall.

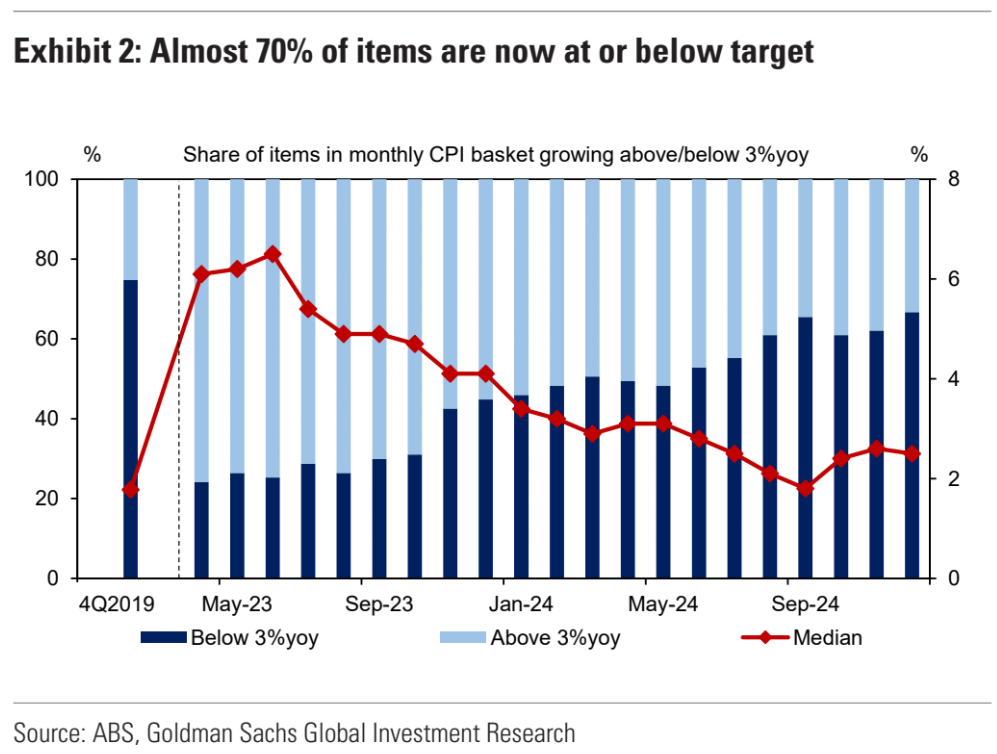

Inflation breadth is smashed.

Leading measures of trimmed mean inflation are crashing through the target band.

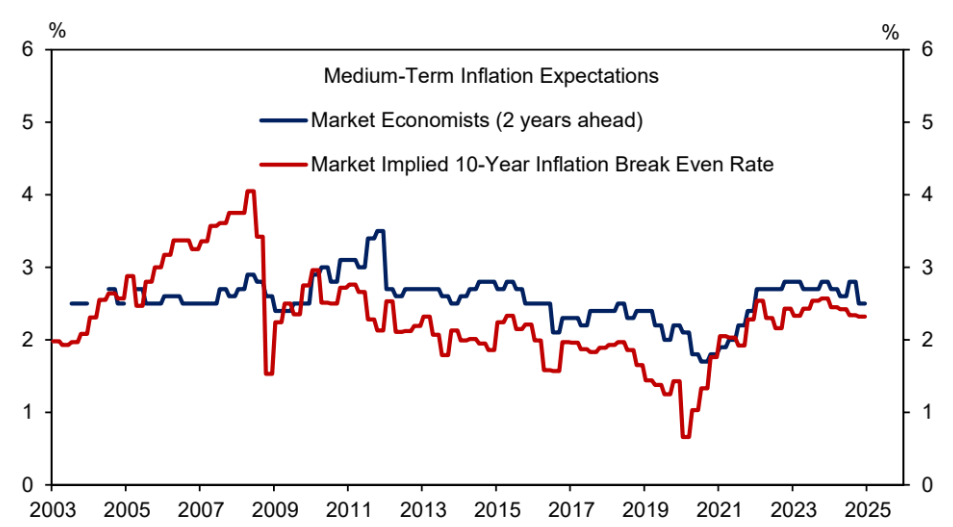

Inflation expectations are thoroughly anchored.

Having learned precisely nothing about the intensely deflationary nature of the immigration-led, labour market growth economic model, the Lunatic RBA has overshot everybody.

You don’t fatten the pig on market day. If the RBA doesn’t cut this week, it’s going to embed another lowflation period as the immigration-led, labour market growth model perpetually grinds everybody into the dirt.

Let’s recall the only reason that RBA reform was triggered. It overtightened for a decade before COVID, smashing the economy pointlessly.

If the Bullock RBA doesn’t cut this week, it should be sacked on the spot.

The rotten fish head should stop stinking up the joint.