Westpac joins the doves.

December quarter CPI surprises to the downside

In our CPI Preview, we noted that the risk to our December quarter CPI and Trimmed Mean estimates were to the downside. That risk ended up materialising, with the CPI increasing just 0.2%qtr/2.4%yr (Westpac f/c: 0.3%qtr/2.5%yr) while the Trimmed Mean rose 0.5%qtr/3.2%yr (Westpac f/c: 0.6%qtr/3.3%yr).

In our post CPI wrap, we highlighted that the CPI had been significantly impacted by various cost-of-living measures, including Commonwealth Rent Assistance (CRA), Commonwealth Energy Bill Relief Fund (ERBF) rebates and various state government energy rebates. We estimate these measures collectively shaved 0.3ppt off the CPI in the December quarter and 0.7ppt over 2024; that is, headline inflation would have printed 3.1%yr in the December without the offset from the cost-of-living measures.

However, the impact on core inflation (as measured by the Trimmed Mean) was negligible given those components impacted by those measures have been trimmed out. We estimate that the cost-of-living measures shaved just 0.1ppt off the Trimmed Mean in the December quarter (and this is a rounded up estimate) and at most 0.1ppt over 2024.

The Trimmed Mean therefore provides a clearer guide on underlying inflationary pressures that are not influenced by the government cost-of-living measures. Thus, the 0.5% increase in the December quarter represents a genuine step down in the pace of core inflation (see tables over).

Housing key to core disinflation

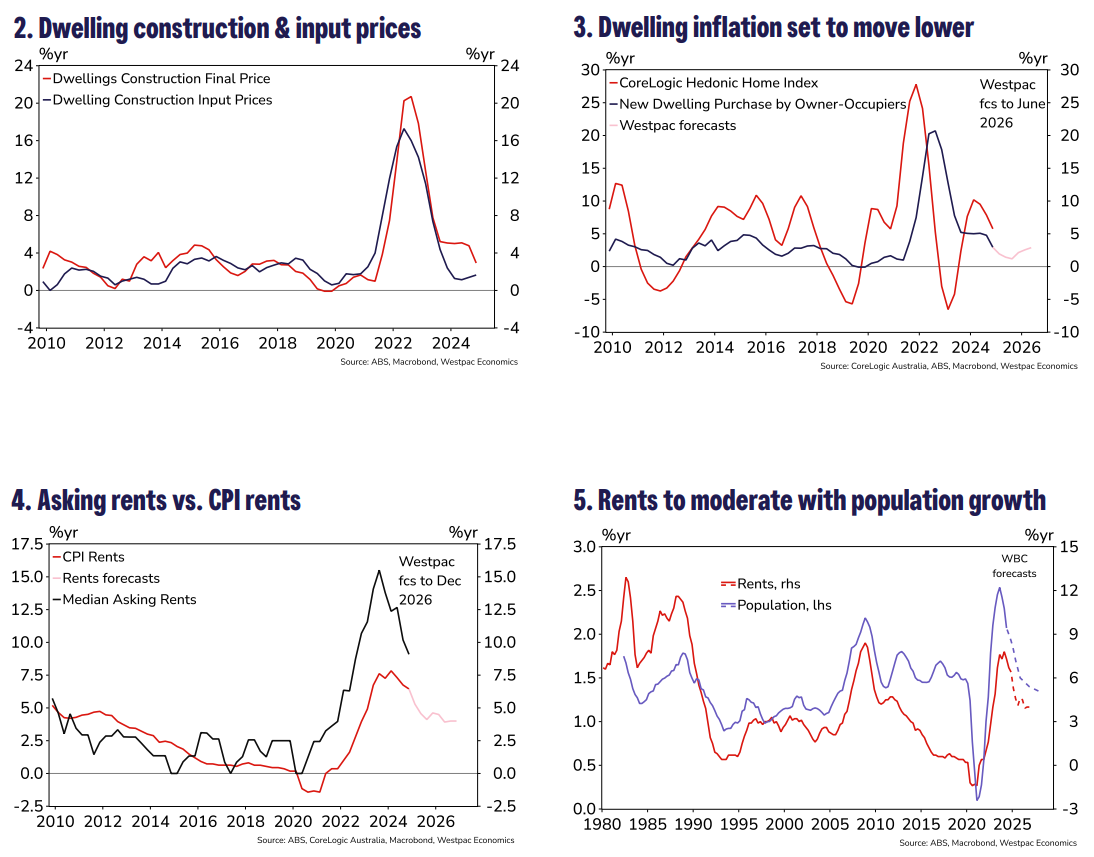

In the December quarter, dwelling prices fell –0.2% taking the annual pace down to 2.9%yr from 4.8%yr in September and a recent peak of 20.7% in September 2022. As noted by the ABS, this is not due to any cost-of-living or home buyer assistance, but rather it “reflects project home builders increasing incentives and promotional offers to entice new business in a subdued new home market”. Remember dwelling prices in CPI measure the cost of constructing or renovating a dwelling, including builders margins, so prices can fall as margins are compressed – even if input costs such as materials or wages are not falling.

Westpac is forecasting dwelling inflation to continue easing from here, falling to a nadir of 1.2%yr in December 2025. December’s Monthly CPI Indicator revealed that dwelling prices rose just 0.1%mth, on par with the flat average of the previous six months. In the six months to December 2023, dwelling prices rose an average of 0.5% per month and our forecast to June 2025 is an average of 0.2% per month over six months.

Rents gained 0.6% in the December quarter, the softest quarterly increase since December 2021. The ABS noted that the “maximum rate available for Commonwealth Rental Assistance (CRA) increased by 10% on 20 September 2024, in addition to the usual biannual CPI indexation on 20 March and 20 September each year.

This follows an additional increase to CRA maximum rates of 15% in September last year.” We estimate that without the additional increase in assistance, rents would have increased 1.5% in the December quarter. Regardless, this still represents a step down in the pace of rental inflation compared to the 1.6% increase in September (1.8% without the rental assistance increase). The pace of rental inflation has clearly taken a step down, and the ongoing moderation in asking rents inflation alongside slower population growth suggests this should persist through 2025.

The annual pace of rental inflation was 6.4%yr in the December quarter, down from 6.7%yr in September and the recent peak of 7.8%yr in March 2024. Westpac is forecasting rental inflation to fall to around 4%yr through 2026.

Our inflation profile has been marked down

Our preliminary estimate for the March quarter is 0.5%qtr/2.0%yr. Our Trimmed Mean estimate is also 0.5%qtr/2.7%yr. Excluding the cost of living measures we estimate a 0.6%/2.6%yr increase in the CPI. As before, we do not see cost-of-living measures as having a meaningful impact on our Trimmed Mean estimate.

Late last year, our forecast for the March quarter CPI and Trimmed Mean was 0.7%qtr/2.2%yr and 0.7%qtr/3.0%yr respectively. The Q4 CPI report subsequently revealed that a broad moderation in inflation seen through the final months of the year, which we anticipate will continue into 2025. As such, we have marked down our estimate for CPI inflation at the June quarter 2025 to 1.7%yr (it was 1.9%yr prior) and 2.4%yr for the Trimmed Mean (it was 2.8%yr prior). Key to this moderation in core inflation has been the moderation in housing costs excluding energy.

Lunatic RBA has overdone it again. The cost of living measures will sure and shit impact the trimmed mean when the headline is running at 1.7% and collapsing administered prices (20% of CPI) over 25/26.

While wage growth keeps draining away.