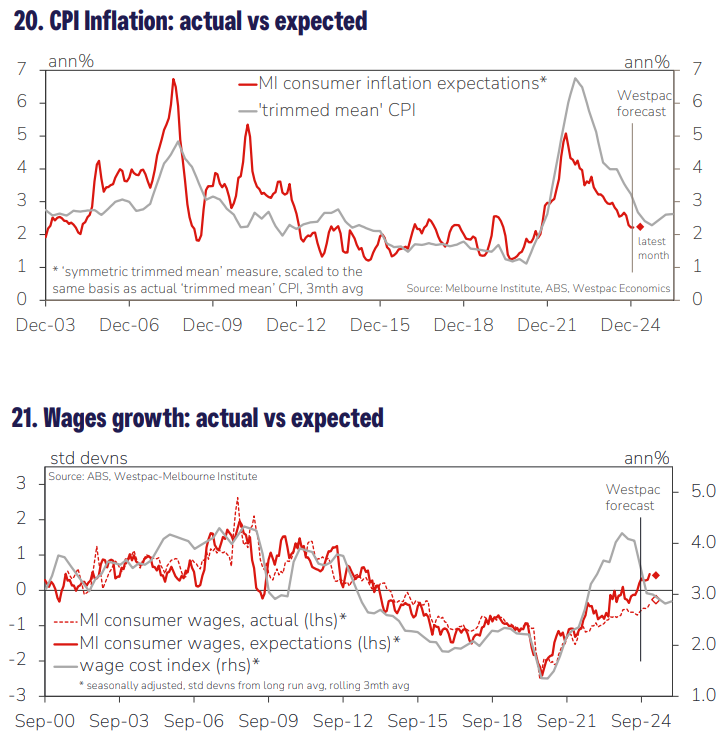

There’s no reason to stop it. Inflation is tumbling. Inflation expectations re-anchored. Wage growth is smashed.

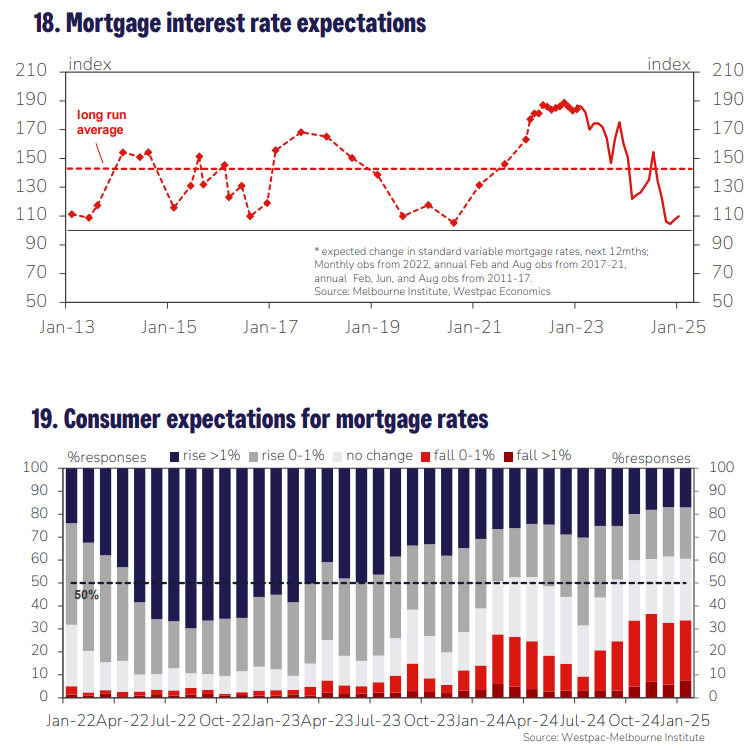

The recent consumer bounce is fragile and related to lifting expectations of easing.

Advertisement

It is also still meaningfully below the RBA forecast. Goldman has more.

We also upgrade our tracking estimate for GDP growth in 4Q2024 by 10bps to 0.5%qoq, corresponding to a year-ended rate of 1.2%yoy. We note this remains somewhat below the RBA’s standing forecast (Nov SMP: 1.5%yoy).

You don’t fatten the pig on market day, and if the RBA does not cut now, it will overshoot its target.

It probably already has.

Advertisement