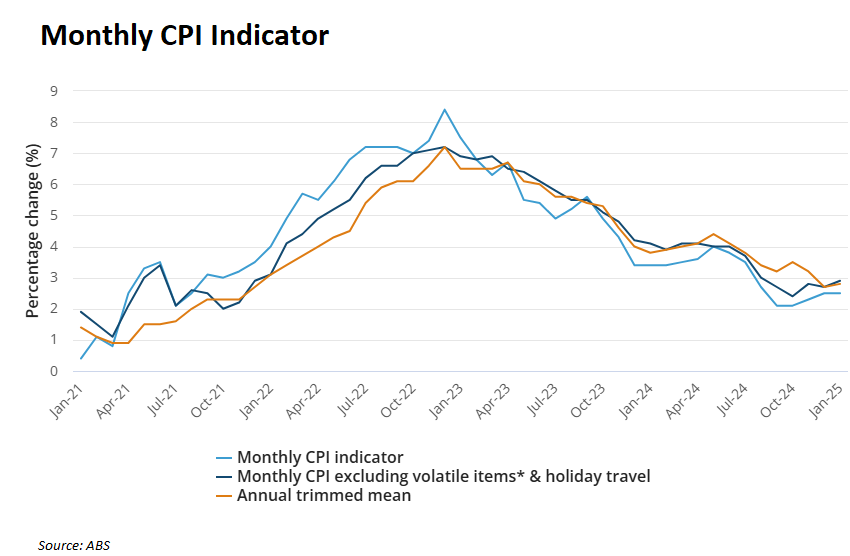

The Reserve Bank of Australia (RBA) would be happy with Wednesday’s monthly CPI indicator from the Australian Bureau of Statistics (ABS).

The ABS reported an annual headline CPI of 2.5% in January (versus 2.6% expected) and the policy-relevant trimmed mean inflation of 2.8% (within the RBA’s target of 2% to 3%).

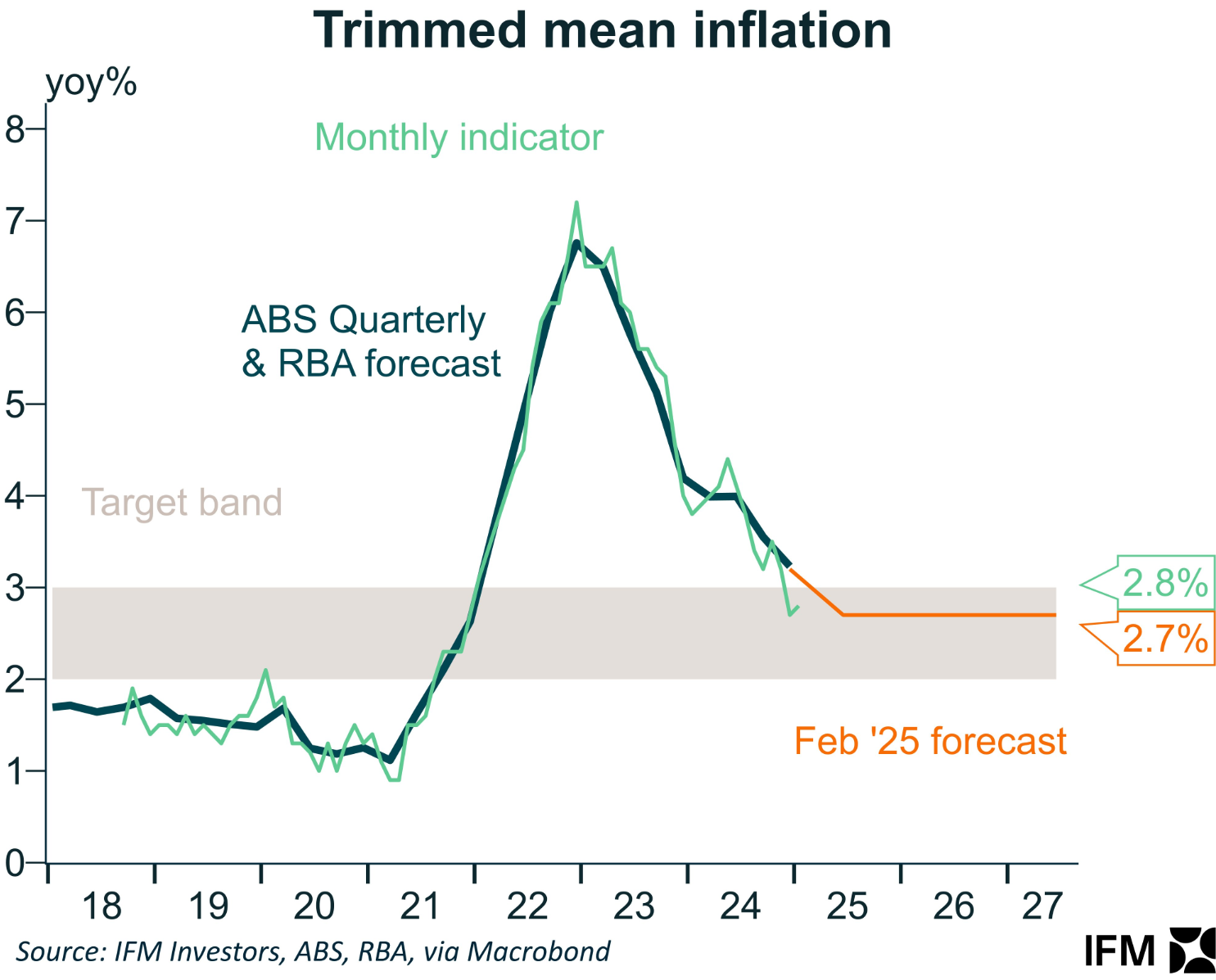

The following chart from Alex Joiner from IFM Investors plots trimmed mean inflation against the RBA’s latest forecast.

As you can see, inflation is tracking below the RBA’s forecast.

However, Joiner cautions that the monthly CPI indicator is goods heavy and not as broad as the official quarterly inflation print.

In other words, the monthly figure doesn’t carry the weight of the official quarterly figure. For that, we’ll have to wait until later in April.

Nevertheless, January’s result would encourage the RBA.